The discussion about sustainability has arrived as a mega trend in the middle of society. One of the driving forces behind this is for sure the climate crisis. On the way to the desired climate neutrality, the decarbonisation of the economy is the mainstay. It affects a lot of commodities because with the restructuring of the economy, the demand for commodities will change massively. In this article I’d like to discuss about it and provide you an overview about the affected commodities (at least from my point of view).

Sustainability has arrived in the middle of society as a mega trend of the post-industrial revolution and is being accelerated by the corona crisis. Sustainability can be understood as a principle of action for the use of resources. For our systems can only withstand a restricted level of resource usage over the long term without being damaged. Sustainability aspects are also playing an increasingly important role for countries and companies. Because if you do not take this seriously, you are taking on increased economic risks in the medium to long term. Therefore, a lot of companies see sustainability as a necessity for future viability and as an opportunity for growth and competitiveness. A few years ago the UN have set 17 goals for sustainable development.

One aspect that has made sustainability “big” is the climate crisis. It’s seen as one of the greatest challenges at the government and corporate level. The EU Commission presented the so-called Green Deal in December 2019 and sees it as a roadmap for a sustainable economy. It is intended to shape Europe into the world’s first climate-neutral industrial region by 2050.

The “Fit for 55” program (as a part of the Green Deal) presented in July is a step in this direction. With this, the EU Commission wants the EU to reduce its greenhouse gas emissions by at least 55 percent by 2030 compared to the levels of 1990. And the decarbonisation of the economy is the mainstay on this path.

Decarbonisation is the reduction of carbon dioxide emissions through the usage of low-carbon energy sources. This results in lower emissions of greenhouse gases into the atmosphere. Reducing the amount of carbon dioxide created by traffic, power generation and industrial production is essential to meet global temperature standards set by the Paris Climate Agreement, among others. Decarbonisation includes, in particular, the usage of renewable energy sources such as wind power, solar energy, hydro power and biomass. There is a controversial debate ongoing about whether nuclear energy should also play a stronger role as an emission-free form of electricity generation.

The usage of carbon-containing energy in the traffic can be reduced in particular through the large-scale use of battery-powered electric vehicles or hydrogen-powered electric vehicles with fuel cells, provided the electricity required for this purpose is coming from emission-free sources. Another option is to use synthetic fuels made from so-called green hydrogen. The industry is also considering the use of hydrogen as a low-emission energy source, for example in the steel production.

Decarbonisation has an impact on many raw materials and there is no sector is spared from its influence. The effects are both positive and negative. In the following, I’ll give you an overview of commodities which are in particular affected (from my point of view).

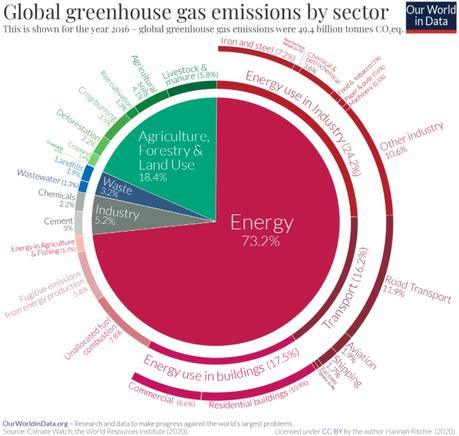

CO2 neutrality in 2050 should force massive upheavals in the energy sector

The energy sector is accountable for around 73% of greenhouse gas emissions and is therefore at the center of the decarbonisation of economic life. When coal, natural gas and oil products obtained from crude oil such as gasoline, diesel, kerosene and heating oil are burned for the purpose of generating energy, a considerable amount of CO2 is released. But the CO2 emissions from fossil fuels to generate electricity are significantly higher, if the efficiency of the respective power plant is taken into account. Therefore, the decarbonisation of power generation plays the most important role in the energy sector. In the transport sector, the focus is on electric mobility.

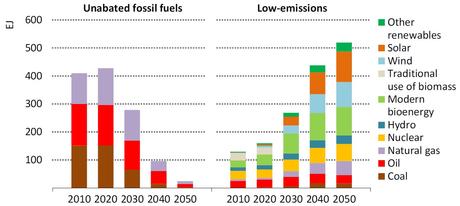

The International Energy Agency (IEA) published a report “Net Zero by 2050 – A Roadmap for the Global Energy Sector“. The Agency is considering this as having far-reaching consequences for the energy sector so that the goal of climate neutrality can be achieved by 2050. According to this, two thirds of the total energy generation will then be provided by renewable energies such as wind, sun, bioenergy, geothermal energy and hydro power.

