We love a good market panic – especially when we were betting on it. We’ve been preparing for this downturn since we set up our disaster hedges again (first time in a long time) on April 21st, which was also a Thursday, when I wrote: "How to Make 500% On The Next Crash." This wasn’t a Member’s Only post, this was something that any PSW Report Reader (subscribe here) would have had in their mailbox at 8:30 am, before the markets opened at pretty much the levels we are at right now. Since that post, we went up and we went down again so there was all the time in the World for our Members to establish their hedges and those hedges allowed us to continue to make long bets – knowing we had a nice hedge should the market turn down suddenly.

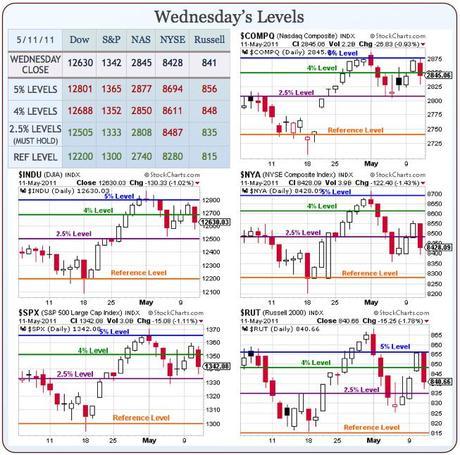

As it turned out, we had plenty of time to ride the market up to our 5% levels and now we’re on the way back down, likely to test our reference levels again, which are approximately the 50 dmas – all very dependent on how the Dollar handles that 75-76 range, of course (see David Fry’s chart).

Some of the trade ideas from the 500% post are still available while others are running away like the EDZ Oct $14/18 bull call spread at $1.80, offset with the short sale of TM June $72.50 puts at $1.25 for net .55 on the $4 spread. Even though it’s an October target, the EDZ $14/18 spread is already 100% in the money but still just $2 but the TM June $72.50 puts have fallen to .24 for a net of $1.76, up 218% in just 3 weeks. Not a bad hedge for a flat market!

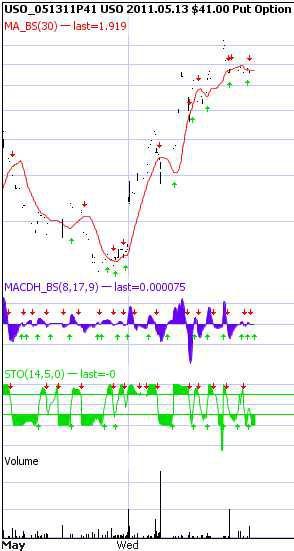

The puts opened at .80 and traded below $1 until right before the inventory report at 10:30 when we got the build we expected (which we also expected to tank the markets) and the puts flew up and peaked out at $2.30, up well over 100% on the day. Of course they should open up even better this morning but most of us took 100% and ran as that’s plenty and there’s always something else we can trade tomorrow when we go to sleep with cash in our portfolios.

We discusses two other trades in yesterday’s morning post (99% of our trades are exclusively for Chat Memberships) – one was the TBT weekly $33 calls and they were disappointing, topping out at $1.93 (up 24%) but our QQQ spread is looking good with the May $60 puts at $1.28 and the short May $59 puts at .64 for net .64, up 23% already but we took advantage of the spike (the May $60 puts topped out at $1.70) and cashed out yesterday with a 50% gain and we will go back in again if we can get that spread for .55 on a bounce.

That’s what we’re expecting this morning, a bounce off our 2.5% lines (see multi-chart on yesterday’s post), which are S&P 1,333, Dow 12,500, Nas 2,808, NYSE 8,487 and Russell 835. Only the NYSE closed below the line yesterday but let’s look at what we expect based on the 5% Rule:

Ignoring spikes up above the 5% line, we call the fall from 5% to 2.5%, obviously, a 2.5% drop and so we expect a 0.5% bounce. Since the indexes move in lockstep and since the S&P is our most important indicator, when they bounce off 1,333, the other indexes will follow suit, regardless of whether or not they hit their marks. The bottom line is that we have only a WEAK BOUNCE if our indexes DON’T gain more than 0.5% after they drop 2.5% and failing to hold the weak bounce line indicates continued weakness. I already said yesterday I expect us to complete an "M" pattern, back to the reference lines by next week and those Ms are going to look dangerously sloppy (more bearish) if they can’t at least round out the top today:

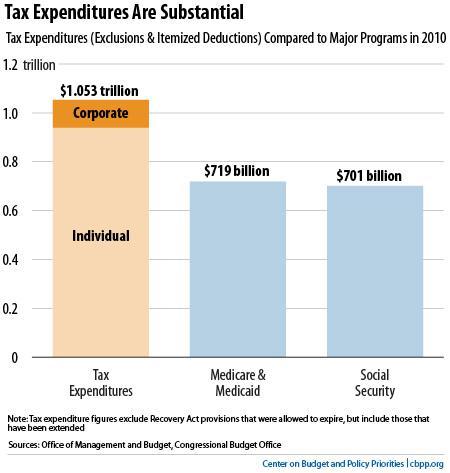

In Member Chat this morning, I put up some charts that illustrate the REVENUE COLLECTION problem we are having on the State and Federal level – I won’t get back into it now but let’s just say things are bad and June it the end of the fiscal year so a lot of things are going to hit the fan, including our own US Debt ceiling, where the very fact that it’s being used as a political football erodes the faith others have in the credit-worthiness of the United States. What are we, Greece?

See, the chart on the right seems fair, doesn’t it? Look at those poor Corporations, shouldering almost $200Bn of our nation’s tax burden. Exxon was "only" able to sell $105,186,000,000 worth of gas last quarter and maybe $122Bn this quarter with a $15Bn profit. That’s just $5Bn a month for one company folks – WHY WON’T YOU LEAVE EXXON ALONE???

The real question here is not "Why are the Greeks rioting?" but "Why AREN’T Americans rioting?"

Today Congress will have the oil companies in to explain why they still need $21 Billion of dollars in tax incentives (for the big 5 alone, who made $125Bn in profits last year on much cheaper oil and gas) and we’re ready to go long on oil (quick trade) as it’s very possible that this little sell-off was only timed to take the heat off the CEOs as they can go to Congress and say "See, we don’t control prices, they just dropped in the week leading up to this testimony – what a coincidence!" The coincidence is even more amazing when you not that it happens EVERY time oil execs are called in to testify. Perhaps Congress should have them in every week and save us all some money at the pumps…

Keep in mind that these declining net sales figures are not even taking into account the 0.8% rise in Producer Prices. If even half those costs are being passed on, then unit retail sales are clearly negative. That’s negative as in Recession – as in who in their right mind buys stocks with p/e’s above 20 in a recession? Overall Producer Prices rose 6.8% year over year in Uncle Ben’s "transient inflationary environment." When was the only time we had a bigger monthly gain in Producer Prices? That’s right – September 2008!

How are you liking those Disaster Hedges now?

Prices of raw materials, known as crude goods, rose 4.0% in April from the previous month, suggesting price pressures in the pipeline that may crush Q2 profits. CSCO’s CEO is being criticized and his stock is suffering due to his gloomy outlook on the economy but, as I said to Members last night – he may be the only guy who is either smart enough or truthful enough to give proper guidance. As I said above – fools or liars – those are the choices we are used to.

As with last week – don’t take any wooden nickels or fall for any weak bounces.

COMMENTS ( 1 )

posted on 08 November at 10:36

great Blog I'm a big bet365.com fan from Holland