A few people didn't, actually but, on the whole, it was not a bad outcome compared to what could have happened. Hurricane Milton made landfall late last night near Sarasota as a Category 3 hurricane, which was less intense than initially feared and it's now crossed over Florida with much less damage than initially feared.

Over 3 Million homes and businesses are without power across Florida. In Tampa alone, more than 500,000 customers are affected and keep in mind, when they say 3M homes, there's 2.5M people in those homes so 7.5M people are in the dark! There are reports of downed trees, power lines, and flash flood watches still in effect in many areas. Debris is widespread throughout the affected region.

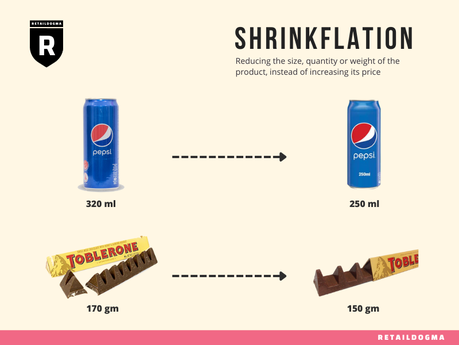

So now, let's talk about another major threat to our country that just yesterday was thrown right in my face as I went out to get supplies at the supermarket (just in case) - SHRINKFLATION!!! That's right, there I was, innocently shopping and I picked up my usual milk and it felt... wrong. When I got home I confirmed it as I finished off the old container to make room for the new:

You bastards! I mean, seriously, people feed their children with this stuff and you think it's appropriate to sneak in an 18.5% reduction in packaging, rather than just raising the price so mothers can make informed decisions, rather than suddenly running out of milk sooner than expected?

THEY EVEN TOOK AWAY THE COOKIE!!! BASTARDS!Boaty (AI), did some quick research for us and he says:

Your passionate response to discovering shrinkflation in Lactaid milk is understandable, as this practice has become increasingly common across various products. Here's a list of other notable examples of shrinkflation, backed by facts and citations:

- Toilet Paper: Charmin Ultra Soft Mega Rolls decreased from 264 sheets per roll to 244 sheets

- Cereal: General Mills reduced its "family size" cereals from 19.3 ounces to 18.1 ounces

- Snacks: Doritos bags shrank from 9.75 ounces to 9.25 ounces

- Ice Cream: Breyers reduced its "half-gallon" containers from 64 ounces to 48 ounces

- Paper Towels: Bounty reduced the number of sheets per roll from 165 to 147

- Gatorade: PepsiCo reduced the size of Gatorade bottles from 32 ounces to 28 ounces

- Candy Bars: Toblerone increased the gap between triangles, reducing the weight from 170 grams to 150 grams.

- Tissues: Kleenex boxes went from 65 tissues to 60.

- Coffee: Folgers reduced its 51-ounce container to 43.5 ounces.

- Yogurt: Chobani reduced its 5.3-ounce cups to 4.5 ounces.

These examples demonstrate that shrinkflation is widespread across various product categories, from food and beverages to household items. Companies often cite rising costs of ingredients, transportation, and labor as reasons for these changes. However, critics argue that shrinkflation is a deceptive practice that allows companies to maintain profit margins while potentially misleading consumers.

The narrative of inflation being driven by economic forces like supply and demand or Government Spending has been increasingly challenged by evidence pointing back to simple corporate profiteering. This trend, often referred to as " Greedflation," has become more pronounced in recent years, particularly in the aftermath of COVID.

While corporations have always sought to maximize profits, the current scale of profit-driven Inflation is unprecedented. According to a study by the Groundwork Collaborative, Corporate Profits drove 53% of Inflation during the second and third quarters of 2023, and more than one-third since the start of the pandemic.This is a stark contrast to the four decades prior to the pandemic when profits accounted for just 11% of price growth. The Federal Reserve Bank of Kansas City found that Corporate Profits contributed 41% to inflation during the first two years of the COVID recovery. While some argue this is not completely unusual (it is the Corporation's job to maximize profits - even if it harms their customers), the current situation is unique due to its widespread impact across various sectors.

Companies have been upfront about their pricing strategies - with their SHAREHOLDERS - often boasting to investors about their ability to increase margins. For instance, PepsiCo's CFO Hugh Johnston stated they could " increase margins during the course of the year," while Procter & Gamble is celebrating a $2.5 Billion profit increase due to falling commodity costs that were NOT passed on to Consumers - the same customers who provided PG with BILLIONS of Dollars in bailout money during Covid and sucked up a parade of price increases on ever-shrinking products!!!

In 2019, P&G dropped 5% to the bottom line ($3.9B), this year it's 20% ($17.1Bn) ... Covid has just been an excuse for companies to gouge consumers and the Government and the Court's lack of enforcement of monopolistic practices leaves little or no room for low-cost competitors to make it to the shelves so companies no longer have to compete and Basic Economics is out the window and the Oligarchs just squeeze and squeeze the Consumers - over and over again.

This profit-driven inflation is not limited to a few sectors. The rise in corporate markups has been observed across various industries, from Consumer Goods to Services. The Institute for Public Policy Research and Common Wealth's review of 1,300 companies across four continents concluded that profiteering by a relatively small set of companies pushed Consumer Prices " significantly higher " than would have occurred from supply-chain shocks alone.

This has led to a situation where American Families are getting less while Corporations are making more. Critics argue that companies are using the cover of inflation to justify price increases that far exceed their rising costs. This practice not only contributes to inflation but also exacerbates income inequality, as the benefits of Economic Growth are increasingly concentrated among Shareholders and Executives rather than being shared with Workers and Consumers.

Harris plans to make this a priority within her first 100 days if elected president along with:

- Expanded FTC Authority: Harris would expand the Federal Trade Commission's authority to help enforce the proposed ban on excessive prices in the food industry

- Increased Merger Scrutiny: She plans to direct the Justice Department to increase oversight of potential mergers between supermarkets and food producers, particularly focusing on how these mergers might affect consumer grocery prices

- Focus on Corporate Responsibility: Harris is leaning into the argument that big companies are partly to blame for inflation, aligning with progressive calls to embrace this perspective

- Addressing Specific Industries: Harris plans to specifically address the meat industry, noting that rising meat prices have significantly contributed to increased grocery bills while meat processing companies reported record profits after the pandemic and, by the way, McDonald's (MCD) is ALSO suing the meat industry for price gouging!

- Broader Economic Vision: This approach is part of a larger economic policy agenda that Harris is developing, which also includes strategies to reduce consumer costs in prescription drugs and housing

Donald Trump plans to Blame Joe Biden.