Solar energy shall to make up a fifth of all energy production and is therefore the most important source of energy. Hence, the solar capacities should increase twenty-fold between now and 2050, the capacities for wind power by eleven times. The share of fossil fuels, on the other hand, is expected to decrease from currently almost 80 percent to a little more than 20 percent.

Electricity generation is expected to cover almost half of the total energy consumption in 2050. For this reason, electricity generation is likely to increase by more than two and a half times over the next 30 years. Almost 90 percent of the electricity generated should come from renewable energies. Wind and solar account for 70 percent of this. The remainder is to be obtained primarily from nuclear energy. In this scenario, the IEA assumes that no new oil and gas fields will need to be approved for development after 2021. In addition, there should be neither new coal mines nor an extension of the service life of existing mines. The IEA also assumes that coal demand will fall 98 percent to less than 1 percent of total energy demand by 2050. The demand for gas is expected to decrease by 55 percent and the demand for oil by 75 percent.

A global scenario of net zero emissions in 2050 is for sure extremely ambitious. In fact, so far only a few regions of the world have committed to the goal of climate neutrality by 2050. Therefore, the IEA has run through further scenarios in its “World Energy Outlook WEO 2021” – one of which is based on the previously announced climate targets. In this scenario, the restructuring of the energy system would not only be less radical, the structure of the energy supply would also be different: According to the current plans and announcements by the governments, the phase-out of coal-fired power would make a relatively higher contribution to emissions reductions, while oil consumption in this “more comfortable” scenario has to fall back significantly less and the demand for natural gas can almost maintain its current status quo.

Nevertheless, this scenario also requires some restructuring, which can already be seen in the near future: The IEA expects an increase in capacities for electricity generation from solar energy and wind power by 500 gigawatts annually by the year 2030. Coal consumption in the electricity sector should be at the end of the decade 20 percent below the current high. The demand for oil is expected to peak in 2025 due to the rapidly growing e-mobility and ongoing advances in fuel efficiency. Total energy demand is expected to plateau after 2030. The electricity sector is expected to make by far the largest contribution to the 40 percent reduction in CO2 emissions in the energy sector by 2050. Investments and thus also financing for clean energies are expected to double over the next decade.

But this still wouldn’t be enough to achieve the goal of net zero emissions by 2050. That’s why the IEA calls on all countries to tighten their targets for 2030. According to the IEA, investments in clean energy would have to increase to 4 trillion US dollars by 2030, in order to achieve the zero emissions target in 2050. Having the money to invest in the fossil fuel production that will continue to be required in the coming years is likely to be a challenge.

Crude Oil

In the next five years, the demand for oil is likely to continue to rise, although the growth is likely to level off significantly after reaching the pre-corona level. The OPEC expects an increase of almost 14 million barrels per day by 2026, the majority of which should take place in the first half of the forecast period. After 2030, however, the demand is unlikely to increase any more.

Oil production, on the other hand, is likely to decline after a short time without any investments. This can be seen in shale oil production in the USA as well as in some OPEC countries such as Venezuela, Algeria, Libya, Angola and Nigeria. In western countries in particular, oil companies are under pressure to reduce CO2 emissions, which is likely to reduce their willingness to invest in fossil fuels such as oil. The dependence on OPEC and its market power is therefore likely to increase.

This speaks in favor of higher oil prices in the coming years than expected. The same applies to natural gas, which as a comparatively low-emission and, above all, base-load energy source for power generation is likely to be increasingly used until there is sufficient storage capacity for renewable energies. Asia is likely to continue to attract the majority of the supply of liquefied natural gas (LNG). Because of decreasing natural gas production in the Netherlands and Norway, Europe will be more dependent on Russia as a natural gas supplier. The sharp rise in gas prices in 2021 could, therefore, may not have been just a brief interlude.

Although coal is the biggest looser…

Coal is undoubtedly the biggest loser in all scenarios. The investment plans for new coal-fired power plants have already been reduced significantly. The IEA assumes that coal demand should reach its peak in the middle of the decade and then decline by 2030, initially due to the phase-out of coal in the industrialized countries. However, the global demand for coal will decline sharply in the following two decades because the climate targets in the major coal-consuming nations should then also take effect.

In 2050, global consumption should only be half as high as it is today. In the net zero emissions scenario, it would undoubtedly even have to drop by 90 percent, with the remaining power plants having to be equipped with the technology of carbon capture and storage. The marked decline in coal consumption tends to suggest falling prices, but in view of the increasingly difficult financing conditions for the coal industry, there can be periods of tension.

