Hello world. My posts on this blog have been sporadic, I’m generally moved to write by economic activity and the global economy (Africa excluded) has been, by and large plodding along in its sluggish manner. There has been no breakthrough policy shift; no ideological shift away from the current set of policies, rather, a continuation of what we’ve seen, which is public sector cuts and the detrimental consequences of such actions.

What this prolonged period of economic activity has shown us is the fact that profits will always by certain sections of our society. Despite policies that have had a nefarious effect on large sections of our community, profits have been made and if we look at the market structure of the firms making profits then it is clear that they mainly resemble oligopolies and monopolies.

Before I explain the ramifications of this apparent anomaly, I should stress that I am not here to lambast profit making. Profits are a sign of an efficient business, whereby costs are controlled and a business can expand. Without profit business would not exist, not only would there be no incentive to innovate and take ideas to market, but a firm would have no means in which to continue producing their good or service. In an ideal world however, profits would be generated in a naturally competitive market. And a competitive market has no room for oligopolies and/or monopolies to form.

My previous pieces here and here show how oligopolies are bad for consumers because they allow firms to charge whatever prices they feel suitable, leaving consumers with no choice. What is so distasteful is the fact that goods and services that are essential to our wellbeing are the ones where competition is non-existent and legal barriers are erected in order to prevent newer entrants from challenging established firms.

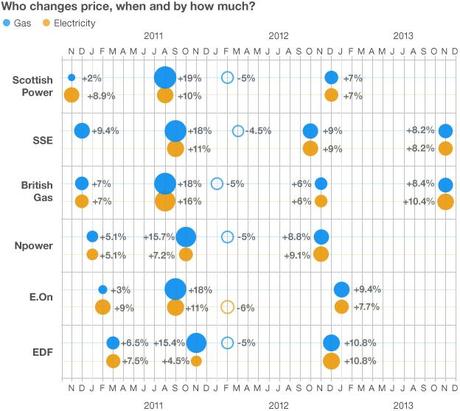

It may be coincidence but as the weather gets cooler the utilities market seems to increase prices and this year is no different. If we look at British Gas, one of the largest firms in this market, they are increasing gas by 8.4% and electricity by 10.4%. Ian Peters of British Gas admits it is “unwelcome news” but in an industry where there is no effective competition comments such as his could act as a condescending reminder of the contrasting fortunes of our increasingly divided society. Whilst I do not doubt the sincerity of his comment, it comes during an extremely difficult period of stagnant economic activity, where households have been forced to cut spending therefore demanding less. Comments such as his can only add insult to injury. The Energy Secretary Ed Davy was not pleased, adding that the price increases in general were “extremely disappointing news.” He and the Prime Minister advocated that consumers “shop around” for the best deals. Therein lies the fundamental problem. Even if consumers switch from one energy company to another the market structure itself dictates similar prices, thus the savings are marginal at best. For savvy consumers looking to save every penny (and in this climate, who could blame them?) this is a restrictive option. It should be noted however that collusion in any oligopoly is either deliberate (which is illegal) or tacit. So firms will mimic their rivals.

Source: BBC

The formation of the energy cartel in the UK is an explicit example of market failure. Market failure is where the free market fails to effectively distribute resources efficiently. In order for governments to erode this failure there are a number of political and economic tools it could utilise in order to help correct this failure. Governments often spout the notion that markets are regulated. Regulation is a surrogate form of competition that probably disrupts the flow of business activity as oppose to aiding it. What governments should do and what they claimed they were doing when they privatised several important industries was ensure that market power cannot become concentrated into the hands of a few large firms. This has not happened. Rather, the inefficient government owned industries have been replaced by the inefficient privately owned firms. In fact, when government owned them they had to answer to the taxpayer, now these firms answer to shareholders, the stakeholders i.e. consumers have no say. Their acquiesce is a formality.

The same situation is prevalent in transport where prices will rise again in January by 4.1%. Again the traits are synonymous with other oligopolies, consumers have no choice.

Powerful firms often use branding as a way to create the illusion of competition. Branding allows consumers to associate that good or service on its own merits, but as the diagram below highlights, rather poignantly, so few firms actually have substantial control over goods and services we have to demand.

The 10 major food companies

I began this piece by stating that profits are still being made by sections of our society. I am not advocating for some quasi profit distribution to the lower echelons of society. I am however suggesting that the public demand much more from national government. Where oligopolies are formed, governments should be pressured by the public to erode the legal barriers preventing a number of newer entrants challenging the dominant firms. Until actual competition is established and markets resemble a monopolist market structure, where there a lot of firms and new entrants can enter the market easily, prices in essential industries are only going to go in one direction.