Inflation is a bad thing. The whole point of money is as a receptacle of value; fluctuating value defeats the purpose. The $10 you put in the bank a year ago has now lost you a dollar. Things you buy cost more. The poor — who always seem to get the short end of the stick — are especially hurt.

No wonder voters are angry. Republicans are having a field day banging the inflation drum. But how to fix it, they haven’t a clue. (While actually bearing much blame for inflation, as we’ll see.)

Inflation ramped up in the ’70s. Nixon tried wage and price controls. Bzzt, wrong answer, as any good economist would have predicted. Then Paul Volcker of the Federal Reserve succeeded in wringing inflation out of the economy by raising interest rates high enough to induce a recession. A big part of the problem was public expectations of inflation, which became a self-fulfilling prophecy, especially as workers demanded higher wages (with unions often still strong enough to get them). And Volcker also succeeded in whacking those inflation expectations.

Interest rates remain the Fed’s key weapon against inflation. The Fed, and central banks elsewhere, have for decades now generally targeted inflation rates around 2%, considered a benign level — particularly to steer clear of deflation, a different nasty problem. Until lately they were succeeding. But while today the public still does not expect persisting high inflation, mounting worldwide government debt levels cause financial market concerns that they’ll deal with it by printing money — i.e., to inflate the debt away.

Republicans do have a fair point in blaming current inflation on the 2021 stimulus legislation; that probably was over-generous, and a contributing factor. But so was the very similar stimulus passed under Trump in 2020. And his tax cut, way over-generous to the rich and corporations, driving up government debt and borrowing. Republicans remember fiscal virtue only when out of power.

More money sloshing around in the economy spurs inflation because in effect purchasers bid up the prices of things they buy. And businesses paying more for raw materials forces them to raise prices. They also buy labor; and when inflation makes dollars worth less, businesses must offer more to attract and keep employees. And meantime, another big factor is pushing up wage costs — a worker shortage.

We see “Help Wanted” signs all over. In particular, customer service type jobs go begging. Understaffing is ubiquitous. Flights are cancelled for lack of personnel.

Some of this is lingering fallout from the pandemic, which discombobulated our economy in myriad ways. One concerns productivity, which seems to have stalled. The productivity effects of increased remote working are yet unclear. And the “quiet quitting” phenomenon doesn’t help. It all forces labor costs, and thus prices, higher.

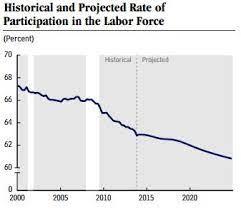

Another giant workforce factor is demography. Population growth is slowing or even reversing in the rich world. And with Americans getting more education (delaying work), retiring earlier, and living longer, the working share of the population inexorably shrinks.

That labor gap used to be filled by work-hungry immigrants. But guess what? Thanks to Trump and Republican xenophobes, immigration is way down. Another big reason for the worker shortage, forcing businesses to raise pay, and prices. A cause of inflation which Republicans don’t want to talk about.

We’ve also foolishly been waging war against globalization and trade. Buying cheap stuff from other countries kept prices and inflation down. Trump put the kibosh on that too. His tariffs equate to direct rises in consumer prices. In fact, globalization and trade benefited all participating countries — a “gigantic shock absorber” for the world economy, said Isabel Schnabel of the European Central Bank, by keeping supply and demand in balance through adjustments to production rather than price swings. That factor too is crumbling.

All these inflationary pressures are only minimally amenable to the Federal Reserve’s interest rate tweaks. (Which President Biden, by the way, doesn’t control anyway.) So when you hear Republicans rant about inflation, ask what’s their plan.