Industrial metals: essential constituents in electric mobility

Most industrial metals are an essential part of decarbonisation. Hence, copper, aluminum and nickel should benefit from this in the next few years. Lead, on the other hand, is more likely to be a loser in this mega trend.

Copper

Copper plays an important role in electric mobility because it’s an essential component in electric motors. But copper is not only needed in the car itself, but also in power generation, the power grid and charging stations. The independent research institute CRU had already carried out a study three years ago, according to which electric cars and the areas connected to them could cause an annual deficit of around 4.7 million tons of copper in 2030.

CRU assumes an average copper consumption in an electric car of around 80 kilograms (176 lbs). That would be more than three times what a car with a combustion engine takes. In addition to electric vehicles, copper will be used extensively in expanding capacities for renewable energies; the demand is particularly high in wind power plants.

Aluminum

Aluminum is used in electric mobility to reduce the weight of a vehicle and thus increase its range. But aluminum is not just lighter than steel. Like steel, it also provides strength and safety. CRU and other research institutes estimate that more than twice as much aluminum is used in electric vehicles than in vehicles with internal combustion engines.

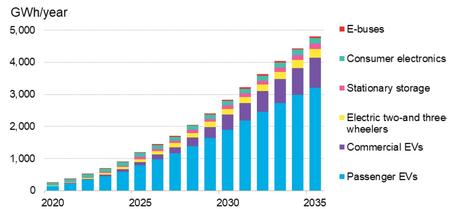

Nickel

In the nickel market, electric mobility may be responsible for the biggest changes in the next few years. Nickel will be used extensively in the cathodes of lithium-ion batteries for electric cars, even if there has recently been an increasing trend towards lithium iron phosphate. According to the estimates by Bloomberg New Energy Finance (BNEF), the demand for nickel for the battery production will jump from almost 180,000 metric tons in 2020 to 1.40 million metric tons in 2030.

This would represent more than half of the total global nickel demand expected in 2021 by the International Nickel Study Group. However, the actual demand of the battery sector will be lower at the end of this decade. The average nickel consumption in an electric car is 35 kilograms. In cars with combustion engines, nickel is hardly used at all (1 kilogram).

Lead

Lead is likely to be affected by the electrification of the vehicles. Batteries are used in cars with combustion engines consist around of 55% of lead. Therefore, in the coming years, the need for lead in car batteries will probably be reduced and redirected towards nickel. Lithium-ion batteries will also be used increasingly in e-bikes in the future. However, this change should not begin immediately but rather be a process that will take years. Lead-acid batteries also benefit from the fact that they are cheaper to manufacture and easier to recycle than lithium-ion batteries.

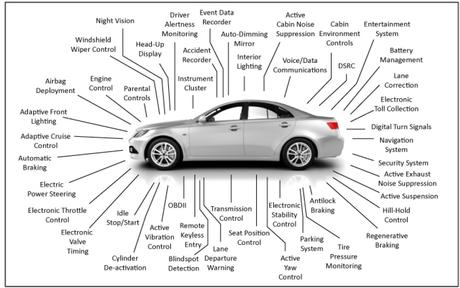

Silver

The topic of sustainability has also reached the precious metals. Industrial precious metals are particularly affected. Silver plays an essential role in many “green” technologies. It benefits from the fact that a little more than half of the total silver demand is use for industrial applications. Due to decarbonisation efforts and propelling electrification, silver should benefit in particular from areas of application in the automotive sector, for example in electronic contacts, microprocessors, memory and circuit boards, radar and camera sensors, and also in the solar industry.

Silver is difficult to replace in various automotive applications because of its superior electrical properties. Many of them are essential for the safety and fulfilling of the stricter environmental standards.

According to a study by the Silver Institute, cars with combustion engines use 15 to 28 grams of silver per vehicle. In hybrid vehicles it is already 18 to 34 grams, and in battery-operated vehicles the use of silver should increase to 25 to 50 grams. Since silver is also used in charging stations, power generation and other supporting infrastructure, the Silver Institute estimates the demand for silver from the automotive industry at 88 million ounces by the middle of this decade (it should be a good 60 million ounces in 2021). In 2040, electric vehicles could even consume almost half of the annual silver supply.

