Here we go again!

Here we go again!

After a very wild ride tracking our VERY aggressive virtual portfolio, we closed out the first half with $53,942 – up 115% for the first half of the year and, since we put $11,630 back in the bank above $25,000 from last year’s $10,000 portfolio, that brings us to a grand total of $65,722 – up 555% from the $10K we started with last year. Our goal in this small, aggressive portfolio is $100K but forget the extra $15,722 – as I said last week, that’s our starting basis with a nice profit so we put that back into nice, safe, conservative investments (like our Income Portfolio) and that leaves us $50,000 to play with.

Our first week of trades has already been very interesting. Make sure you to read the original post and the update if you haven’t already to get an idea of what we are trying to learn by following this "hyper-aggressive" portfolio model – especially last quarter’s lesson on taking those profits off the table and working on those losers. Our "biggest loser" of last quarter was, of course, FAS and those Aug $23 calls hit $5 last week (we are already out), which is $40,000! Anytime you can roll and DD a position in a $25,000 portfolio that eventually cashes out for $40,000 – you will probably come out well…

The problem is mainly in learning how to stick with a position like that and that requires a lot of conviction because there were dozens of opportunities to panic out with a loss and that’s why we practice this kind of trading – you need to get the experience in playing these out over time so that you can learn to BELIEVE in the strategy and, even then, it should only be used in places where you REALLY have a very good reason to believe a stock or ETF will, eventually, come back sharply enough to make all the work pay off – because it’s a LOT of work!

The problem is mainly in learning how to stick with a position like that and that requires a lot of conviction because there were dozens of opportunities to panic out with a loss and that’s why we practice this kind of trading – you need to get the experience in playing these out over time so that you can learn to BELIEVE in the strategy and, even then, it should only be used in places where you REALLY have a very good reason to believe a stock or ETF will, eventually, come back sharply enough to make all the work pay off – because it’s a LOT of work!

Of course, no one makes 100% every six months by taking it easy, right? Practice, practice, practice with virtual trading until you get comfortable with the strategies and, even then, use them sparingly. This aggressive portfolio is meant to be a small part (10% or less) of a larger, more conservative portfolio, like our nice, sensible Income Portfolio – which is making a very nice, virtual 2.2% a month so far – WITHOUT swinging for the fences!

As it’s earnings season, we’re doing a few ratio backspreads to get warmed up. Ratio backspreads are a great way to take advantage of high front-month premiums with short sales, which giving yourself a little fall back protection – JUST IN CASE – you are totally wrong. As we are here to PRACTICE strategies, it does not upset me when trades go badly as it gives us an opportunity to discuss adjustments and we have a great opportunity right off the bat with CMG, which we went short on Tuesday at 10:46 with this trade idea:

- 3 CMG Aug $310 calls sold for $18.50 (-$5,550)

- 2 CMG Dec $340 calls at $18 ($3,600)

So that was a net credit of $1,950 and CMG was trading at $317 at the time. Unfortunately, the madness continued and they ran up to $329.80 before pulling back to finish Friday at $325. Is this a disaster then? Hardly. The 3 Aug $310 calls that we are short on ran up to $24 ($7,200, up $1,650) while our 2 Dec $340 calls ended up at $22 ($4,400, up $800) so a net UNREALIZED (big lesson from the first half) of $850 with 4 months to roll and adjust the position before we’re even forced to move our longs.

So that was a net credit of $1,950 and CMG was trading at $317 at the time. Unfortunately, the madness continued and they ran up to $329.80 before pulling back to finish Friday at $325. Is this a disaster then? Hardly. The 3 Aug $310 calls that we are short on ran up to $24 ($7,200, up $1,650) while our 2 Dec $340 calls ended up at $22 ($4,400, up $800) so a net UNREALIZED (big lesson from the first half) of $850 with 4 months to roll and adjust the position before we’re even forced to move our longs.

Options spreads are like chess strategies – you make your opening move and then you see what your opponent does and then you study the board and decide on your next move. The secret to winning in options trading – like chess, is to think more than one move ahead or, as we like to say – "Plan the trade and then trade the plan." Avoid making moves that "trap" you in do or die positions. Always leave yourself some "outs" – places you can shift to IF you decide you don’t want to take a loss and are willing to work with the trade.

