The Supply-Side School of economics gets its moniker from its exclusive emphasis on government factors that affect production such as taxes and regulation. According to the Supply-Siders, the best, and perhaps only, way to grow the economy is through policies that encourage investment and production, like reductions in the top marginal tax rates or market deregulation. Production is incentivized by lower costs and general growth is guaranteed by the increase in supply this entails. These ideas are controversial. Over the last few decades the debate over supply and demand in the political arena has coalesced into a partisan issue between conservatives and liberals. Arguments in America over taxes, entitlements, and deficits can descend into accusations of class warfare and socialism. The present day Supply-Side School began in the mid 1970s, but theories regarding supply side forces along with the counterpart forces of demand, are rich in the history in economic thought. I will summarize the legacy and evolution of Supply-Side Thought before returning to the contemporary perspective.

The modern arguments for Supply-Side policy have centered squarely on reducing marginal tax rates for top earners, corporations, capital gains and dividends. It is useful to begin with the early arguments against taxation. In France, in the middle of the eighteenth century, the Physiocratic School of thought introduced the concept of laissez-faire to economics. Led by Francois Quesnay, the Physiocrats argued that the government could help the economy best by not getting in the way, except to enforce natural laws such as property rights. Quesnay, who before contributing to economics was the court physician for Louis XV and Madame de Pompadour, suggested that the only fair tax was that levied against landowners. The Physiocrats believed that the only source for economic surplus was derived from agriculture, which was taken by landowners through the insidious charging of rents. They thought that all other taxes were indirectly passed on to landowner’s anyway since they were the sole holders of the surplus, and by locking taxes to their natural target the overall burden on the economy would be lifted. (Brue, Grant 35-37) Keep in mind that the Physiocrats lived in 1750 agrarian France, where virtually all of the land was owned by the nobility. It is likely that this fact biased the school’s views about rents and surpluses.

The relative importance of supply as measured against demand has waxed and waned throughout history, just as the modern Supply-Siders influence over US economic policy has. Classical School economists like Adam Smith and James Mill emphasized the benefits of supply, the latter suggesting that national purchasing power was positively linked to aggregate production. The most famous Classical School proposal on supply comes from Jean-Baptiste Say, and his Law of Markets. Say’s reasoning was simple. People desire money not for its own sake, but to employ it in purchases. Each purchase is a product sold, and each sale is a payment to a producer, who is compelled ultimately to utilize his income in additional consumption. This is summed up best in the characterization, “supply creates its own demand.” (Brue, Grant 131) Say’s emphasis on supply misses the short run problems that can develop in markets when demand shifts. Holders of cash can curb consumption and become hoarders. Thomas Malthus thought that the subsistence wage earned by most workers was not sufficient to keep consumption growing at the pace of investment. When returns cease to impress, investment will dry up and the capitalists will keep their money on the sidelines since they are not prone to consuming their own produce. (Brue, Grant 91)

With the rise of the Marginalist School in the last quarter of the 19th century, supply side factors became overshadowed by the focus on demand in price determination. The Classical economists thought that the costs of production, like those for labor and raw materials, determined the market price of a good. William Stanley Jevons rejected this assumption and offered a theory of value that relied primarily on the marginal utility received from a good (Brue, Grant 232). The Austrian economist Carl Menger proposed that the price of capital goods were also determined by marginal utility due to imputation of value from the subjective worth of the finished good (Brue, Grant 242). Thus Adam Smith’s water-diamond paradox was reconciled with the idea that value could be derived from utility. The paradox pointed out that low utility diamonds were valued much more than high utility water. Water is abundant and due to the concept of diminishing marginal utility, the subjective value of each additional unit of water declines as the quantity grows. The marginal utility on each additional unit of diamonds is valued higher relative to water because of the relative scarcity of diamonds. However, if someone was dying of thirst in the dessert they would certainly trade a diamond for even one drink. Supply is merely secondary to the pull of demand when framed from the perspective of marginal utility.

Alfred Marshall re-introduced the importance of supply to economics, and transformed the Marginal School into the Neoclassical School. Although not a return to complete dominance, supply was put on an equal footing with demand as Marshall’s second blade on the scissors of price determination (Heilbroner 208). However, time plays an important role in the interplay between supply and demand as distinct economic forces. In the immediate present, supply is controlled by demand so that if the latter unexpectedly spikes for a particular product the quantity supplied cannot be increased. In the short run producers can influence supply to a greater degree by controlling variable costs. For example, Businesses can expand by hiring workers, or pay for cutbacks through layoffs. In the long run, even fixed costs like overhead and top executive salaries are variable. Labor supply, along with demand, also helps to set wages (Brue, Grant 284-289). If the amount of doctors graduating from medical school were to increase dramatically the typical salary for doctors would decline unless demand for services increased enough to compensate. In Neoclassical economics the forces of supply and demand interact to determine equilibrium price.

