Going by their track record – "fixing" things does not seem likely. The markets put on quite a show yesterday but the NYSE and and the S&P (we said to watch them, remember) could not close the deal at resistance and now it’s all about jobs and whatever the EU is going to do. Unfortunately, I will not be around today so I have no idea what’s going to happen but let’s review how we played this (aside from the obvious "cashy and cautious" position).

I mentioned in yesterday’s post that we weren’t liking the rally and had flipped bearish into the close. We got our $99 short entry on the oil futures (/CL) and rode those down to $97 and stopped out at $97.25 (up $1,750 per contract) as we got exactly the kind of inventory report we expected. Maybe the oil markets aren’t fixed but it sure is nice that I can call a trade at 8:30 to do something at 10:30 that works out perfectly, isn’t it?

As we expected, the overwhelmingly bad news did lead to some profit-taking yesterday but, as you can see from the Big Chart – not all that much damage has been done but, if we can’t take back those "Must Hold" lines on the RUT and the NYSE today – it’s not going to be looking good into the weekend.

In yesterday’s morning Alert to Members, we added a more aggressive play on the S&P with the SDS Aug $20/22 bull call spread at .55 (now .57), selling either WFR Oct $7 puts for .45 (now .41) to make a .10 spread or the JPM Sept $37 puts for .50 (now .53) for a .05 spread. As long as you REALLY want to own WFR or JPM if they drop 10% – this is a very cheap way to speculate on a drop in the S&P. Even better, SDS is already at $20.32 so any move down at all puts you well on the way to a 1,000% or 2,000% return on your net cash.

Do you see the pattern this week? When the market is testing the bottom of our expected range, like it did on Monday – we add some bullish hedges (our Monday SPY trade idea was up 615% as we flipped bearish on Tuesday and our SSO spread was up 3,350%). With this kind of leverage – we don’t need to take a lot. Allocating just $130 in cash and $7,500 in margin (selling 5 SPY Sept $120 puts) on our Monday SPY spread returned $930 the next day. That’s 1% of a $100,000 virtual portfolio. The goal isn’t to cover EVERYTHING – just to hedge so you have some cash to allocate towards adjusting positions that do go wrong.

Just ahead of the oil inventories, at 10:24, we added USO Aug $38 puts at $1.12 and those gave us 20% on the nose as oil dove, topping out at $1.35 when we stopped out of oil at $97.25. 10 of those in our $25KP made a quick, virtual $230. As I mentioned, a single futures contract made $1,750 on the same entry and exit – that’s why those are fun (but dangerous)! We flipped bearish on FAS with our FAS Money trades and then, at 1:42, with the S&P bouncing off it’s lows – it was time to speculate to the upside with the purchase of 2 SSO Sept $55/57 bull call spread at .82 ($164), with the suggested offsets of selling 1 MO Jan $25 put for $1.25 ($125) for net $35 on the $200 spread or 1 MSFT Jan $6 put sold for $1.50 for net $10 on the $200 spread.

These are very simple, small ways you can hedge a run in either direction. We know we’re going to get a bounce and we know we have gains we want to lock in from our earlier short plays so why not take a leveraged long, using a small percentage of the profit, to lock in our gains? That’s all this is about – it’s not too complicated! I tell Members it’s like surfing – you need to make constant adjustments to maintain your balance but, once you get used to it, you can ride out all but the most violent waves in style!

These are very simple, small ways you can hedge a run in either direction. We know we’re going to get a bounce and we know we have gains we want to lock in from our earlier short plays so why not take a leveraged long, using a small percentage of the profit, to lock in our gains? That’s all this is about – it’s not too complicated! I tell Members it’s like surfing – you need to make constant adjustments to maintain your balance but, once you get used to it, you can ride out all but the most violent waves in style!

We re-shorted oil futures (/CL) at $98.50 as it went back up (predictably) into the NYMEX close – but there are just 22,731 open August contracts left on the NYMEX so we stopped out very quickly, very happy to take a quick quarter – so we collected an even $2,000 per contract on the day and now we will move on to trade the September contracts (but not at this stage of the cycle, when they usually run it up).

