Wheeee! What fun!

Wheeee! What fun!

At the moment, the Dow (/YM) Futures are up 200 points after being down over 100 points. The downturn was caused by China threatening to escalate the trade war (yet again), with the Minister of Finance saying that China "would take necessary countermeasures" against any new US tariffs and said the new tariffs "seriously violated the consensus" that Trump and Xi has come to at the G20 meeting. China meanwhile injected $2.4Bn of stimulus into Hong Kong and then said that Trump and Xi were engaging in phone meetings – flipping the Futures back up.

WalMart (WMT) had good earnings and positive guidance this morning and they are adding 50 points to the Dow by themselves with a 6% gain pre-market but I seem to remember WMT doing well in the last recession as more and more middle-class shoppers looked to cut costs so I'm not sure if what they see as a positive trend is really a positive for the US economy.

Meanwhile, remember that big blue line we drew on the S&P chart two weeks ago with bounce lines predicting the future action of the index? Well we're still there:

We discussed the 5% Rule in yesterday's Live Trading Webinar as well as our hedges and, at the time, we decided not to get more aggressively bearish, despite the TERRIBLE DAY the market had yesterday, as we are pretty well-balanced and the situation is extremely difficult to predict – so why bet bearish when we are comfortably neutral? 2,880 is the weak bounce line on the S&P Futures (/ES) and we failed that so my note to our Members after the Webinar reflected what I said at its close:

So ugly. Failed the weak bounces, looks like we're on the way to 2,700 (10% total corrections).

25,500, 2,850, 7,500 and 1,465 are the lines to watch, shorting the laggard if 2 go below and out if any get back above after that but could be a nice payday if we follow-through lower.

As I noted in the Webinar – I want to wait and see before adding more hedges as there are too many people talking up the markets. Strong Dollar can also be knocked down to boost us.

We like playing the Futures rather than adjusting our hedges for short-term moves and, as you can see, we got exactly a 30-point overshoot (same as a weak bounce but the other direction), which gave our early-bird Members (or Asian night-owls) a lovely $1,500 per contract gain this morning – you're welcome!

We like playing the Futures rather than adjusting our hedges for short-term moves and, as you can see, we got exactly a 30-point overshoot (same as a weak bounce but the other direction), which gave our early-bird Members (or Asian night-owls) a lovely $1,500 per contract gain this morning – you're welcome!

You might have noticed we haven't made any Futures calls this month and that's because we like to WIN when we play – so we wait for times when we see a high-probability play with good stop lines that allow us to make solid risk/reward bets and we simply haven't had any recently but our patience paid off and now we are back to hugging some very solid support/resistance lines and, hopefully, we stay around here long enough to make some extra intra-day cash.

Today we'll be watching those bounce lines closely and the great thing about our 5% Rule™ is that, unlike TA, we don't have to re-draw random lines after every day (because TA predicions are only pattern recognition and have nothing to do with Fundamentals, which are slower to change) so we are still using the same lines we've been using all month – the same lines we were using BEFORE the market tanked (yes, I predicted the last 1,000-point Dow drop that morning for a $2,500 per contract gain!):

- Dow 25,000 is the mid-point and bounce lines are 25,550 (weak) and 26,100 (strong)

- S&P 2,850 is the mid-point and bounce lines are 2,880 (weak) and 2,910 (strong)

- Nasdaq 7,200 is the mid-point and bounce lines are 7,360 (weak) and 7,520 (strong)

- Russell 1,440 is the mid-point and bounce lines are 1,472 (weak) and 1,504 (strong)

As noted in the Webinar, the S&P carries a lot more weight than the other indexes (NYSE is actually 2nd but it has no Futures) and it's double-red while the other indexes have lost a combined 4 out of 5 greens they had on Monday and we've added 2 red boxes (Dow and S&P). That's all we need to know to see whether the markets are weak or not but we also know it's not a disaster until we lose that last green box and gain at least one more red on the weak bounces – then we can get back to shorting the laggard.

Also in yesterday's webinar, we talked about keeping a cool head in these downturns and using our hedging profits to add to our longs when they hit bargain prices and, to illustrate my point, Warren Buffett increased his stake in Amazon (AMZN) by 11% as that company tested its 200-day moving average at $1,750. Amazon is also a holding in our own Hedge Fund, with a target of 2,200 in June of 2021.

Yes the chart is ugly and yes, it might go lower but that doesn't change the VALUE of the stock and that's how Buffet plays and that's how we play as we're both long-term FUNDAMENTAL INVESTORS, not traders. Meanwhile, we (our Hedge Fund) did sell short Jan calls on AMZN at $2,000 as we thought that was getting a bit ahead of itself at the time – so I guess we are traders too!

We'll see what kind of bounce we get today but economic output in Germany, the world’s 4th-largest economy, contracted in the second quarter, according to a report Wednesday, while a report on factory output in China, the second-largest economy, came in lower than expected. “It’s almost like we’re starting to see a textbook version of a pre-recessionary period,” Nicholas Akins, CEO of American Electric Power Co.,said in a WSJ interview Wednesday.

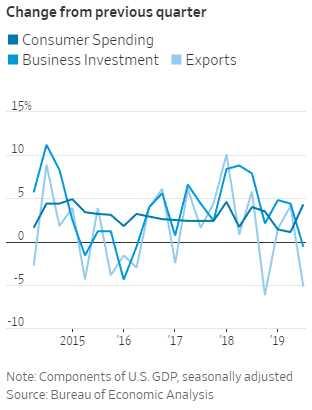

Already, both corporate earnings and investment are sliding. U.S. corporate profits before taxes were down 2.2% in the first quarter compared with a year earlier, according to the Commerce Department. And U.S. business investment fell at a 0.6% annual rate in the second quarter, after achieving quarterly growth rates exceeding 8% in late 2017 and early 2018.

Already, both corporate earnings and investment are sliding. U.S. corporate profits before taxes were down 2.2% in the first quarter compared with a year earlier, according to the Commerce Department. And U.S. business investment fell at a 0.6% annual rate in the second quarter, after achieving quarterly growth rates exceeding 8% in late 2017 and early 2018.

Yesterday, a sound-byte was released from Janet Yellen by Fox, in order to help Trump by stopping the market slide, in which she said: "I think that the U.S. economy has enough strength to avoid a recession" but she also said (in an inteview that will be fully available tomorrow): “But the odds have clearly risen and they are higher than I’m frankly comfortable with.”

See how completely different that is when you include the rest of her statement?

That's why this market is so tricky to play – you can't trust the Government to tell you the truth and you can't trust the media either – because some are now in bed with the Government and some are completely against them – that makes facts very hard to find indeed.

Be careful out there!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!