Now oil is down 2.5%.

Now oil is down 2.5%.

Of course $62 is going to be bouncy, that's our shorting line and, according to the fabulous 5% Rule™, a 5% drop gives us 1% bounces (20% of the drop) and we're down $1.60 from $63.60 so 0.32 bounces to $62.32 (weak) and $62.64 (strong). If we fail to hold the weak bounce and head back to $62, there's a good chance it will fail. Failing at $63.64 is a bit trickier as we could be consolidating for a move up or down – it requires patience.

If we fail $63.64 and then fall back below the weak bounce line and consolidate between the strong and weak bounce lines – THEN we can anticipate a break lower. How much lower? At least half of the previous drop so another 1.25% to $61.66. Now that we KNOW how much the potential reward is, we can calculate the potential risk and decide whether it's worth the trade. Clearly, at $62.25, I can make a bet that $62.32 will fail and set a stop at $62.35, risking a loss of $100 per contract if we stop out at $62.35. The next test would be at $62.60, with a stop at $62.70 – so another $100 risked but the reward of a drop back to $61.66 would be $1,000 gain per contract.

We've been playing the Oil Futures (/CL) with conviction and, although we have a nice $10,000 gain this morning – it only makes us even as we've had to double down our two shorts twice. Now we're at goal as all we ever wanted to do was get back to even and get back to 2 shorts – but now at a much higher basis ($62.24) for a long-term play.

We've been playing the Oil Futures (/CL) with conviction and, although we have a nice $10,000 gain this morning – it only makes us even as we've had to double down our two shorts twice. Now we're at goal as all we ever wanted to do was get back to even and get back to 2 shorts – but now at a much higher basis ($62.24) for a long-term play.

Conviction shorts are very different and require a lot more risk tolerance – they are certainly not for everyone. Our conviction is that next week's OPEC meeting will not do enough to keep prices over $60, so we're positioning for that.

So we're back to just 2 short at $62.245 and we'll add 2 more at $62.60 with that same stop at $62.70 on the 2 new ones. If we go higher than that, we wait to DD again at about $63.50, which would raise our basis to about $62.85 on 4 shorts and we'd be down $1,400 per contract. Knowing how much you will win and how much you will lose helps you make better trading decisions – you should always have clear expectations for every trade.

The 5% Rule™ is not TA – it's just math. People like charts so we put them up but when I was young and rebellious, I refused to put charts on this site, thinking I could break people of the habit of staring at the entrails of companies to make predictions about their future. Our predictions are based on Fundamentals, coupled with Short-Term and Long-Term macro analysis and the 5% Rule™ simply tells us where the inflection points will be – the places we are likely to see support and resistance along the way.

OPEC+ (OPEC plus Russia, Mexico and 8 others) are meeting next week but it's very unlikely, in the midst of an Economic Crisis and with oil selling well over $50/barrel – that the Saudis will be able to get the other nations to pledge to continue production cuts.

OPEC+ (OPEC plus Russia, Mexico and 8 others) are meeting next week but it's very unlikely, in the midst of an Economic Crisis and with oil selling well over $50/barrel – that the Saudis will be able to get the other nations to pledge to continue production cuts.

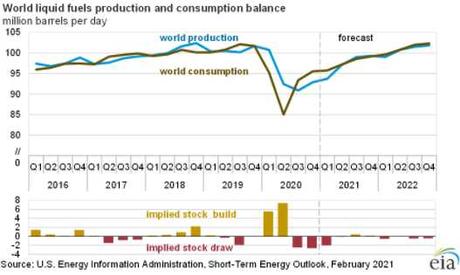

As you can see from the chart on the right, any loss of control over the producers that brings production back to normal levels would quickly create a massive glut of oil again – and we saw how long that took to grind down last year. Only continued production cuts can keep oil prices over $50 but, like Powell's stimulus – at this point – where's the upside catalyst going to come from?

If you believe the oil market is well-controlled by OPEC, how come you can still buy oil for the Summer of 2022 for just over $55 per barrel? Oil Futures are like Bitcoin – they are pure speculation and can swing wildly one way or the other but the long-term trends tell a story and the story, at the moment, is that short-term prices are too high and likely to correct. Just like our economy, oil prices are being manipulated by a Central Board (OPEC) who are doing everything they can to keep the prices up but there are consequences for the OPEC nations – less oil production means less money to pay the bills and, unlike the US, other countries do have to pay their bills.