The Keynesian Revolution of the mid 20th Century introduced the concepts that formed into modern Macroeconomics, which is the study of an economy taken as a whole. Supply’s importance would be relegated to Microeconomics, the study of individual firms, industries and markets. John Maynard Keynes argued that a reduction in aggregate consumer demand could become chronic if deep and long enough. A permanent reduction in employment and production can result from the erosion of savings needed for investment in a prolonged down turn. Investment and savings are not directly linked in modern finance, but mediated by business men. People save money for future consumption, but investment of those savings are determined by the business outlook. Economic recessions occur when investment is withdrawn as a result of declines in expected profits (Heilbroner 267). If a vicious cycle develops, where falling production increases unemployment thus curtailing consumption and spending in such a way as to further reduce production and employment, then an economy may not be able to grow itself out of the hole naturally. This happened in the Great Depression according to Keynes, and he recommended proactive government action to stimulate aggregate demand in this kind of situation. With deficit spending leaders can fund programs such as unemployment insurance and infrastructure construction, and this creates a multiplier effect that raises production by subsidizing consumption for a time.

The rise of the Supply-Side Economics in its present form can be credited to University of Chicago Professor Robert Mundell, and his student Arthur Laffer. The impetus for a new school of thought was perpetuated by a growing discontent with the Keynesian programs of demand management and a belief that the economic woes of the late 1960s and early 1970s would only be solved by a focus on supply and production. They believed that high marginal tax rates on top earners and corporations disincentivized production causing supply to be restricted. Keynesian attempts to stimulate demand would only drive up prices in an environment that was unfriendly to production. Inflation without growth, known as stagflation, was the only possible result of government expansion of demand while simultaneously squeezing out supply. Cuts to top marginal tax rates, and other supply targeted actions, were the solutions proposed by the Supply-Siders. They contended that the increased incentives created by the potential for higher earnings spur production and consumption follows naturally from the rising employment that more supply entails.

Robert Mundell has called Supply-Side Economics “a policy without a theory” (Arlo Track 5), even though theory is most certainly applied in the justifications of these policies. The major premise for Supply-Side initiatives is that unnecessary barriers to production and supply, resulting from high tax rates, trade restrictions, and regulations constitute a greater incentive to consume leisure rather than work for productive purposes. Instead of working longer hours or striving for pay increases, if a worker is faced with a narrowing rate of take home pay at higher levels of income, it will induce a preference for slacking. The steeper the progressive increases in marginal tax rates, the lower the opportunity cost for work rather than play. Furthermore, reducing marginal tax rates for the top earners gets the biggest bang for your buck in increased incentives in a progressive tax system. Arthur Laffer demonstrates an extreme example of this by looking at the tax cuts proposed by President John F. Kennedy in 1962 and implemented by President Lyndon B. Johnson in 1964. The top marginal tax rate was decreased from 91% to 70%, and the lowest marginal tax rate was dropped from 20% to 14%. The increase to incentives for the top earners was 233%, because their take-home income for each additional dollar in the higher bracket went from $0.09 to $0.30. On the other hand the increase to incentives in the lowest rate was only 23%, because the additional take home pay for each additional dollar moved from $0.80 to $0.86. Thus Supply-Siders can justify the focus on encouraging the wealthy because the increase to incentives, at least in Kennedy tax cuts example, is 300 times greater. (Laffer)

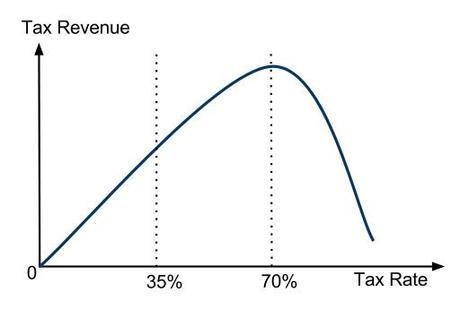

Whit the support for the rich inherent in Supply-Side theory, it has been justified by its proponents with the slogan “a rising tide lifts all boats”, a phrase borrowed from Kennedy that was originally used to justify government funding of a dam construction project. Supply-Side opponents have given the spotlight on the wealthy the derisive moniker, “trickle down economics.” (Roberts) “Voodoo Economics” is another nasty phrase used by George H.W. Bush to characterize the Supply-Side proposals that Ronald Reagan campaigned on for the Republican nomination to President in 1980 (Roberts). This title originated from the counterintuitive and controversial claim by Arthur Laffer that lower tax rates will actually increase total government revenues. He illustrates this principle with the Laffer Curve, which was first published by Jude Wanniski in a 1976 article after he saw Laffer draw it on a restaurant napkin. The argument is that the increased growth that results from stimulating supply and production will expand the tax base by encouraging more work and employment. The total revenue received from top earners would actually grow as well because lower marginal rates would lower the incentive to evade taxes and allow the upward levels of mobility to be strengthened by the added inducement for middle earners to strive for more pay. (Laffer)