Although down $800 at the moment, we don’t think CMG will survive earnings on July 19th AND, with the stock at $325 and the $310 calls at $24, there’s still $9 of premium baked into the price of those 3 contracts and there’s $2,700 of our $850 "loss" right there (in other words, still a nice profit if the premium wears down at this price). Another thing we need to do is consider what our next move would have to be. At the moment, the September $320 calls are $21.50 so that is currently our Roll Target. If we did it now, it would cost us $750 to make that roll and that would cut our net credit on the roll down from $1,650 to $900 – that’s not so terrible, is it?

So we’re going to keep an eye on that relationship (the $2.50 cost of the roll). No matter what price the Aug calls are – as long as they are only $2.50 more than the Sept $320s, we don’t care if they are trading at $24 or $34 because it’s still "on target" for our rolling plan. Since we can make that roll (up $10 to the next month for $2.50), we can assume that we can make a roll to the October $330s for $750 more (net credit $150) and the November $340s for $750 more (net debit of $600) and that would wind us up a spread of 2 Dec $340 calls that are at least at the money (or we wouldn’t have done the next rolls) covered with 3 Nov $340s which means we are at least even with two of our callers and only stand to lose whatever amount CMG is over $340 by on the 3rd short call.

See what I mean by FLEXIBLE? This is why I sometimes get annoyed when people panic 3 days into a 6-month trade just because a stock spikes. We don’t care if CMG is at $325 or $335, as long as we don’t believe it’s going to be over $350 in December, we can’t lose more than $1,000. As long as we’re confident that CMG won’t gain 7.5% ($1Bn in market cap) between now and December expirations (16th) – we’re still on track for a profit!

See what I mean by FLEXIBLE? This is why I sometimes get annoyed when people panic 3 days into a 6-month trade just because a stock spikes. We don’t care if CMG is at $325 or $335, as long as we don’t believe it’s going to be over $350 in December, we can’t lose more than $1,000. As long as we’re confident that CMG won’t gain 7.5% ($1Bn in market cap) between now and December expirations (16th) – we’re still on track for a profit!

Even with a p/e of 55, adding $1Bn in market cap would imply another $200M in profits, which would be 10% more than the $200M currently projected for this year. Even if we do get nervous – let’s say if CMG does go over $330 – we can simply add another long call (either the same Dec $340s or something a little higher like the Dec $360s) and suddenly we’re bullish on CMG for the long haul! Heck, we could add 1 more long at $330 and one at $340 and one at $350 and one at $360 and, by the time CMG hit $370, we’re have 6 long calls against the 3 short ones. How’s that for a trading plan?

As we buy each additional long option, we simply set a stop on one offsetting long that we already have profits on so if, for example, we were to cover with an additional Dec $360 call, now $15 ($1,500), we could do that and set a stop on one of the Dec $340s at $20 (now $22, so a 10% pullback) and that would take $200 in profits off the table and put us back with one Dec $340 at $18 ($1,800) and the Dec $360 at $15 ($1,500) for a total outlay of $3,300 less the $200 profit we took off the table against the 3 Aug $310s we sold for $5,550 so now it’s a net credit of $2,450 (up $500 from our initial spread) and keep in mind that we only trigger that position AFTER CMG pulls back enough to drop our longs 10%.

As we buy each additional long option, we simply set a stop on one offsetting long that we already have profits on so if, for example, we were to cover with an additional Dec $360 call, now $15 ($1,500), we could do that and set a stop on one of the Dec $340s at $20 (now $22, so a 10% pullback) and that would take $200 in profits off the table and put us back with one Dec $340 at $18 ($1,800) and the Dec $360 at $15 ($1,500) for a total outlay of $3,300 less the $200 profit we took off the table against the 3 Aug $310s we sold for $5,550 so now it’s a net credit of $2,450 (up $500 from our initial spread) and keep in mind that we only trigger that position AFTER CMG pulls back enough to drop our longs 10%.

Our Dec $340s were at $20 Tuesday at noon, when CMG was at $318 and it’s not going to line up exactly but that means that, down the line, we’d have that $2,450 net credit against 3 CMG $310 calls that have $800 of intrinsic value ($2,400) as they get closer to expiration. So, when someone asks me in chat whether we should adjust CMG on a spike to $330 and I say "don’t worry yet" – that’s the background to my answer. I wish I had time to lay that all out every time someone asks but that’s in my head in 30 seconds but takes about 15 minutes to write out so I stick with "don’t worry" but this portfolio, on weekends – is a good time to lay out the logic.

Believe it or not but if you put in your 10,000 hours of practice (see Gladwell) – you’ll have all this nonsense rattling around in your head too! Of course, as Bill Gates points out – there’s a little more to it than JUST practice but believe me – you’re not going to learn anything if you DON’T practice!