But the expansion of renewable energies is also driving demand of silver, especially the installation of solar systems. The photovoltaic sector is currently in demand for around 100 million ounces of silver annually. Even if the silver part in the solar modules would be reduced due to the improvement of technology, the increasing number of modules is likely to overcompensate this effect. Some market watchers estimate that silver demand from the photovoltaic industry will rise to around 185 million ounces over the next ten years. All in all, among precious metal, silver is likely to be the main beneficiary of the transformation of the economy towards sustainability.

Platinum

In the case of platinum, the production of hydrogen plays a major role, which should drive demand over the next few years as platinum is used in the fuel cells. The major economic areas of Europe, the USA and China have set ambitious goals for hydrogen technology. By the end of the decade, several million hydrogen-powered vehicles could be on the road and up to 1,000 refill stations will be available. China is advancing the development of hydrogen propulsion faster than other countries / regions.

According to the World Platinum Investment Council, demand for platinum from hydrogen-powered vehicles (FCEVs) is likely to be around 2 million ounces higher in 2030 than it 2021. The need for platinum for fuel cells should therefore cushion the loss of demand for catalytic converters in combustion engines, so that the demand for platinum from the automotive industry should remain high in the long term.

Palladium

The demand for combustion engines is likely to suffer significantly. The automotive industry accounts for around 85 percent of the total demand for palladium. After 2030, the automotive industry could even become a supplier of this precious metal, as more of it could be recovered from scrapped catalytic converters than is used for the production of new catalytic converters.

Commodity Stocks To Buy

As you can see, there should be (as usual) winners and losers in the upcoming mega trend. Among the metals, the clear winners should be nickel, copper, aluminum and silver. A bit later, platinum should join the game. Therefore, a long term investor should take a closer look at these commodities and search for new investment opportunities.

Among the energy sector, coal should be the biggest loser (thankfully). Winning of energy from the wind, sun, bioenergy, geothermal energy and hydro power will most likely be the winners of the upheaval.

If you would like to invest in commodity stocks, which one should you pick to profit from the megatrend of sustainability? Well, as usual, you always should do your own research. But just for the idea, I’m providing you a list with a couple of stocks you can analyze and make a choice:

- Nickel:

- Vale (VALE)

- BHP Group (BHP)

- Rio Tinto Group (RIO)

- Haynes International (HAYN)

- Materion Corporation (MTRN)

- Schnitzer Steel (SCHN)

- Copper:

- Freeport-McMoRan (FCX)

- Global X Copper Miners ETF (COPX)

- Hudbay Minerals (HBM)

- Southern Copper Corporation (SCCO)

- Silver:

- First Majestic Silver Corp (AG)

- Pan American Silver Corp (PAAS)

- Silvercorp Metals (SVM)

- Platinum

As platinum is a very rare metal, it’s hard to find a good and viable company specialized in providing platinum. The most stocks of such companies are penny stocks producing losses year after year. Therefore, it’s better to look for bigger viable companies having platinum in their product program. In this case it’s may be also worthwhile to check some different companies using platinum in their product like jewelry companies, or scrap companies.- Vale (VALE)

- Umicore (UMICF)

- Norsk Hydro (NHYDY)

- Aluminum

- Alcoa Corporation (AA)

- Kaiser Aluminum Corporation (KALU)

- Constellium SE (CSTM)

- Solar

- SunPower Corporation (SPWR)

- NextEra Energy (NEE)

- Clearway Energy (CWEN)

- SMA Solar Technology (SMTGF)

- Wind

- NextEra Energy (NEE)

- Clearway Energy (CWEN)

- Northland Power (NPIFF)

- Vestas Wind Systems (VWDRY)

- Bioenergy

- Crop Energies AG (XTRA: CE2)

- Drax Group (DRXGF)

- Mercer International (MERC)

- Geothermal energy

- Ormat Technologies (ORA)

- Eversource Energy (ES)

- Hydro power

- Brookfield Renewable Partners (BEP)

Disclosure: I have no stocks, options or similar derivative positions in of the companies I’ve mentioned in this article, and no plans to initiate any such positions in the next 72 hours

Disclaimer: This information is neither an investment advice nor an investment strategy or investment recommendation. The information I am giving you in this article is for informative purposes only. The information presented would not be suitable for investors who are not familiar with securities. Any readers interested in trading or investment activities related to the information in this article should do their own research and seek advice from a licensed financial adviser. The securities are products that are not simple and can be difficult to understand. This information contains information that relates to the past. Past performance is not a reliable indicator of future results.

*Affiliate link: when you click on this link, no additional costs would arise for you and the product or the service will not become more expensive. When you decide to buy the product or use the service, I’ll get a little benefit from the provider which I would reinvest to keep this blog alive.