With President George W. Bush’s tax cuts in 2001 and 2003, a contentious issue still today, there have been four distinct eras of tax cutting in America. Aside from Bush, there were the Harding/Coolidge tax cuts of the 1920s, the Kennedy/Johnson cuts of the 1960s, and the Reagan cuts on the 1980s. The Coolidge and Kennedy eras were cited by the Supply-Siders in the 1970s as positive proof that stimulating supply was the ticket to greater growth. With the Reagan era to look back on as well, Arthur Laffer argued in 2004 that evidence from all three eras supports the premise that tax cuts are good for the economy and these instances became the justification for Bush’s tax policies. A comparison of the average GDP growth, unemployment, and government revenues for the four years before and after the last round of tax in each of these examples, demonstrates an improvement in most metrics according to Laffer. In fact, he indicates that the Laffer Curve argument was made by President Kennedy himself:

Tax reduction thus sets off a process that can bring gains for everyone, gains won by marshalling resources that would otherwise stand idle-workers without jobs and farm and factory capacity without markets. Yet many taxpayers seemed prepared to deny the nation the fruits of tax reduction because they question the financial soundness of reducing taxes when the federal budget is already in deficit. Let me make clear why, in today’s economy, fiscal prudence and responsibility call for tax reduction even if it temporarily enlarges the federal deficit-why reducing taxes is the best way open to us to increase revenues. – John F. Kennedy (Laffer 6)

The modern Supply-Side Revolution in America came into full force with the election of President Reagan, and the economic team he brought with him. Paul Craig Roberts, the Undersecretary of the Treasury for Policy in the administration’s first term, credits the regime with ending stagflation and spurring long run growth. This was achieved by adjusting the policy mix by lowering marginal tax rates and simultaneously ending the monetary expansion by the Federal Reserve. Keynesians were incorrect to think that high taxes caused more work effort and that easy money would end stagflation by keeping interest rates low. This assumption came from Phillips Curve depiction that unemployment and inflation were a trade-off. The belief was that higher inflation came naturally with diminishing unemployment, so that inflation was actually a sign of growth. Roberts, and other Supply-Siders, contend that this is erroneous, because inflation can be caused by the increasing abundance of money for consumption if there is no addition to supply. This new view suggested that extra money in the system was causing the inflation, and by easing tax policy and tightening the money supply, this equation could be reversed. Thus Supply-Side policies would reduce inflation and stimulate growth it was hoped. Interest Rates would eventually come down as well, because increased savings and investment promoted by these actions would drive up the demand for bonds, raise prices, and, since there is an inverse relationship between bond rates and prices, interest rates would fall (Roberts).

Supply-Side fever was, and is, not just an American phenomenon. The UK, Japan, and Australia were early adopters of these policies after witnessing their application in the US. Finland and Turkey cut top marginal tax rates dramatically and they grew faster than any other nations in their respective regions afterward. Before long, Sweden, Norway, France, Italy, Austria, Belgium, The Netherlands, and West Germany had all followed suit in Europe. In North America, Canada joined the US, and in South America, Columbia and Chile, the two best performing South American economies, as well as Bolivia, climbed on board the Supply-Side train. In Asia, Hong Kong, Singapore, and The Philippines cut their top marginal tax rates alongside Botswana in Africa and Israel in the Middle East. (Arjo Track 8). With the fall of the Soviet Union, Russia, Estonia, and Lithuania would adopt flat tax rates, which are credited with increased tax compliance and actually raising output and government revenues (Papp, Takats).

Recent history has not cast the Supply-Side fervor in America in as favorable a light as was experienced in the 1980s. Tax hikes by President George H.W. Bush and President Bill Clinton in the 1990s, did not create the long term stunting of growth that the Supply-Siders feared. Clinton was even able to balance the federal budget and eventually build a surplus. Growing deficits had long been an argument against tax cuts made by liberals, although proponents of Supply-Side would reply that Keynesians were the original advocates of deficit spending. Nonetheless, the 1990s are associated with one of the longest eras of economic growth in a century, and offer a counter example to the doctrine that lowering marginal tax rates are the only sure way to achieve long term growth (Ettlinger, Irons). Clinton did cut rates on capital gains toward the end of his second term, and in 1996 the capital gains tax on owner lived in homes was cut to 0%.

