During seminary, I believe it was, a professor once told those of us in class, “You don’t get rich in academic publishing.” As the author of a widely used class resource, he added, “unless you write a textbook.” Both sides of his observation are true. I work with many young scholars who haven’t published as much as I have and I have to “manage expectations.” No, that monograph will not become a bestseller. Libraries will buy it, and, statistically, a few hundred people will read it. For those who play the more lucrative game of being acknowledged experts, however, cash can be freely flowing. The public is hungry for authentic information on religion. Despite what we’re told in the media, people are very curious about the truth.

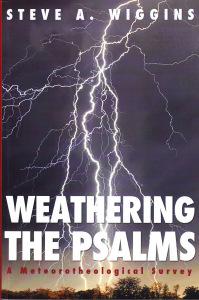

My own academic career ended before I could crank out all the books I’ve got in my head. You have to reach a certain stage of academia before that begins to happen. I’ve been working on my writing in the meantime, and I think I might be able to reach that crossover crowd that writes for non-professionals. I’m not sure I’ll have the time, but the ideas and, I hope, the skills are there. This all came back to me when preparing my taxes. One of the truly religious certainties of this world, taxes are, I know, for the common good. At least in theory. I never complain about them. Preparing them is a different story. My little book, Weathering the Psalms, followed the typical academic course of being largely ignored. I received a small royalty check for it. I wished I hadn’t. You see, I use TurboTax to file my return because someone with as simple an economic life as I have finds hiring a professional superfluous and, ahem, not cost effective. We don’t own a house or any capital. We just hope we’ve paid enough to get a little back in the spring.

Then I came on the 1099 for my meager book royalties. (They were in the double digits, just to give you an idea.) I tried to enter it into TurboTax. Uh-oh. That kind of income requires a separate form. “Congratulations,” the screen said, “on earning money from your freelance business.” That can’t be good. It turns out I had to purchase an add-on for TurboTax to handle this new tax scenario. The add-on, literally, costs more than the amount of royalties. Technically, then, I lost money on the publication of my latest book. Those are the harsh realities of academic publishing. An abstract publisher contacted me a few days later—would I like to do the abstract of my own book? Why not? I’ve paid for it. If I ever get back into academe I’m going to write books people will want to read. In the meantime, I write them to contribute to the tax base. At least academically.