S&P 2,000 – YAY!!!

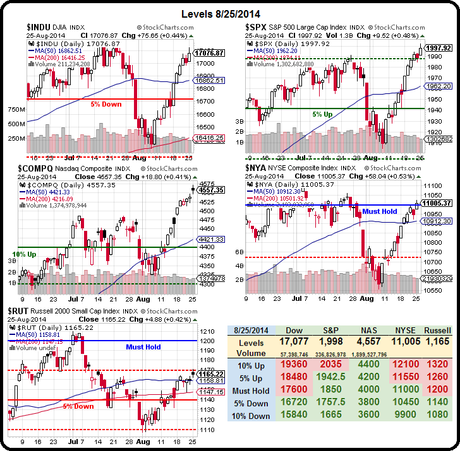

OK, I'm cheating, that's what I wrote on August 26th, when we first hit that mark. At the time, everyone was in rally mode and our Big Chart looked like this:

Despite the HUGE rally signals, I remained skeptical (imagine that!) and said we needed to confirm 17,160 on the Dow and 11,000 on the NYSE before we even began thinking of looking for our real bullish goals of 1,200 on the Russell (the July high) and 17,600 on the Dow (the Must Hold line we have yet to have held). As I said at the time: "Until then, we need to be just a little bit cautious."

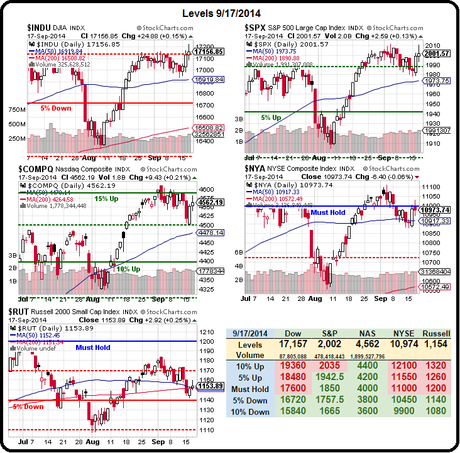

Turns out that cautious was a good play because, since then it was mostly downhill – until this week and our Big Chart now looks like this:

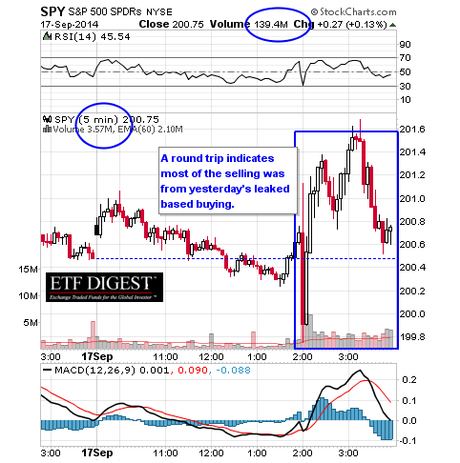

So you can see why we're not terribly impressed with this Fed-induced rally and we're not impressed with yesterday's silly spike – especially with such erratic action. On 8/26, I laid out my logic for you in the morning post and our shorting lines for the Futures were:

So you can see why we're not terribly impressed with this Fed-induced rally and we're not impressed with yesterday's silly spike – especially with such erratic action. On 8/26, I laid out my logic for you in the morning post and our shorting lines for the Futures were:

- Dow (/YM) 17,058, bottomed at 16,839 on 9/11 – up $1,095 per contact

- S&P (/ES) 1,995, bottomed at 1,968 on 9/15 – up $1,350 per contract

- Nasdaq (/NQ) 4,066, bottomed at 4,004 on 9/16 – up $1,240 per contract

- Russell (/TF) 1,165, bottomed at 1,135 on 9/16 – up $3,000 per contract.

As I mentioned in yesterday's post (and you can get these ideas delivered to you every morning, pre-market in addition to much more in our Live Daily Chat Room, by subscribing here) we called the dead bottom on Monday and we published our expected bounce lines for the week (in anticipation of a doveish Fed report) using our 5% Rule™, which were:

- Dow 16,980 (weak) and 17,010 (strong)

- S&P 1,985 (weak) and 1,990 (strong)

- Nasdaq 4,560 (weak) and 4,570 (strong)

- NYSE 10,950 (weak) and 11,000 (strong)

- Russell 1,160 (weak) and 1,170 (strong)

As I reminded our Members yesterday afternoon, we're not going to be shifting more bullish (though we have been doing some bottom-fishing off this week's lows) until all we weak bounces and 4 of the 5 strong bounces are taken back. Anything less than that will keep us bearish into the weekend and we STILL haven't had one full day where the S&P was over 2,000 – not one!

As I reminded our Members yesterday afternoon, we're not going to be shifting more bullish (though we have been doing some bottom-fishing off this week's lows) until all we weak bounces and 4 of the 5 strong bounces are taken back. Anything less than that will keep us bearish into the weekend and we STILL haven't had one full day where the S&P was over 2,000 – not one!

It's going to be crazy into the weekend but, in our Live Chat Room this morning, I said to our Members:

Futures pumped back up to yesterday's highs at 17,125, 2,001.50, 4,080 and 1,156.5 so I like shorting below 17,100, 2,000, 4,075 and 1,155 – short the laggard, out of any of them cross back over – very simple!

That's our plan into the weekend. As I've mentioned before, we're also using DXD, TZA and SQQQ to hedge our long portfolios – just in case things unravel over the weekend. We also discussed FXI puts earlier in the week as a play on China melting down so PLENTY of ways to profit from the downside.

HOPEFULLY (not a valid trading strategy) we won't need those shorts and we'll hold our levels and we can begin doing some more bottom-fishing using our Buy List. But first – let's at least make the levels we've been looking for since August 26th – is that really too much to ask?

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!