In the early part of this decade, the bursting of the dot-com bubble and the September 11th tragedy conspired to plunge America into its first recession in a long time. With Republican George W. Bush as President it meant that Supply-Siders were once again in charge of policy and were able to experiment with tax cuts once more. By lowering tax cuts on capital gains and marginal income tax rates across the board, the administration hoped to pull us out of our slump Reagan style. Unfortunately, the long term growth expected as a result of these actions was short lived, and when the housing bubble burst in 2008 it caused credit to freeze and stock prices to dive. Voters elected Democrat Barak Obama over Republican candidate John McCain. Obama argued for “trickle up policies” that addressed wealth inequality and although he was, and is, accused of a Socialist agenda that will destroy growth and wealth, his intention to return to pre-Bush tax rates is quite mild by historical standards.

The Supply-Side ideas have been in and out of vogue, and there is little arguing that when tax rates are excessive the impact to growth can be severe. However, it also still true that over-stimulation of Supply-Side factors can cause overheated booms that exacerbate the business cycle. In 2002, Arthur Laffer praised Clinton’s elimination of capital gains taxes on owner lived in homes with an ever expanding boom in housing sales and prices. For Laffer to credit Supply-Side theory for the housing boom is to also admit that this policy also produced with a devastating bust that spread to the whole world, becoming the worst economic crisis since the 1930s. In hindsight it would seem that when marginal tax rates are already low or moderate that tax cuts have the potential to harm the economy rather than help it by the overstimulation of supply, or by incentivizing overinvestment. Supply-Side economics, just like most financial policy tools, has an appropriate time and place which is determined by the context of the situation. Supply-Side is not a panacea for prosperity. Now that Supply-Side economics appears to be coming back into fashion again Americans should be cautious about its predictions and keep in mind that supply is just one hand on the economic scissors.

Jared Roy Endicott

Subscribe in a reader

Subscribe in a reader

Works Cited

Brue, Samuel L., and Randy R. Grant. The Evolution of Economic Thought. Seventh Edition. Mason, OH: Thomsom South-Western, 2007. Print.

Ettlinger, Michael, and John Irons. “Take a Walk on the Supply Side.” Americanprogress.org and epi.org. Center for American Progress and the Economic Policy Institute, Sep. 2008. Web. 15 Aug. 2009.

Greenberg, David. “Tax Cuts in Camelot?” Slate.com. Slate, 16 Jan. 2004. Web. 15 Aug. 2009.

Heilbroner, Robert L.. The Wordly Philosophers. New York: Touchstone, 1953. Print.

Klamer, Arlo J., et al. Monetarism and Supply Side Economics. Unabridged Edition. Knowledge Products, 2006. Audio.

Laffer, Arthur B.. “The Laffer Curve: Past, Present, and Future.” Heritage.org. The Heritage Foundation, 1 Jun. 2004. Web. 15 Aug. 2009.

Laffer, Arthur B.. “We’ve Cut Rates, Now Let’s Cut Taxes.” wsj.com. Wall Street Journal, 11 Nov. 2002. Web. 15 Aug. 2009.

Papp, Tamas K., and Elod Takts. “Tax Rate Cuts and Tax Compliance-The Laffer Curve Revisited.” Imf.org. International Monetary Fund, Jan. 2008. Web. 15 Aug. 2009.

Roberts, Paul Craig. “Twenty Years After Supply-Side Revolution, Washington Still Favors Higher Taxes.” Vdare.com. VDare, 31 Dec. 2002. Web. 17 Aug. 2009.

Roberts, Paul Craig. “My Time with Supply-Side Economics.” Vdare.com. VDare, 07 Jan. 2003. Web. 17 Aug. 2009.

Roberts, Paul Craig. “What Is Supply Side Economics?” Vdare.com. VDare, 27 Feb. 2006. Web. 17 Aug. 2009.

Roberts, Paul Craig. “Bush To Abandon Supply-Side Economics.” Vdare.com. VDare, 20 Jan. 2008. Web. 17 Aug. 2009.

Roberts, Paul Craig. “How Will Obama’s Deficits Be Financed?” Vdare.com. VDare, 12 Feb. 2009. Web. 17 Aug. 2009.

Roubini, Nouriel. “Supply Side Economics: Do Tax Rate Cuts Increase Growth and Revenues and Reduce Budget Deficits?” nyu.edu. New York University, 1997. Web. 15 Aug. 2009.

Rugy, Veronique de. “1920s Income Tax Cuts Sparked Economic Growth and Raised Federal Revenues.” Cato.org. Cato Institute, 3 Mar. 2003. Web. 16 Aug. 2009.

Stein, Herbert. “Why JFK Cut Taxes.” msjc.edu. Wall Street Journal, 30 May 1996. Web. 15 Aug. 2009.