Before the US markets opened yesterday, things looked pretty grim and our morning Futures shorts (see yesterday's post) did well but rumors of even more QE and surprisingly good earnings from Macy's (M) turned things very quickly around, as you can see from this short Dave Fry video on XRT. This morning we have disappointing earnings from WMT and a big guide-down by CSCO and, once again, we went with shorts on the Futures (see morning tweet) – but from higher ground.

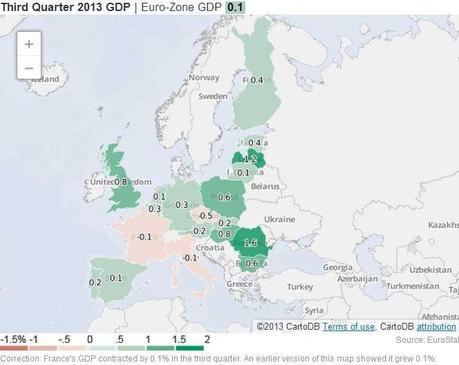

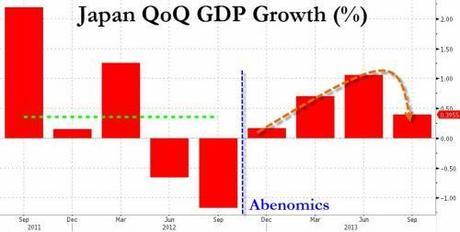

Now that Yellen's opening statement is pre-released, we can focus on what will happen next, which is the GOP Senators will attempt to tear her to shreds and try to tear down the administration by criticizing Government policy through the Fed. If that fails to spook the markets off their new highs, we have oil inventories at 10:30 after 9:45's Consumer Comfort Index and we've already seen poor GDP numbers in Europe (20% of the Global Economy) as well as all sorts of turmoil in Japan while China's swap rates are rising again as Local Governments pile on $1.7Tn of debt in their "expansion."

Nomura sees the Nikkei falling back to 12,000 (down 20%) if the Government doesn't do MORE to persuade investors that it's economic stimulus efforts will succeed. Japanese equities are still the best performers among developed markets this year, with the Nikkei 225 and broader Topix index rising 40 percent through yesterday. Overseas institutional investors have poured $108.5 billion into Japanese stocks this year, the most among 10 Asian markets tracked by Bloomberg.

Twenty-five of 34 economists including those at Goldman Sachs Group Inc. and UBS AG expect the BOJ to add to easing in the first half of next year, according to a Bloomberg survey carried out Oct. 23-28. The average target for the Nikkei is…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.