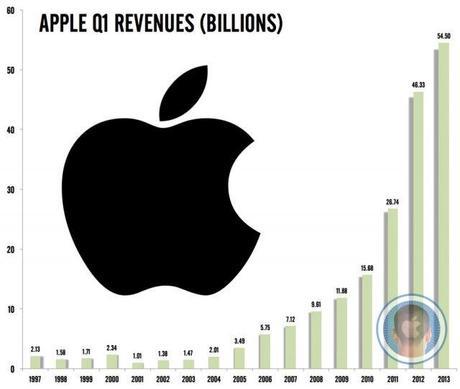

AAPL's earnings were a disappointment and the stock plunged 10% overnight (not reflected yet in Dave Fry's chart). Of course, first it went up 3% during the day but we won't split hairs, their earnings failed to excite but did nothing to scare us off – especially considering that this quarter had one less week than last year's Q4 (fiscal Q1 for AAPL). That's a 7% handicap to overcome.

Nonetheless, AAPL managed to squeeze out $13Bn in profits in 13 weeks and since they've also done a lot of share buy-backs this year, those earnings represented a whopping $13.81 per what is now (briefly, I think) a $465 share. That's just for a quarter. AMZN, by comparison, HOPES to earn 0.27 per $268 share this Q and MAYBE, if all goes well, $1.73 for the year or about 2 weeks of AAPLs earnings for the whole year. And, for that, you are expected to pay what is now much more than 50% of AAPL's stock price.

IBM was just rewarded for reporting $15.25 in earnings per $200 share for the entire year and that's in-line with XOM, who earns $9 per $90 share and GE, who make $1.80 per $22 share. NFLX jumped 40% overnight because they earned 26 CENTS for the quarter. Now a share of NFLX is $140 for earning what AAPL does EVERY 12 HOURS.

As I said on TV last Tuesday: "AAPL can go down to $400 from here ($485 that day) but, if you are a long-term investor, so what?" So the entry on the One Trade is still valid and, if anything, today should be a good day to sell puts as an initial entry on new positions but, as I noted in the pre-market Alert…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.