"Come easy, go easy

All right until the rising sun

I'm calling all the shots tonight

I'm like a loaded gun

I'm back in the saddle again" - Aerosmith

And we're back.

Right back to S&P 3,000 as the S&P gains 7 points in pre-market trading – more so on China Trade Progress than Trump's Impeachment, which is a truly quantum political event as he is at the same time guilty and not guilty – depending on who is observing his exact same actions. Here's some stuff we've been reading on the subject:

- Trump says Hunter Biden ‘walks out of China with $1.5 billion.’ Biden’s lawyer said that’s not true.

- Trump’s false claims about Hunter Biden’s China dealings

- Six Other Countries Where Trump Has Committed Impeachable Offenses

- Trump to Ukraine: Such a Shame if Anything Happened to Your Nice Country

- Donald Trump’s call with Ukrainian president drips with impeachable crimes

- Trump quietly met with Ukraine’s president last night (Tuesday) — and Zelensky just tweeted a picture of it

- Zelensky adviser says Biden case was precondition to Trump phone call

- Ukrainians understood Biden probe was condition for Trump-Zelenskiy phone call

- Whistleblower alleges Trump White House moved records onto separate network: report

- Oops! White House Emails Democrats Its Trump-Ukraine Talking Points.

- George Conway: Rudy Giuliani may have sealed Trump’s doom by blabbing about Ukraine in May

- Pentagon Letter Debunks Donald Trump’s Claim About Why He Withheld Ukraine Military Aid

- GOP senator quoted saying: ’30 Republican senators would vote to impeach Trump’ if it was secret

- After Reading Complaint GOP Ben Sasse Warns His Party Not to Circle the Wagons to Protect Trump

- Pelosi Tells Trump: ‘You Have Come Into My Wheelhouse’

- Donald Trump and the Derp State

- How Bad Is This Ukraine Situation For Trump?

- U.N. confirms the ocean is screwed

I threw that last one in there to remind us that the planet is dying and we're wasting time worrying about whether or not Trump might be lying about his phone call to the Ukraine. What, Trump lie? Do we really need an investigation when it's pretty much his defualt setting? It's kind of like conducting an extensive investigation into your entire family when "somebody" peed on the rug. Sure you could just blame the dog – but where would the justice be in that?

I threw that last one in there to remind us that the planet is dying and we're wasting time worrying about whether or not Trump might be lying about his phone call to the Ukraine. What, Trump lie? Do we really need an investigation when it's pretty much his defualt setting? It's kind of like conducting an extensive investigation into your entire family when "somebody" peed on the rug. Sure you could just blame the dog – but where would the justice be in that?

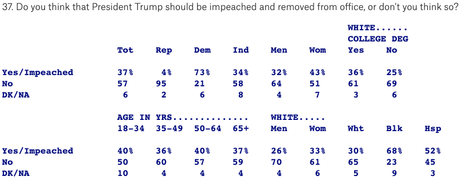

As you can see from the poll, "only" about 1/3 of the voters think Trump should be impeached but only 15% of the voters though Nixon should be impeached when Watergate started – it was 68% by the time he left office in total disgrace but, SURPRISE, most Republicans still thought he should remain in office. Keep that in mind when you see these polls – 66% is the new 100% because 1/3 of the country is never going to be convinced about anything that goes against their pre-concieved notions. This "Democracy" is now all about convincing the middle 1/3 to swing one way or the other.

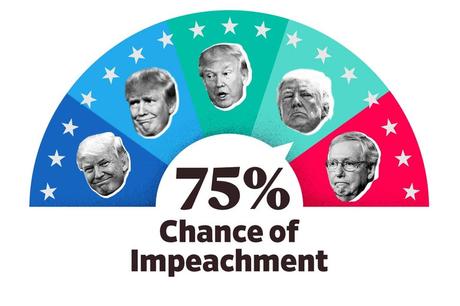

What does that mean for the markets? UNCERTAINTY – and lots of it. As you can see from the official Impeach-O-Meter, we're at a new high of 75% – higher than it was during the Mueller investigation.

What does that mean for the markets? UNCERTAINTY – and lots of it. As you can see from the official Impeach-O-Meter, we're at a new high of 75% – higher than it was during the Mueller investigation.