Actually, I should print up this NYMEX chart so we can capture an image of this scam in progress. Tomorrow is the last day of trading for the August contracts and there were, about 3 weeks ago, over 400,000 open contracts – implying a demand for 400M barrels of oil in August and, at that time, there were just 70,000 open contracts in September. Now that the August contracts are winding down – they have rolled the August contracts and now September is filled with 377,000 contracts of fake demand, implying that America has a need of about 350M barrels more than we actually do in the month of September. Faking this demand every month is expensive (they have to roll the barrels) but these contracts help set the price on Billions of barrels of global oil that are sold each month – jacking up the prices you pay at the pump by as much as 65% per barrel – isn’t that special?

Click for

Chart

Current Session

Prior Day

Opt’s

Open High Low Last Time Set Chg Vol Set Op Int

Aug’11

97.95

98.35

97.90

98.10 *

20:07

Jul 19

Sep’11

98.75

98.75

98.40

98.75 *

20:07

Jul 19

Oct’11

Jul 19

Nov’11

Jul 19

Dec’11

Jul 19

We are very excited about that December barrel count – those are going to be really tough for the NYMEX crew to get rid of, maybe we’ll get a full-blown crash! Let’s keep this chart in mind as we watch the shenanigans next month as they push those barrels down the line. For now, we are rooting for them to get oil back to $100 or even $105, where we can load up on the short side and enjoy the ride down.

Our last trade idea of the day was the DIA Aug $122 puts at $1.22 with a stop at $1 – we’ll have to wait until morning to see how these play out but certainly we went into today’s close even more bearish than yesterday. We have plenty of long-term, bullish plays, this is just short-term protection we’re messing with, of course. Still, it’s a fun way to play while we watch the markets try to pick a direction…

Our last trade idea of the day was the DIA Aug $122 puts at $1.22 with a stop at $1 – we’ll have to wait until morning to see how these play out but certainly we went into today’s close even more bearish than yesterday. We have plenty of long-term, bullish plays, this is just short-term protection we’re messing with, of course. Still, it’s a fun way to play while we watch the markets try to pick a direction…

Morning Update: Wow, pick a direction is right! Greece is fixed, Greece is defaulting, Greece is getting a loan – pick your rumor and, last night, it moved the markets! The same nonsense was knocking the US around as Obama accepts a debt deal, rejects a debt deal, etc…

Dow futures have gone up and down 100 points and are currently (5:45 am) down a bit as the Dollar comes off the floor at 74.80, back to 75.30 (see David Fry’s chart above). So it’s the same nonsense we’ve had all week but they have changed the narrative a little. Sifting through the news, it seems like the EU will lend Greece money at 3.5% for 15 years so that can is getting kicked WAY down the road. Now on to Portugal!

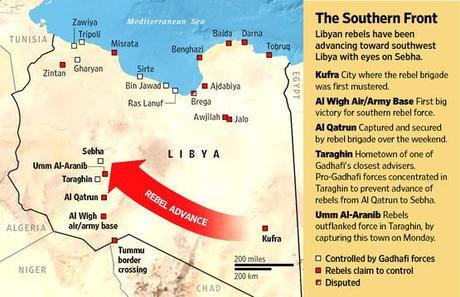

But first, let’s stop in Libya (remember that crisis?), where rebels are knock, knock, knockin’ on Gadhafi’s door. Unrest in Libya was good for about a $15 per barrel boost in the price of oil and the timing could not be worse for the oil crooks as we head into that huge build-up of December barrels on the NYMEX, possibly without a crisis to hold prices up.

But first, let’s stop in Libya (remember that crisis?), where rebels are knock, knock, knockin’ on Gadhafi’s door. Unrest in Libya was good for about a $15 per barrel boost in the price of oil and the timing could not be worse for the oil crooks as we head into that huge build-up of December barrels on the NYMEX, possibly without a crisis to hold prices up.

I’m liking the SCO Jan $51/56 bull call spread at $2, and that makes 150% by itself but you can pair that with the sale of the $37 puts at $3 for a $1 credit on the $5 spread so 500% potential upside playing that way and SCO bottomed out at $35.38 in late April, when oil was $114.83 so the crux of the bet is oil is not back over $110 in January and you make at least a buck, possibly $6!

Aside from "fixing" Greece and a possible debt deal, we have Jobless Claims at 8:30, Leading Economic Indicators, the Philly Fed and Home Prices at 10 am and Bernanke and others will be at a Senate hearing about the Dodd-Frank Act – but that doesn’t mean the won’t try to get him to say QE3 again. It’s going to be an interesting day but, in the end, it’s all going to be about whether we are over or under those 2.5% lines

Be careful out there.