China's July PPI fell a whopping 2.9% and this total collapse of the Chinese Economy since last summer is now so dramatic that even inflation (ex-food and energy, of course) is down to about 2% and you know what that means – NOW CHINA CAN PUMP MORE MONEY INTO THE ECONOMY!!!

That's right, the answer to every question in the post-Draghi era of Central Bankster BS is: MORE FREE MONEY! No actual free money of course, but rumors of free money which, we now have learned – is way better at propping up the stock market than actual money because actual money is finite while imaginary, anticipated money is infinite.

And because the rumored money is infinite and apparently comes from sources that won't add to anyone's debt (because we don't imagine consequences, do we?) or be a tax or devalue existing currencies – we can use just about any excuse to say "here it comes!"

Maybe that's Draghi's plan – while we're all sleeping he's going to come down the chimney and put a Trillion Euros under Spain's pillow and then say it was a gift from the currency fairy.

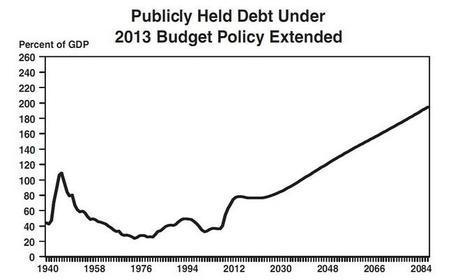

Hopefully the currency fairy will visit the US too as the CBO just calculated that our fiscal gap – the only realistic measure of our long-term budget outlook as it includes those "obligations" no one like to talk about, like all the SS and Medicare and Retirement benefits that we've already promised to hundreds of millions of Americans. That deficit has grown by $11 TRILLION in the past 12 months!

Now truly, the depth and breadth of the US Budget Crisis is indeed so bad – it's good. There is simply no way we will ever deal with this. Maybe we would have to if we were the only country in such a mess – the way Japan was 20 years ago – but now we have plenty of company, pretty much everybody, in fact. When you play Monopoly and one kid is stealing from the bank – perhaps you kick him out of the game or make him pay the money back if he wants to keep playing but when every kid is stealing from the bank – you just keep playing and end up bidding $10,000 for Boardwalk (usually $500) in a rapid inflationary spiral.

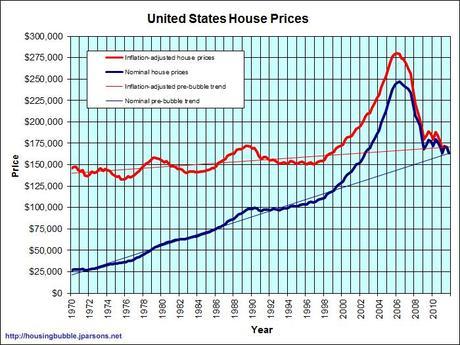

THAT is the reason people are buying stocks and commodities. Hyperinflation is in the Global Future – there's really no way around it. We WILL pay back that $220Tn – but, by the time we do, gas will be $100 a gallon. The good news is your $500,000 house will be about $10M, which kind of puts arguing with your mortgage broker over a $1,000 fee into perspective. Don't be afraid – it's not like we haven't done it before. From 1970 (when Nixon removed the gold standard) through 1981, US CPI inflation climbed from 5% to 13%.

Sure it all ended in tears – but what a party! Now nominal home prices are back to $150,000 and, adjusted for inflation – they are right back to where they were in 1970 – and that means we're ready for the next 10x run – to $1.5M. so we can all pay off those pesky debts and make our children think we were such clever investors because we happened to buy a house in the 2010s.

That's why we remain long-term bullish, despite expecting a short-term correction on QE Dysfunction as well as what is now a snowballing Global food shortage (still no one is talking about this?) that the UN now says will cost consumers $1.24 Trillion. Who will be in charge of that bail-out? The Global rubber supply (Transports) is in such a glut that stockpiles will rise 26% this year alone, to 1.57M tons (about 15% of a year's typical demand). Machinery orders in Japan were weaker than expected and Singapore has cut their own GDP forecast by as much as 50% – to just 1.5% to 3% – probably in-line with China's real numbers.

“Europe and the U.S. face serious economic problems,” Prime Minister Lee said. “Asia is doing better than other regions, but China and India are slowing down.” The Financial Times is flat out calling China's banking system a Ponzi scheme with a projected $40Bn capital shortfall in 2012 that is on a path to hit $60Bn in 2013 IN JUST THE 5 LARGEST BANKS! Gordon Chang gave an interview yesterday explaining "Why China's Growth is Worse than You Think."

Good luck to the bulls – but they look a lot more like ostriches to me…