Well, it didn't work the first time – so why not do it again?

Well, it didn't work the first time – so why not do it again?

Congress is voting to punish China for its treatment of the Uyghur Muslims, which is kind of funny considering how we treat Muslims in this country. We are also talking about sanctioning China over their aspirations in Taiwan and we're staging a diplomatic boycott of the Olympics and, oh yes, Trump's tariffs are still in place.

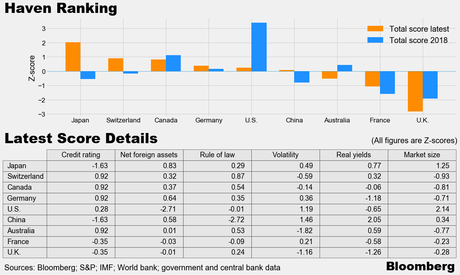

China has dropped behind the US in it's "Safe Haven Ranking", which means it's an even worse place to put your bonds than the US but, then again, they rank Japan first and that country is DEFINITELY going to end up defaulting on its debt at some point – as they are already over 300% of their GDP in debt. China is already paying effectively 2.05% interest on their debt – far more than any other nation on that list. Notice China is as bad as Japan in Credit Rating and, as I just said, Japan is DEFINITELY going to default.

What exactly does it take to be considered a haven asset, anyway? According to a European Central Bank working paper, safe assets are debt issued by a “safe” government of a country that has its own central bank, a stable currency, protection of property rights and low inflation. They are also highly liquid, an International Monetary Fund report said.

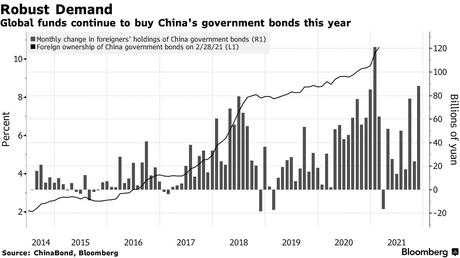

In the context of the China's Government Bonds, one key concern is that a sudden change in rules could make it harder for investors to sell their holdings or repatriate proceeds. Despite those risks, overseas investors have kept putting billions of dollars in China’s government bonds. Their holdings have grown by 513.7Bn Yuan ($81Bn) in the first 11 months of the year, the most ever for this period. Like everything else in the past two years – all this new money being printed has nowhere else to go – so it's forced into risky investments.

As China's economy softens, the Communist Party has been making it harder to obtain information about the Chinese Economy: A new data-security law has made…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!