Photo courtesy of iStockphoto

Last year around Thanksgiving time I forecasted the what cost of a traditional Thanksgiving dinner for ten people would be in 2011, in an article titled Inflation and the Cost of Thanksgiving Dinner. The American Farm Bureau Federation (AFBF) tracks the annual price of turkeys, sweet potatoes, cranberries, stuffing, and pumpkin pie, along with some of the other staples found at the Thanksgiving dinner table, and I predicted that 2010’s cost of $43.47 would rise to $44.33 in 2011, a modest and typical increase of about 2%. But alas, my forecast was unfortunately well below the actual price increase, with the price of a traditional Thanksgiving dinner rising by around 13% to reach a total cost of $49.20 in 2011 (“Classic Thanksgiving”). This cost did fall within my 95% confidence interval which had an upper limit of $50.23, but blew out the top range of my 68% confidence interval at $47.20. Saying that I have a confidence interval of 68% is like saying that I expect my forecasts to fall outside of a certain range about 32% of the time. So my forecast error was large but not surprising enough to be considered a significantly rare event.

My forecast last year was made within the context of the Federal Reserve’s second round of monetary policy called Quantitative Easing (QE2), and was intended to counter fears that this policy would trigger massive inflation, or even hyperinflation. I disagreed with the worrisome inflation forecasts that I was hearing last year, which were being made in conjunction with criticisms of Federal Reserve Chairman Ben Bernanke and his monetary policies. So it is a fair question to ask. Was incorrect in my original assessment of QE2? Considering that Thanksgiving dinner costs are up much sharper than had I anticipated, could it be that monetary easing, a course of action intended to keep interest rates low and to simulate job growth, has backfired and resulted in massive inflation? Before we hyperventilate about hyperinflation I would point out that the general inflation rate on all items is only 3.5% in 2011. This is not optimum, which would be about 2% or so, but it is not nearly as alarming as the many paranoid predictions I heard last year.

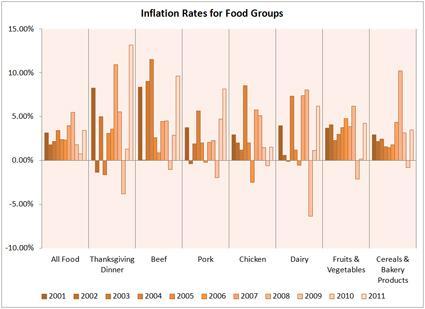

Food prices have increased sharply across the board this year, according the US Department of Agriculture (USDA) and the Bureau of Labor Statistics (BLS), with general food prices rising 4.7% between October 2010 and October 2011. To put these changes in perspective, general food prices only rose 1.4% from October 2009 to October 2010, and actually fell 0.6% in the equivalent interval from 2008 and 2009. The USDA expects the average food inflation rate in 2011 to be between 3.5% and 4.5%, but does expect price pressures to abate in 2012, forecasting a more modest and normal increase of between 2.5% and 3.5% for next year (“Food Price Outlook”). For the last twenty years the inflation rate for food has averaged about 2.6% a year, so 2011 is a bit on the steep side, but is comparable to 2007 and 2008, years which saw food cost rise 4% and 5.5% respectively. I have summarized the inflation rates for various food groups and items since 2001 in the chart below:

Chart compiled from data available at the BLS

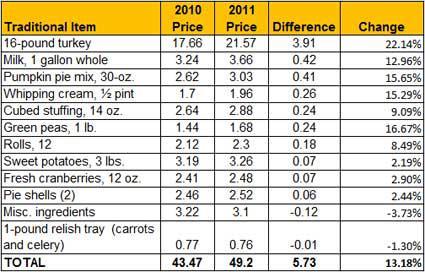

While most of the dishes served at a traditional Thanksgiving dinner rose in price, it was the turkey that really made the difference in the total increase of 13.2%. In only one year, turkey prices increased an average of $3.91, for an inflation rate of 22%. Consider that if the cost for turkey had risen at an equivalent rate to that of the cost for pork, at 5.9%, then the change in the price level of the entire Thanksgiving dinner would have been 6.6%, only half of the real increase. The most recent year over year price comparisons of Thanksgiving dinner items are tabulated below.

The dramatic jump in turkey prices was certainly not something I anticipated last year, and it demonstrates the volatility in food prices that can happen due to complex supply and demand factors, especially among specific items. A senior economist at the AFBF cites stronger US and global demand for turkey meat as the reason for the sharp price increase (“Classic Thanksgiving”). Turkey exports from the US increased 25% this year, with China’s demand for turkey meat rising 78% (Euteneuer). Emerging economies are demanding more robust diets, and these new markets for consumption are putting upward pressure on food prices, including turkeys.

