How low can we go?

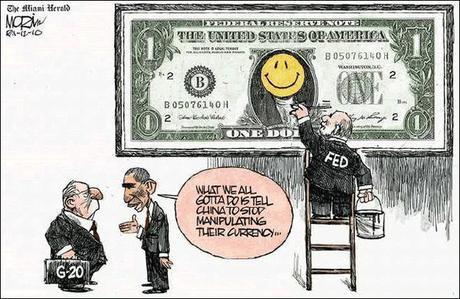

I made a bottom call on the Dollar at 73 (and a top call on the markets) last week, not because the Dollar is strong but because the alternatives aren’t so hot either. While we have dipped a bit below that line, we are in serious danger of recovering now and I say danger because – as I have pointed out in Tuesday’s post and discussed yesterday as well and as we have long been discussing in Stock World Weekly, the recent equity and commodity gains are nothing more than an illusion based on the fact that their value has been calculated in an ever-weakening dollar.

This is not a small correlation – this is almost an exact correlation between the Dollar (using the UUP ultra-ETF), the S&P (red), oil (green) and gold (gold – that one worked out). I couldn’t put silver (SLV) on the chart because silver is up a ridiculous 120% in the same period and distorts the rest (was 170% last week) but you can view that set here. Note how we’re pulling back this week just because the Dollar STOPPED going lower – what will happen if it actually goes higher?

As I pointed out on Monday, silver was beyond ridiculous when you look at it in terms of the value of your home. The "value" of your home has dropped 78% when priced in silver in just 3 years. Are we to extrapolate that in 3 more years you will have to accept an pound of silver for your home? Surely you have more silver IN YOUR HOME than that!

Homes are something people NEED, food is another thing people NEED, fuel is something people WANT, while metals are things people DESIRE. Thus, as we move from NEED to DESIRE, prices are able to get less and less realistic. This is, in part because we do not have enough metals or even fuel to fulfill everyone’s desires but food is grown and houses are built as the need arises. Yes there are occasional gluts and shortages but, Malthus aside (and, over 100 years later, can we finally put that aside?), we make enough stuff to fulfill people’s needs – most shortages are a distribution problem – including starvation in Africa, a problem that was addressed accurately by the late Sam Kinnison:

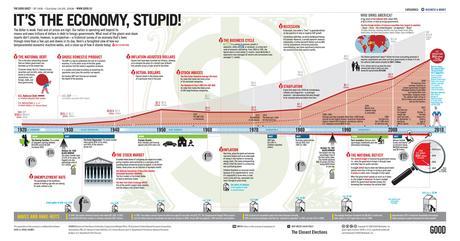

Of course pricing, supply, demand, production, etc. is all very complex – I hear they have entire Masters programs studying this sort of thing but, unfortunately, something goes very, very wrong in these schools because the only thing you can count on when you survey Economists is that none of them will have a clue about what an economic number is going to be. In fact, you would think that these jokers actually have a degree in Bistromathics rather than Economics, the way they routinely miss EVERY SINGLE projection on EVERY SINGLE economic data point.

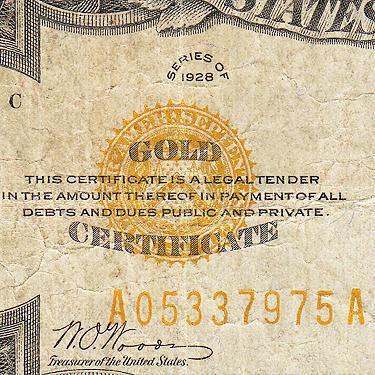

After World War II, the Brenton Woods Accord fixed the value of a Dollar at 1/35th of an ounce of gold and other major currencies had similar fixes. The Dollar became the global reserve currency because Europe (including Russia) and Japan were effectively broke and has massive rebuilding to do (so deficit spending) and China, at the time, was a non-entity while the US was able to do massive stimulus spending on infrastructure, which provided millions of jobs and paved (literally) the way for decades future growth.

Unfortunately, in the late 60′s, the US went to war in Vietnam while, at the same time, Nixon cut taxes, this quickly snowballed into a disaster that made it impossible to maintain the Dollar peg to gold as the amount of gold in US reserves (Fort Knox, etc) fell from 55% of the amount required to cash US currency at 1/35th of an ounce to just 22%. Washington’s solution to deficit spending at the time was to print more money and we quickly got into an inflation spiral to which Nixon reacted with wage and price controls as well as a 10% import surcharge to help balance our Trade Deficit (also made worse by the weak Dollar).

As the war dragged on, the money kept going overseas and gold began to skyrocket to the Dollar, running from $15 an ounce in 1969, when Nixon took office, to over $70 an ounce in early 1973 and, at that point, Brenton Woods collapsed (the "Nixon Shock") and the S&P 500 fell from 120 in January of 1972 (the market was in a huge inflationary rally) to 63 in July of 1974 (down 48%). Keep in mind this was THE SAME THING that is happening now: Tax cuts 1968 (108), market crash 1970 (70, down 35%), money printing, inflation and market rally 1973 (120, up 70%), followed by another crash back to 60 over the next 18 months (down 50%). It’s a good thing we learned our lesson and would never do that again, right?

Don’t forget UUP, which has an almost even correlation to the S&P and oil, is an Ultra ETF, which moves 2x to the Dollar so a very small move in the Dollar of 5%, can send UUP 10% higher – if the correlation remains intact, we’re looking at a 10% S&P correction off a 5% bounce in the Dollar, back to 76.65. If the Dollar recovers to 80 – the S&P can wind up down 5% for the year all of a sudden.

As we expected, the ECB did NOT tighten rates – they can’t, for reasons we have discussed for weeks in Member Chat. Not only that but Trichet gave no indication that he would be raising rates soon so the Dollar bears have almost nothing to hang their hats on – other than the very pathetic state of our own economy. German factory orders fell 4% in March vs a 0.4% gain expected by "Economists" but a 1,000% miss is par for the course in "the dismal science."

We are going to have a weak open and, if the markets don’t recover during the day, we’re going to have a big problem in the morning as the Nikkei has been closed since Monday and will reopen tomorrow with the Yen under 80 to the Dollar and 82 is about the level that causes exporters to go into a dive. Not only that but the Nikkei closed Monday MORNING from our perspective so the last they saw, the Dow was at 12,900 in the futures so down about 300 as of this morning means we can look for a similar snap in the Nikkei down from that critical 10,000 mark – a gap down rejection that will not sit well with the technical traders after their silly gap up to hit 10,000 on Monday.

In fact, if people see that, they might get the impression that these market movements were bullshit….

Be careful out there!