Stick to that and everything else don't mean s**t, as old Curly would say. What that one thing is, we have to figure out! This week, our one thing is not Greece but the Nasdaq, which needs to hold that 5,200 line (on the /NQ Futures, about 4,550 on the index) if we are to believe that other things, like Greece, can be ignored as our own markets move on to new highs.

We're still watching 2,120 on the S&P, of course and 1,300 on the Russell would be nice to make but it's the Nasdaq, where all the hot stocks are, that should be leading us higher in a real rally that's not going to get dragged down by the Fed, or Greece, or China, or Russia, or our Negative GDP or anything that investors used to worry about in the times before things were different – like they are supposed to be now.

You know I DETEST low-volume rallies and here we are in another one and I've certainly given up hope that the S&P will lead us into the promised land. That means the torch has been passed to tech (and we have SQQQ as a hedge in our Short-Term Portfolio) and that means we should take a look at the only tech company that matters, Netflix (NFLX).

You know I DETEST low-volume rallies and here we are in another one and I've certainly given up hope that the S&P will lead us into the promised land. That means the torch has been passed to tech (and we have SQQQ as a hedge in our Short-Term Portfolio) and that means we should take a look at the only tech company that matters, Netflix (NFLX).

No, I'm just messing with you! We shorted the crap out of them yesterday on that ridiculous pop over $700 and we already made a ton of money on the Icahan-inspired pullback. Obviously I'm talking about Apple (AAPL), which is almost 20% of the Nasdaq in weighting and, if you add in all the Apple suppliers, probably about 25% of the Nasdaq's moves depend on what AAPL does on any particular day. Overall, the Nasdaq won't make new highs if AAPL doesn't make new highs.

Does AAPL deserve to be at new highs? Well, as a disclosure, it was our Stock of the Year selection for 2015 and 2014 and 2013 before that so it's safe to say we like AAPL and we are not debating the merits of the company but we did cash out of the trade as AAPL tested $130 with the bull call spread at $20.30 ($40,600) and the short puts at $2.60 ($5,200) which is net $35,400 and a $27,400 profit (up 342% on cash).

Does AAPL deserve to be at new highs? Well, as a disclosure, it was our Stock of the Year selection for 2015 and 2014 and 2013 before that so it's safe to say we like AAPL and we are not debating the merits of the company but we did cash out of the trade as AAPL tested $130 with the bull call spread at $20.30 ($40,600) and the short puts at $2.60 ($5,200) which is net $35,400 and a $27,400 profit (up 342% on cash).

It's not that we lost faith in the trade, which will top out at $60,000 for a $52,000 profit in Jan 2017. It's just that we've already made more than 50% of our potential profit in 25% of the time and that is simply too far ahead of our projections to ignore. So, ahead of Apple's July earnings, we have to consider whether there may be some disappointment ahead or whether AAPL will justify a 25% price increase since we made our pick back in December.

Before we go further, I know, as a new trade, investing the $35,400 we cashed out to get $60,000 back in Jan of 2017 sounds very exciting not when you started with $8,000 – now it's just $35,400 we could be putting into other trades that can make 300%, not 70%, which is the current trade's forward potential.

If we did go back into AAPL, we'd sell higher puts, like the 2017 $105 puts at $7 and we'd buy a more aggressive spread, like the 2017 $110/140 bull call spread at $14.50 for net $7.50 on the $30 spread and then we're back in a trade that can return 300% on our cash AFTER we see earnings and AFTER we are confident AAPL is going to be well over our $140 target.

Of course we cashed out of AAPL at $130 because we expected a pullback. If it popped to $150, we would still be in it because a 20% pullback wouldn't really hurt us, so why not sit back and take the additional 70%? As it stands though, we felt AAPL would pull back – not because they did anything wrong, but as part of a general market correction that, so far, has not materialized.

Of course we cashed out of AAPL at $130 because we expected a pullback. If it popped to $150, we would still be in it because a 20% pullback wouldn't really hurt us, so why not sit back and take the additional 70%? As it stands though, we felt AAPL would pull back – not because they did anything wrong, but as part of a general market correction that, so far, has not materialized.

ASSUMING (very dangerous) that the market isn't going to correct, then we have to think about whether or not we have the right catalysts to get us over that 5,200 mark on the Nasadq and, as noted above, it should be called the AAPLdaq – so it really comes down to what we think AAPL can do going forward.