GLL was our second $25KP play of the week and we picked up 20 of the July $23s for .40 ($800) in Wednesday morning’s Member Alert but we took .50 for 10 ($500 – up 25%) and stopped the rest out at .30 ($300 – down 25%) and ended up even as the movement in gold was disappointing. Not part of the $25KP but we did go back for the Aug $24 calls at .40 in Friday as we thought gold’s move up to $1,544 was a bit overdone and having until August to be right makes it a little more fun than those crazy July calls!

Shortly after I put out the morning Alert, I posted another $25KP trade in Wednesday’s Member Chat at 10:57 on another Momo stock, LULU, which had spiked over $120, diving their market cap over $8.5Bn with $900M in sales and less than $200M in profits so a p/e of 42 IF everything goes very well for them in earnings.

Shortly after I put out the morning Alert, I posted another $25KP trade in Wednesday’s Member Chat at 10:57 on another Momo stock, LULU, which had spiked over $120, diving their market cap over $8.5Bn with $900M in sales and less than $200M in profits so a p/e of 42 IF everything goes very well for them in earnings.

Like CMG, LULU is predominantly a US operation so they do not benefit from a weak dollar and are subject to cost pressures – in LULU’s case, from overseas suppliers (and cotton prices went through the roof last Q). The industry average p/e is 14.5 so things can get ugly if LULU isn’t growing profits at the 50% projected clip WITHOUT margin compression so our trade idea was:

- 5 LULU July $120 calls sold for $3.40 ($1,700)

- 3 LULU Sept $135 calls at $4.10 ($1,230)

That one is a net credit of $470 and you can tell from the tight time-frame, shorter spread duration and larger proportion of short calls to long calls that I was more confident in this one than I was in CMG – which seems to get a constant sprinkle of fairy dust to keep it going higher each week. Nonetheless, LULU did give us a scare on Thursday as it popped to $123.50 but that’s just .10 over our intrinsic sale value so nothing to panic over. Yesterday they fell all the way back to $118 and recovered back to $120 at the close with the 5 July $120 calls falling to $2.65 ($1,325, down $375) as time runs down their premium value while our 3 Sept $135s are still $4.10 so we’re already ahead $375 (79%) but very confident that we can do even better, as that $1,325 of remaining value on the short calls is all premium that expires next Friday!

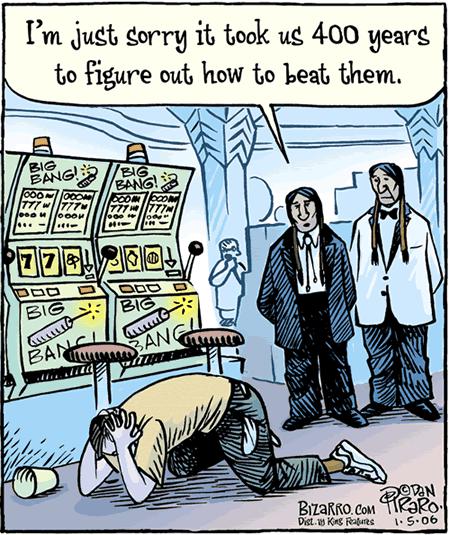

As Mick and the boys said the year after I was born: "Tiiiiiiiiiiiiime is on my side" and "yes it is" when you are the SELLER of premium. If we can only teach you one single thing at PSW it’s that you should BE THE HOUSE – not the gambler. Millions of people may walk into casinos each year but none of those people are as rich as the Billionaires who own them! What game do the gamblers play? They buy risk. What game do the owners play? They SELL risk – and they sell it consistently, over and over again – letting TIME and STATISTICS take care of the rest…

As Mick and the boys said the year after I was born: "Tiiiiiiiiiiiiime is on my side" and "yes it is" when you are the SELLER of premium. If we can only teach you one single thing at PSW it’s that you should BE THE HOUSE – not the gambler. Millions of people may walk into casinos each year but none of those people are as rich as the Billionaires who own them! What game do the gamblers play? They buy risk. What game do the owners play? They SELL risk – and they sell it consistently, over and over again – letting TIME and STATISTICS take care of the rest…

Unfortunately, on our other Wednesday spread, we chose to go head to head AGAINST a casino, taking a trade on WYNN that could be going better. Fortunately, I was LESS confident in this one so we did a 5:4 backspread with an October time-frame so, like CMG, plenty of time to adjust:

- 5 WYNN Aug $155 calls sold for $6.60 ($3,300)

- 4 WYNN Oct $165 calls at $6.60 ($2,640)

This spread had a net credit of $660 but WYNN flew up to $161 on Friday and those August $155s are now $11.60 ($5,800, down $2,500) and the October $165s are only $10.40 ($4,160, up $1,520) for a net UNREALIZED loss of $980 so far.