Click for

Chart

Current Session

Prior Day

Opt's

Open High Low Last Time Set Chg Vol Set Op Int

Cash

-

63.47

63.47

63.47

18:19

Feb 25

63.47s*

-

-

Apr'21

63.46

63.57

61.80

62.51

07:53

Feb 26

-

May'21

63.17

63.24

61.49

62.16

07:53

Feb 26

-

Jun'21

62.57

62.68

60.99

61.63

07:53

Feb 26

-

Jul'21

61.83

62.05

60.38

60.97

07:53

Feb 26

-

Aug'21

61.14

61.25

59.75

60.29

07:53

Feb 26

-

Sep'21

60.53

60.66

59.13

59.65

07:53

Feb 26

-

Oct'21

59.83

60.02

58.79

58.79

07:33

Feb 26

-

Nov'21

59.35

59.45

58.00

58.28

07:38

Feb 26

-

Dec'21

58.99

58.99

57.52

58.02

07:53

Feb 26

-

Jan'22

58.32

58.46

57.10

57.29

07:35

Feb 26

-

Feb'22

57.89

57.99

56.64

57.03

07:43

Feb 26

-

Mar'22

56.90

56.90

56.82

56.82

23:33

Feb 25

-

Apr'22

56.50

56.50

56.50

56.50

04:28

Feb 26

-

May'22

56.91

56.91

56.91

56.91

18:18

Feb 25

56.91s*

Jun'22

56.16

56.25

55.24

55.63

07:49

Feb 26

-

Jul'22

56.22

56.22

56.22

56.22

18:18

Feb 25

56.22s*

Aug'22

55.90

55.90

55.90

55.90

18:18

Feb 25

55.90s*

Sep'22

55.60

55.60

55.60

55.60

18:18

Feb 25

55.60s*

There's also a lack of control with OPEC+ as, for example, Vladimir Putin may decide that there's more money to be made by shorting oil and then having Russia refuse to cooperate on cuts at next week's meeting. As you can see, there are 436,000 open contracts of 1,000 barrels each at $63.53 and let's say Vlad shorts 100,000 contracts at $5,000 in margin per contract ($500M) and then Russia tanks the meeting and oil plunges to $6. He would make $3,530 per contract or $353,000,000 for a week's "work". But Putin has $80Bn – he can do a lot better if he wants to.

In fact, that's why Putin has $80Bn – he controls the levers of a major World economy and constantly uses it to his advantage. Now, let's say on the other hand, Russia cooperates and cuts production from 9.5Mb/d to 9Mb/d. Even if oil goes to $65, revenues go from $570M/day at $60 (assuming a drop) to $585Mb/d at $65 so it would take Putin a month to make $353M, which isn't bad but that wouldn't be Putin's money, would it? He would only get his share as an owner of some of the production whereas, playing the Futures – he gets it all.

In fact, that's why Putin has $80Bn – he controls the levers of a major World economy and constantly uses it to his advantage. Now, let's say on the other hand, Russia cooperates and cuts production from 9.5Mb/d to 9Mb/d. Even if oil goes to $65, revenues go from $570M/day at $60 (assuming a drop) to $585Mb/d at $65 so it would take Putin a month to make $353M, which isn't bad but that wouldn't be Putin's money, would it? He would only get his share as an owner of some of the production whereas, playing the Futures – he gets it all.

Do you think Putin made $80Bn by just taking his share?

And then there is always option C, where Russia INCREASES production by 10%, oil falls to $55/barrel but that's $550M per day so little damage to Russia's revenue stream and Vlad pockets $850M instead. Of course, no national leader would put their own self-interest ahead of their country's – right America?

No matter what happens, expect a lot of rumors taking oil for a wild ride next week and we'll be watching the nonsense closely – as well as the nonsense of the market, which is finishing up it's second down week in a row. If we were to use the 3,400 line as a base (340 on SPY) – as that's where we peeaked out in February of last year – then 3,960 was up 16.5%, which is a 15% move with a 10% overshoot. The 15% line is 3,910 so we need to get over that or we look down to a 20% retrace of the 510 run so call that 100 points, back to 3,800 (weak retrace) and 3,700 (strong).

So that's very simple then, if 3,910 fails to be taken back and held into the close – we are very likely to see 3,800 and possibly 3,700 in the next two weeks. So we know where the restistance is – now we think about what will happen to get us over it? Will there be MORE FREE MONEY? Can Powell be even more doveish? Can Yellen ask for even more stimulus? Will Republicans decide to give Joe Biden a blank check? That's what the Democrats did for Bush in 2008 and what they did for Trump last year – I'm sure the Republicans will be just as cooperative in helping President Biden fix our economy.

Have a great weekend,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!