Holy Crap!!!

Holy Crap!!!

I'd love to say I'm that good as we were up early this morning (1:54) in our Live Member Chat Room and all seemed quiet with the Futures heading higher and I said to our Members:

Oil hit $50 just after midnight, /NG topped out at $3.37, gasoline at $1.385 and the markets spiked up almost 1%. India cut their reserve rates 0.25% – a total surprise. Also, positive notes from China and /NKD is up from 16,600 yesterday to 17,200 just now (and I like /NKD short on that line with tight stops above).

Just two hours later, ALL HELL BROKE LOOSE and the Nikkei dropped 300 points (now more) and those /NKD shorts gained $1,500 in just two hours. That one was more luck than skill as the Swiss National Bank made a VERY SURPRISING announcement that they were removing their 3+-year currency peg to the Euro and that sent the EUR/CHF pair from the usual 1.20 all the way down to 0.85 before stabilizing at about 1.02, down 20% in minutes!

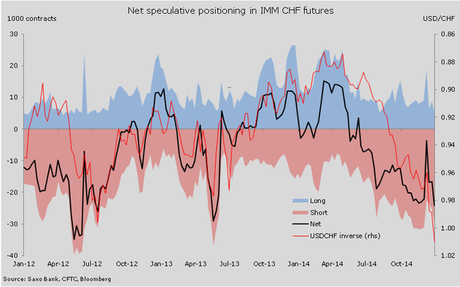

Needless to say, hedge funds who made the very usual, very normal short bet on the Swiss Frank are F'd this morning. As the Euro had been very weak recently, there were a large amount of short bets on the Franc (CHF) in expectations of the SNB stepping up their Euro-buying program to get back to their usual 1.20 goal.

Needless to say, hedge funds who made the very usual, very normal short bet on the Swiss Frank are F'd this morning. As the Euro had been very weak recently, there were a large amount of short bets on the Franc (CHF) in expectations of the SNB stepping up their Euro-buying program to get back to their usual 1.20 goal.

But nooooooooooooooooooooo! They went the other way by 20% and, as I reminded our Members this morning, those wrong way currency contracts (and there are 1M of them on this chart) lose $1,100 PER PENNY move. That's $22,000 on a 0.20 move in CHF x 1M = $22Bn in losses this morning for currency traders. Someone is gonna have some 'splainin' to do!

I already sent out a detailed tweet on the subject earlier this morning, so you can delve further into the subject at your leisure. For now we should contemplate the potential effect on the market and what such a violent shift in a major Central Bank's policy will mean for the Global Markets.

I already sent out a detailed tweet on the subject earlier this morning, so you can delve further into the subject at your leisure. For now we should contemplate the potential effect on the market and what such a violent shift in a major Central Bank's policy will mean for the Global Markets.

As you can see from the chart on the right, the interest rates on Swiss notes has gone NEGATIVE all the way out 7 years as they are now priced in the World's Strongest Currency. This is going to be devastating for Swiss exporters and already this morning Swatch is down 15%, leading the whole Swiss market in a 9% drop for the session.

Overall, it seems to me that if the SNB is taking such drastic action – it must be BECAUSE they KNOW Draghi is about to take drastic action to devalue the Euro to the point where they are no longer comfortable supporting it. That SHOULD make the markets happy, not sad, so we're taking the money and running on our Nikkei shorts and it's a good time to go LONG on the Futures at 17,250 on /YM, 1,990 on /ES, 4,120 on /NQ and 1,165 on /TF. Tight stops if any of them fail, of course, but that's my logic for the moment.

I sent out another tweet yesterday, killing the long Natural Gas play we featured in Monday Morning's post as /NG hit $3.30 for a $4,750 PER CONTRACT gain into yesterday's close. We got a lot of fan mail on that one and you're welcome. It's really the same natural gas line we played bullish all last week so not as clever as it seems but we nailed it on the timing this week.

I sent out another tweet yesterday, killing the long Natural Gas play we featured in Monday Morning's post as /NG hit $3.30 for a $4,750 PER CONTRACT gain into yesterday's close. We got a lot of fan mail on that one and you're welcome. It's really the same natural gas line we played bullish all last week so not as clever as it seems but we nailed it on the timing this week.