Americans are not facing turkey inflation alone this holiday season, turkey prices in Great Britain are expected to be about 25% higher, with a 12 pound turkey going from £40 in 2010 to £50 in 2011. This indicates that turkey inflation is a global issue. An increasing demand for turkey meat around the world, fueled mostly by the growing middle classes of India and China, has been cited as the reason for the domestic price increase in Great Britain, which corresponds with the AFBF analysis.

While higher demand is putting upward pressure on the price of turkey, input costs are also rising, and this compounds the effect. To raise one pound of turkey meat requires 2 ½ pounds of grain feed, accounting for 70% of the total productions costs, and demand growth in for the holiday bird has caused feed prices to double in a year in Europe (Elliot). Corn prices have risen 58% this year in the US, and are at historical highs due to the lowest crop yields in three years while more of this yield is being diverted to ethanol production (Euteneuer). This is forcing turkey farmers to pass on these higher costs to consumers in order for them to remain profitable.

So far, my research into the dramatically escalating price of turkey for the holidays has not uncovered any allusions to QE2 being the root of the problem. However, this will stop those opposed to central banking from making this claim. It is an odd correlation that the US money supply, as measured by the M1 statistic, has increased by about 21% in the last year, while turkey price have increased 22% at the same time. Is this just coincidence, or could monetary policy and the increase in the dollar supply still be the underlying reason for this year’s turkey inflation?

Economist Milton Freidman is famous for pointing out the eternal relationship between prices and the money supply, but this refers to the general inflation of prices on all goods over the long run. Turkey meat and other food items are experiencing inflation that is higher than the general inflation rate, which is at 3.5% year over year in October, and the core inflation rate, which excludes food and energy from the calculation, is only at 2% (BLS). Inflation in a small basket of items, such as foods served at Thanksgiving dinner, is not indicative of the general price increases needed to support the claim that monetary policy is the inflationary force in dominant effect.

Food prices have many reasons for their fluctuations, and the explanations for turkey’s 2011 bounce in cost is likely related to particular changes in supply and demand, and does not appear to be caused by the extra money in the system from QE2. In fact, the story about the elevation of food prices globally began a few years before the Great Recession and the subsequent loosening of monetary policy. Because of globalization there are rapidly rising middle classes in the previously third world nations of China, India, and elsewhere. As incomes rise in these countries, people who had previously consumed meager amounts of meat are now demanding more chicken, pork, beef (not so much in India), and it appears now turkey.

In terms of feed grain, it takes 8 pounds to produce 1 pound of beef, 3 pounds to produce 1 pound of pork, and 2 ½ pounds to produce 1 pound of turkey. The rising demand for beef, pork, and poultry around the world has increased the demand for grain faster than just population growth would, and in the last few years a rising demand for grain has also come from of the promotion of ethanol production, using government mandates and subsidies. Food supply growth has not kept up with food demand and this is going to continue to push food prices up at a higher rate than the general inflation rate.

The dramatic jump in turkey prices was certainly not something I anticipated, and it demonstrates the volatility in food prices, and the risks in attempting to predict them. Last year I made a forecast in multiple dimensions, a point forecast and confidence intervals, and this conveyed the risk in my prediction. I am going to try this again and forecast the price of Thanksgiving dinner for 2012. I forecast it will cost $51.86 for the traditional Thanksgiving dinner for ten in 2012 (as measured by the AFBF) with 68% confidence that the price will fall between $49.22 and $54.51, and 95% confidence it will be within in $46.58 and $57.15. I am expecting a 5.4% increase in the cost of Thanksgiving dinner, and this is higher than I, and I’m sure most people, would prefer. I underestimated the price rise this year; hopefully I am overestimating next years.

Jared Roy Endicott

Works Cited

“Classic Thanksgiving Dinner Costing More in 2011”. American Farm Bureau. Contacts: Tracy Taylor Grondine and Cyndie Sirekis. 10 Nov. 2011. Web. 18 Nov. 2011.

“Cost of Classic Thanksgiving Dinner Up Slightly in 2010”. American Farm Bureau. Contacts: Cyndie Sirekis, and Don Lipton. 12 Nov. 2010. Web. 21 Nov. 2010.

Elliot, Valerie. “China’s Appetite for Meat puts £10 on the Cost of Your Christmas Turkey”. Daily Mail. 13 Nov. 2011. Web. 25 Nov. 2011.

Euteneuer, Blaire. “Turkey Farmers Lost Out on Thanksgiving Day Rally as Corn Costs Rise”. Bloomberg. 23 Nov. 2011. Web. 26 Nov. 2011.

“Food Price Outlook, 2011 and 2012”. United States Department of Agriculture, Economic Research Service. Contacts: Richard Volpe and Ephraim Leibtag. 25 Nov. 2011. Web. 25 Nov. 2011.

Westhoff, Patrick. The Economics of Food: How Feeding and Fueling the Planet Affects Good Prices. Upper Saddle River, NJ: Pearson Education, Inc., 2010. Print.