WHY did WYNN shoot up 2.5% on Friday? It did that in a poor market so we’re pretty concerned and it turns out they are up because Fitch upgraded the Wynn’s debt closer to investment-grade status (which means they are still junk), citing “robust operating trends, primarily in Macau.” We knew about Macau, that news came out 2 weeks ago and WYNN went from $130 to $155, where we decided the run was overdone but this Fitch upgrade was unexpected so we’re going to be more apt to cover this one with another long if they are holding $160 next week. We’re not going to panic, of course, as we sold $155 calls for $6.60 so, effectively, anything under $161.60 at August expiration (19th) is going to be a victory AND we have 2 more months to roll so we will watch this one carefully at the $160 line.

WHY did WYNN shoot up 2.5% on Friday? It did that in a poor market so we’re pretty concerned and it turns out they are up because Fitch upgraded the Wynn’s debt closer to investment-grade status (which means they are still junk), citing “robust operating trends, primarily in Macau.” We knew about Macau, that news came out 2 weeks ago and WYNN went from $130 to $155, where we decided the run was overdone but this Fitch upgrade was unexpected so we’re going to be more apt to cover this one with another long if they are holding $160 next week. We’re not going to panic, of course, as we sold $155 calls for $6.60 so, effectively, anything under $161.60 at August expiration (19th) is going to be a victory AND we have 2 more months to roll so we will watch this one carefully at the $160 line.

At the same time as the WYNN trade, we went short BXP with 10 Aug $105 puts at $2 and they have fallen 10% to $1.80 so far but I don’t see how their earnings will justify a 57% run in the stock since last July ($70) that’s added $6Bn in market cap to a company with $1.5Bn in revenues and a net profit of $200M IF everything goes well. Like LULU, that additional $6Bn in cap is coming in at a p/e that is well over 100 so this is a short we’ll be happy to roll and add to until the inevitable day of reckoning.

Another trade that went right was our USO Aug $38 puts. We took 10 of those on Thursday morning at $1.20 and took the money and ran on Friday at $1.65 for a very nice, quick $450 gain but that was NOTHING compared to the futures call I made in the same paragraph to short oil itself (/CL) at $99 as we hit $96 on Friday for a gain of $3,000 PER CONTRACT – sticking it once again to the pump boyz at the NYMEX! By the way, I nailed that bottom on Friday with my 11:42 call to get out of gasoline (/RB) and our oil shorts and shorts in general, saying:

$3.0785 on Gasoline! That’s a stop back at $3.08.

Let’s take the $1.65 and run on the Aug USO $38 puts in the $25KP as $96 is holding.

12,600 seems to be holding for now as well now that Europe has closed – expect a bounce and we can reload puts later. Watch the Dollar – now below 75.50, which gives the bulls a chance to come out and play.

I am in no way bullish – just not willing to give up profits to some silly stick move.

That concludes our first week’s adventures in the $25KP’s 2nd half. We closed one trade even (GLL) and took $450 off the table on USO while the rest are just works in progress. So far, we’re a bit to bearish so we’ll be looking for bullish plays next week if things don’t turn down. We can afford to "guess" the market direction when we’re coming off 100% cash but, after that, it’s all about BALANCE, where we sell premium to bulls AND bears, KNOWING we will collect money from at least half of them no matter what and that we will collect money from both of them when the markets are flat. As our buddy Steve Wynn says – it’s nice work if you can get it…

Note from Greg: The $25,000 Portfolio is up to $50,000 and we’re going for $100,000 by the end of the year. We just cashed out one week ago and these are our first new trades. There is not better time than now to join www.philstockworld.com where you can track this and other virtual portfolios as well as participate in our intra-day Member Chat rooms. Find out more at http://www.philstockworld.com/subscribe/ - Summer is our slow season, it is very doubtful there will be room for new Premium Subscribers in the Fall.

Tags: Backspreads, BXP, CMG, FAS, Hedging, LULU, oil futures, Option Strategy, Portfolio Management, USO, WYNN

$3.0785 on Gasoline! That’s a stop back at $3.08.

$3.0785 on Gasoline! That’s a stop back at $3.08.