We also played long on oil and oil services as we discussed the whole BS move down in oil and how Fundamentally ridiculous it was, exacerbated by Goldman Sachs' manipulative call that morning which was clearly designed to spook the hapless Retail Traders out of their long positions right before energy finally turned back up. As I said at the time:

This is just a scam – a con that is being played on energy investors that is giving us fantastic opportunities to buy companies like BHI ($56.47), RIG ($15.83), XCO ($1.90), TOT ($48.64), etc – as well as actual oil ($47 on /CL), natural gas ($2.825 on /NG) and gasoline ($1.30 on /RB) for some fantastic LONG-TERM gains.

We were just going over some trade ideas from last year, when GS was telling people oil would be $150 per barrel and chasing the sheeple INTO it at $103.50 and it did, in fact, get to $107.68 in June but we remained relentlessly short the whole time and, ultimately, the position we called a short on on Dec 15th, 2014 (2 short oil Futures at $103.50 for $9,000 in margin) gained $110,580 (1,228%) as of Friday's close. So now, to summarize, I'm saying I like oil long for the next 12 months.

Remember, I can only tell you what is going to happen and how to make money trading off this information – that is the extent of my powers - the rest is up to you. Keep in mind that two oil contracts shorted at $103.50 were down $4,180 each ($9,360, down 100% on margin)when oil topped out at $107.68 in June, so this kind of trading is not for the feint of heart. As we discussed in last week's Live Webinar, however, we have techniques that help us ride out the waves – and make even more money along the way, profiting from the volatility.

We don't know for sure that this is a bottom, things may go lower from here but, if they do, we will want to buy more, not less. With many stocks still trading at all-time highs (GMCR, for example!), now is an excellent time to take some winners off the table and make some long-term investments on beaten-down materials plays. We have some on our Buy List (Members Only) and we'll discuss some in Tuesday Live Webinar at 1pm (Members Only).

If you are interested, you can review our Live Webinar HERE. We talk about all sorts of interesting things and the oil trade we made at that time, going long on the contracts at the $45 line, ran all the way to $50 (up $5,000 per contract) early this morning and this morning, back in our Member Chat Room, we went long again at $47.50 and already we're back to $49.50 for another $2,000 per contract gain.

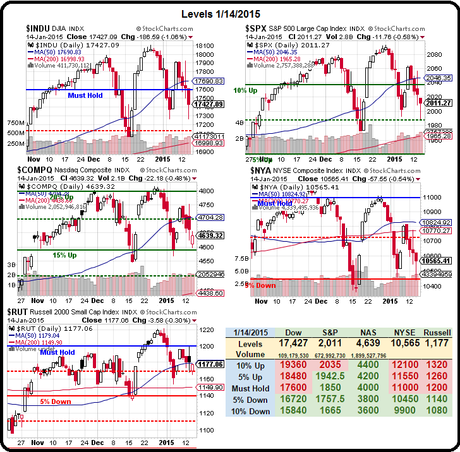

We'll see how well our index longs do today and, of course, we have plenty of long plays on oil and energy stocks as that was a one-year bottom call with conviction that we made this week. More importantly, we'll see how well our Bounce Lines hold up, as of yesterday's close, we were at:

We'll see how well our index longs do today and, of course, we have plenty of long plays on oil and energy stocks as that was a one-year bottom call with conviction that we made this week. More importantly, we'll see how well our Bounce Lines hold up, as of yesterday's close, we were at:

- Dow 17,280 (weak) and 17,460 (strong)

- S&P 2,006 (weak) and 2,027 (strong)

- Nasdaq 4,608 (weak) and 4,656 (strong)

- NYSE 10,560 (weak) and 10,670 (strong)

- Russell 1,172.50 (weak) and 1,185 (strong)

Very simply, we need to see 3 of those Strong Bounce Lines turn green to close the week or we'll have to go into the weekend aggressively short – despite the promise of Draghi's easing. It should be concerning that the SNB and India's National Bank both took emergency liquidity measures today – as if they know something nasty is coming down the pike.

Be careful out there!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!

Remember, I can only tell you what is going to happen and how to make money trading off this information – that is the extent of my powers - the rest is up to you. Keep in mind that two oil contracts shorted at $103.50 were down $4,180 each ($9,360, down 100% on margin)when oil topped out at $107.68 in June, so this kind of trading is not for the feint of heart. As we discussed in

Remember, I can only tell you what is going to happen and how to make money trading off this information – that is the extent of my powers - the rest is up to you. Keep in mind that two oil contracts shorted at $103.50 were down $4,180 each ($9,360, down 100% on margin)when oil topped out at $107.68 in June, so this kind of trading is not for the feint of heart. As we discussed in