Impeachments can get very ugly and the market dropped 50% during Watergate, despite the Vietnam War ending (for US) in Jan of 1973, which should have been rally fuel but was instead the beginning of a 2-year slide that didn't really bottom out until 1982 – taking the Dow from 6,150 to 2,125 (down 65%) over that period of time. The S&P 500 followed a similar path:

As I said to our Members during yesterday's Live Trading Webinar, that doesn't mean we won't be able to trade but it does mean we'll have to trade differently over the next couple of years than we did for the last couple of years. For example, on Tuesday we discussed some commodity plays that seemed obvious and I suggested the following trade idea for Coffee (/KCH20) at $102:

There's no ETF for Orange Juice but there is for Coffee (/KC) and we always love it below $100 and /KCH20 (March) is down to $102 and that makes for a fun play but you have to be willing to Double Down at $98 to average 2x at $100 with a stop at $95, which would be a loss of $375 per $1 or $1,875 per contract. So the risk is $3,750 but the reward, even at just $122 would be $7,500 on a single contract and /KC has been very good to us for two years now.

Coffee does have an ETF (JO) and, like SOYB above, we can pick up a spread that can give us a nice return. We think $100 (though it can dip below) is a good floor for Coffee as it's a point below which the farmers simply can't make money selling it. For the ETF, which is at $32.50, we can do the following spread:

- Sell 5 JO March $30 puts for $1.40 ($800)

- Buy 10 JO March $30 calls for $4.40 ($4,400)

- Sell 10 JO March $32 calls for $3.20 ($3,200)

That's net $400 on the $2,000 spread so $1,600 (400%) upside potential if JO holds $32 into March. As long as /KC stays above $98, you should get paid in full. The downside to this trade is that, below $30, you would be forced to buy 500 shares of JO at $30 ($15,000) but we like that price and you can turn right around and sell calls against it to lower the basis further.

As you can see from the charts, we've already had nice pops on /KC and the ETF with /KCH20 testing $106 this morning and that's already good for gains of $1,500 per contract (you're welcome) and the short JO puts are now 0.90 ($450) and the $30 ($4.80)/32 ($3.55) spread is net $125 ($1,250) for net net $800 – already a double and well on our way to our $1,600 profit goal. That's pretty good for 48 hours, right?

We're still waiting for Soybeans and Orange Juice to pop but, most importanly, we just keep watching the news for investing signals – hopefully ones that don't depend on a stable political atmosphere (or a stable planetary atmosphere!). Soybeans should be next to move as Bloomberg just reported this morning that China indeed will be boosting their Soybean Purchases during the October Trade Talks – just as we expected they would!

We're still waiting for Soybeans and Orange Juice to pop but, most importanly, we just keep watching the news for investing signals – hopefully ones that don't depend on a stable political atmosphere (or a stable planetary atmosphere!). Soybeans should be next to move as Bloomberg just reported this morning that China indeed will be boosting their Soybean Purchases during the October Trade Talks – just as we expected they would!

Remember – I can only tell you what is likely to happen and how to make money trading it – the rest is up to you!

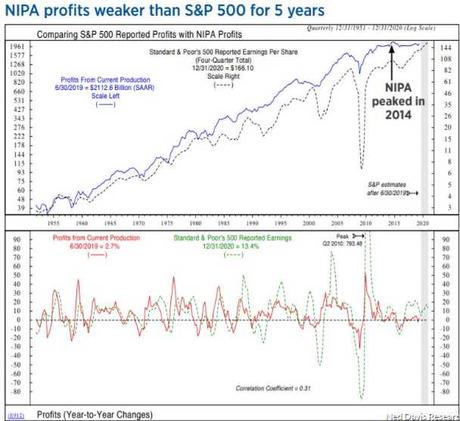

We're still not warming up to stocks, however, as we're already seeing a lot of profit warnings in Europe (where CEOs tend to be more forthcoming with such things) while a BEA report shows that Corporate Profits, after adjusting for Inventory Valuation and Capital Consumption, are 3.6% LOWER than they were 5 years ago, in 2014. According to the BEA, the difference between earnings that are released and GAAP (Generally Accepted Accounting Principles) Earnings has rarely been wider stating "The implication is that companies are pulling levers up and down the income statement to (falsely) sustain earnings growth."

And, of course, Corporate Share Repurchases are driving EPS down – even when the earnings are flat. In the last 4 quarters along, companies repurchased $750 BILLION of their own stock, comprising one out of every 4 stock transactions. Markets simply don't get more artificial than this!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!