That was enough to send the Dow Futures flying up 200 points at 6am (where we shorted them at 12,800 along with S&P at 1,350, RUT at 780 and Oil at $90) because no one cared that he also said "within our mandate" nor do the bulls seem to realize that this is already year 3 of the ECB doing "whatever it takes" to save the Euro and, apparently, it takes a HELL OF A LOT MORE than what they've already done.

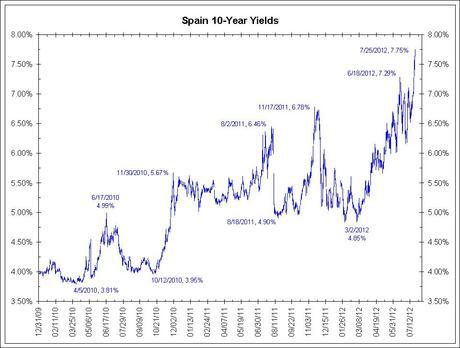

We were silly, we should have flipped more bullish last night as Spain's 10-year yields hit 7.75% – new highs on Spain and Italy's 10-year have been pretty reliable BS triggers for more happy talk from the ECB, because "whatever it takes" is lying to investors and posturing and bluffing – WHATEVER IT TAKES to stop these rates from heading to double digits, which necessitated a $500Bn bailout for Greece and would mean TRILLIONS for Spain and EVEN MORE TRILLIONS for Italy.

Of course, our motto at PSW is "We don't care IF the markets are manipulated as long as we can figure out HOW the markets are manipulated and place our bets accordingly" so, early this morning, I put a note up for our Members, indicating how ridiculous the move was and indicating the shorting targets on the Futures. Just yesterday, right in the morning post, I mentioned our shorting target for the Dow Futures (/YM) was 12,650 and we hit it 2 times after the open with 2 drops below 12,600 where we stopped out with $500 per contract gains. Those are just the free ideas folks!

Every quarter, during earnings month, we like to show off with a few free trade ideas to give non-Members a chance to have some fun. We've been nailing it this month but July is almost over and so are the free trade ideas – just a heads up with 2 days left!

Already this morning (8:20) we picked up another $500 per contract on the Dow and $500 on Oil ($89.50) and that's enough to pay for the Egg McMuffins this morning so we're done and waiting now for the Durable Goods Report (which I expect will disappoint) as well as the usual 360,000 jobless claims. Later today we get Consumer Confidence (or lack thereof), Pending Home Sales, the KC Fed and a $29Bn 7-year note auction so busy, busy with the data today.

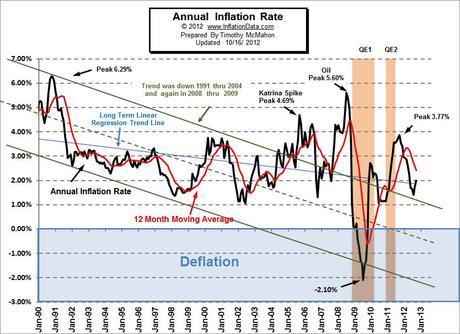

Of course we've got plenty of bullish plays – our Income Portfolio is full of Long-Term Bullish positions as we do believe that inflation is the only viable solution to the Global Debt Crisis. I wrote "Inflation Nation" years ago and the Los Angeles Times informed us yesterday that leading economists are finally catching on my program as the Milken Review has now concluded (obviously, one would think) that debt is almost always denominated at fixed interest rates, so as prices and wages rise, the relative debt load falls. To set up world economies for more growth, the report states: "The important thing is to shrink the size of debt contracts."

Up to now, European countries have been trying to do that through austerity — cutting government spending and services, forcing down employment and wages. "You see people trying to grind their way to balanced budgets and hence stabilize debt levels," Economist Menzie Chinn says, "and it's excruciatingly hard. Because of the political difficulties in taking austerity measures over the long term, you have to ask yourself if it's feasible."

Chinn and Frieden, along with such other inflation doves as Charles L. Evans,, president of the Federal Reserve Bank of Chicago, aren't talking about letting inflation go nuts. They're talking about a temporary rise to 4% to 6% from today's benchmark of 2%. (Evans proposes allowing inflation to rise to 3%.). Inflation hasn't always been regarded as the fearsome gargoyle it is now. In fact, it's more commonly been treated as a useful policymaker's tool in times of economic crisis. It was the principle underlying the Democratic Party's attack on the gold standard in 1896 — that's what William Jennings Bryan's "Cross of Gold" speech was all about.

Wage-earners love inflation – they earn more money. The only people who hate inflation are the people who lend money to you at fixed rates. They don't want to get paid back in Dollars that are worth less than the ones they lent to you and they really don't want you to live in a home that INFLATES in value and leaves you with enough equity that maybe next time you won't need a home loan where the Banksters can get you to pay over $430,000 in payments for a $200,000 loan (true fact at 6%).

Now that the Banksters control our Government and the MSM, they have done all they can to convince the bottom 99% that inflation is evil and must be fought at all costs. So far, the costs have been our nation's middle class, who have seen wages decline over the past 30 years while the incomes of the top 1% (who lend them the money they need because their pay keeps going down) have almost doubled.

When did America turn into a school playground, where the rich bullies steal your lunch money every day?