Correction, what correction?

Correction, what correction?

Monday's drop is now completely erased in the Futures for no particular reason this morning and that's great, I guess. Traders are back to believing in a China deal because Trump said we're close and, if there's one thing we know for sure, it's that President Trump would never lie to the American people, right?

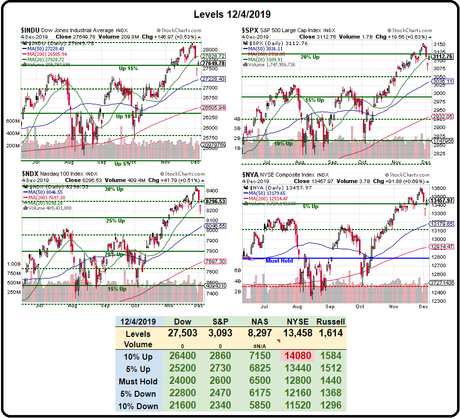

BUT, just in case he is, maybe we should discuss the idea of having hedges as we now find ourselves with long positions we should probably protect from the next "misunderstanding" we have over trade progress. We now have a handy "map" that shows us which indexes fell by how much on trade rumors and we know how much that would have paid on the Futures: The Dow (/YM) fell 450 ponts ($2,250), the S&P (/ES) fell 40 points ($2,000), the Nasdaq (/NQ) fell 125 points ($2,500) and the Russell (/RTY) fell 20 points ($1,000) so the best hedge looks like the Nasdaq.

Apple makes about $3Bn of their Global Profit in Russia so about 5% of their total and AAPL trades at $260 so $13 to $247 wouldn't be tragic but it's a catalyst for another Nasdaq drop at some point so it gives us another reason to use the Nasdaq as a hedge. Of course, time-frame is also an issue and we'd like to have a trade that lets us take advantage of quick dips and I'd say December 15th is a pretty good deadline for action as it's when the next round of tariffs are supposed to kick in (though they may get delayed).

SQQQ is the Ultra-Short ETF for the Nasdaq and it just bounced off the $25 line back to $27 on the recent dip and the Dec (20th) $24 ($2)/26 ($1) bull call spread is net $1 on the $2 spread so it pays 100% if SQQQ stays over $26 and the Nasdaq would have to make a new all-time high for it not to. If we set a stop at 0.25 on the spread (or roll out the long calls before they fall below $1) then we risk 0.25 to make up to $1 as a hedge – that's a good deal!

If we want more bang for the buck, we could go with the March $22 ($5)/27 ($2.50) bull call spread at $2.50 and sell March $24 puts for $1.70 and that nets us into the $5 spread for 0.80 with $4.20 (525%) of upside if SQQQ is over $27 in March (20th) and that's up 3% from here which would correspond with a 1% drop in the Nasdaq. The difference is we won't be able to cash out early so maybe a little of both will be appropriate – we will decide during the day's trading what to add to protect our portfolios.

There's still a lot of uncertainty in the markets but that doesn't seem to stop them from going higher and higher so, for now, we'll just go with the flow and see where it takes us but, now that we do have long positions to protect – we'll proceed just a bit more cautiously and add some hedges.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!