Now we're getting some action!

Now we're getting some action!

About 1/3 of the S&P 500 reports this week so there should be lots of opportunities for baragain hunting – unless, of course the earnings are not good and we finally begin to deflate this bubble market. This will be the first week in 4 years that there is likely to be more focus on the markets than the Government as the Government goes back to "normal" functions with a President who doesn't try to dominate the news cycle.

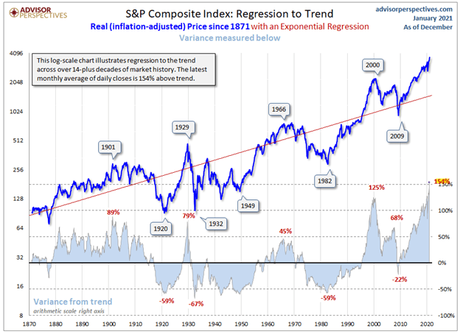

That shifts the focus back to earnings but one might wonder how earnings can possibly justify the sky-high valuations we have been giving most stocks in the past few years. According to Jill Mislinsky at DShort: "The peak in 2000 marked an unprecedented 129% overshooting of the trend – substantially above the overshoot in 1929. At the beginning of December 2020, it is 154% above trend. The major troughs of the past saw declines in excess of 50% below the trend. If the current S&P 500 were sitting squarely on the regression, it would be at the 1457 level."

154% above treand. That's a lot! While I don't see the S&P going all the way back to 1,457, I do see a 20% correction almost inevitable, back to about 3,000 and, while we may go higher, we'll still pull back at some point so 3,829 (this morning's open) is a very tough pill to swallow on the S&P 500.

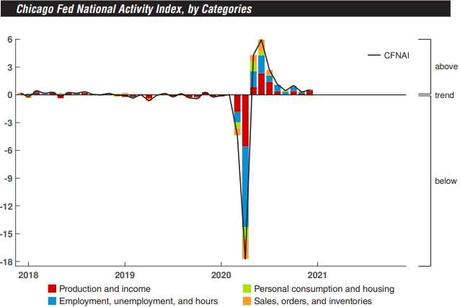

Dallas Fed comes out at 10:30 and tomorrow we get Home Prices and Consumer Confidence, Wednesday it's Durable Goods, Investor Confidence, Business Uncertainty and the Fed and then Thursday we have GDP, Retail Inventories (very important after Christmas), New Home Sales, Leading Economic Indicators and the KC Fed. Friday we finish the week with Personal Income, PMI and Consumer Sentiment – a very busy data week with NO Fed speak – other than Powell's press conference on…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!