That markets have done nothing but go up since Mario Draghi promised to do "whatever it takes" to save the Euro (and, coincidentally, his phony baloney job). Since July, we have had plenty of rumors and whispers and promises and denials but, what we haven't gotten – is an actual commitment.

Well, today is the day – or it better be – when we finally get "THE PLAN" that will save the Euro and the European Union and re-employ the 12% of Europeans who are jobless and stop their debt to GDP ratios from going over 100% and turn around their faltering manufacturing base and boost exports and lower bond rates and fill in banks' balance sheets…. I can't wait!!!

If you've been reading Philstockworld lately, you may have noticed we're a bit skeptical of Draghi's ability to actually fix things. Nonetheless, yesterday I suggested a couple of aggressive upside plays because it doesn't matter if Draghi actually fixes things – only that people believe he can – that will be enough for a short-term boost. Clearly the market needs a boost because, as you can see from Springheel Jack's S&P chart – we're pretty screwed if we break down from here:

As we have noted for quite a while, "THEY" have pulled out all the stops to prevent this market from going down but there's only so many tricks you can pull and the past two weeks we've seen a real deterioration in the ability of the bulls to maintain those daily pre-market run-ups and, as noted in yesterday's post, for the past two months, On-Balance Volume has widely diverged from the S&P print, as more and more "smart" money heads for the exits – even as the MSM continues to herd the sheeple in for the slaughter.

We've already had the 7:45 ECB rate decision which was NO DECISION as they left their benchmark lending rate unchanged at 0.75% – still 300% of the US rates. Unlike the US, though, the ECB doesn't turn around and PAY 0.25% on required reserve balances so banks in Europe are encouraged to LEND MONEY rather than leave it on deposit. I know it's a radical Socialist idea, to expect banks to engage in banking activities, but them Europeans is just CRAZY!

We already shorted oil in Member Chat at $96.50 and, as noted in Friday's post, our $25,000 Portfolios are VERY BEARISH and there's nothing in what Draghi is saying that makes me regret that. As you can see from David Fry's chart, the Dollar's collapse since mid-July has fueled this "rally" but what is there about what the ECB is doing that would make the Dollar do anything other than go up against the Euro.

Even worst for the bulls, we just got a very strong ADP report with 201,000 new jobs created and if that follows through to a strong NFP report tomorrow, then our Fed is off the table with QE3 for at least another month and probably through the year's end while the ECB BUYBUYBUYs crap bonds at 50% below fair market value – over and over and over again – hammering the relative value of the Euro every step of the way. This is why Draghi is currently tip-toeing around liquidity issues and BS'ing about "sterilizing" the debt, etc. You don't want the Forex crowd to get the wrong idea…

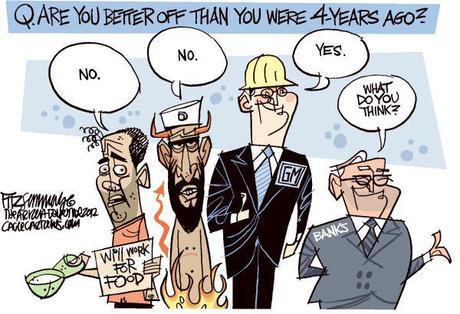

There is nothing that the ECB did today that will address this issue and there is nothing likely to be done by the Fed either. That means it's up to Congress to save us and last month, they couldn't even agree to formally adjourn before taking their summer vacation (warning, they are back next week!).

We can certainly expect some degree of excitement as the MSM swoon's over Draghi's brilliant solution and that's why we took our aggressive longs yesterday to cover a move up but we'll be watching closely for signs of weakness as we watch our Big Chart and keep and eye on those adjusted levels, which have consistently failed so far.

Be careful out there!