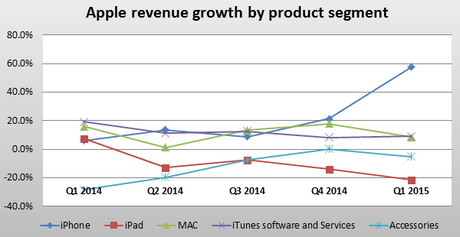

Q2 earnings (fiscal Q3 for AAPL) will be reported the week of July 20th (probably Thursday pm), which is after July options expire. In the last two years, Q2 has been down about 18% from Q1 (above) but this year we have the iPhone 6 and the iWatch and Piper just put out a note showing both strong sales and high prices paid for the 6 and 6+ along with very strong iWatch demand. This bodes well for AAPL's numbers.

Even more exciting, Apple RAISED prices in March around the World in order to offset the strength of the Dollar – who else has the power to do that and get away with it? That should remove them from much of the pain that's been hitting the bottom line of other Global Retailers. Estimates are for AAPL to earn $1.76 per share in Q2 but, from these numbers, we could see $2, which is almost 20% over what they were expected to make 3 months ago.

Even more exciting, Apple RAISED prices in March around the World in order to offset the strength of the Dollar – who else has the power to do that and get away with it? That should remove them from much of the pain that's been hitting the bottom line of other Global Retailers. Estimates are for AAPL to earn $1.76 per share in Q2 but, from these numbers, we could see $2, which is almost 20% over what they were expected to make 3 months ago.

That's the "if all goes well" number but then I'm concerned that iPod sales are just about done for and iPad sales are going to take a big hit as the 6+ makes the iPad Mini kind of pointless. So we're probably going to see an "alarming" drop in iPad sales, which were $4.3Bn in revenues last Q – if only because the 6+ eats the Mini's unit numbers (AAPL doesn't really care which one you buy).

So, not $2 a share and not 20% more income. In fact, even at 6M watches, that's "only" $3Bn ($500/watch avg), though we noted earlier that band sales will boost margins in that category. AAPL just renewed their exclusive contract with Liquid Metal (LQMT) (featured in Tuesday's Live Trading Webinar at 0.12 and already 0.14) and that stuff will be amazing for watch and phone skins! The original iPhone 6 preview featured Liquid Metal but it wasn't ready for mass production this year (they were also going to lose the home button).

So, not $2 a share and not 20% more income. In fact, even at 6M watches, that's "only" $3Bn ($500/watch avg), though we noted earlier that band sales will boost margins in that category. AAPL just renewed their exclusive contract with Liquid Metal (LQMT) (featured in Tuesday's Live Trading Webinar at 0.12 and already 0.14) and that stuff will be amazing for watch and phone skins! The original iPhone 6 preview featured Liquid Metal but it wasn't ready for mass production this year (they were also going to lose the home button).

I suppose professional writers know what they are going to say before they start writing but I'm an analyst, not a writer and I still haven't decided either way but I am glad we took our AAPL cash off the table because, AFTER earnings, THEN we can decide what the best set-up will be going forward. I hope AAPL does somehow disappoint as we'd love to get back in at $120 or lower but, meanwhile, what I don't see is any major catalyst that should send AAPL up over $130 before earnings – which means I don't see the Nasdaq holding 5,200.

The markets are overextended and this morning, in our Live Member Chat Room, we already grabbed the Russell Futures (/TF) as they topped out at 1,287.50 (6:36) and already (8:52) we're back down to 1,284 (now the stop) for a $350 per contract profit – just enough to pick up Egg McMuffins for the whole office!

The markets are overextended and this morning, in our Live Member Chat Room, we already grabbed the Russell Futures (/TF) as they topped out at 1,287.50 (6:36) and already (8:52) we're back down to 1,284 (now the stop) for a $350 per contract profit – just enough to pick up Egg McMuffins for the whole office!

2,120 is still the line to beat on the S&P, 18,000 must hold on the Dow and 11,100 on the NYSE is needed to keep us from being more bearish today but, overall, we remain "Cashy and Cautious" into earnings season – until there's PROOF that we should do otherwise.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!