I love CASH!!!

I love CASH!!!

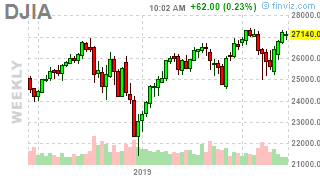

We cashed in most of our Member Portfolios so I'm not at all worried about what will happen today. It's the end of the quarter for options and Futures (2 kinds of each) so "quad witching" and these days can have some violent swings – though we're not expecting anything dire. We still thought it was a good idea to take advantage of this triple market top – JUST in case Q 4 Earnings don't go well or the Trade Talks don't go well or Brexit doesn't go well, etc.

Just because we moved to CASH!!! doesn't mean we can't still find fun things to trade. We've been watching McDermott (MDR) collapse for the last few days and yesterday morning, I sent a Top Trade Alert out to our Members saying:

MDR – Fortunately, we got out of ours a long time ago as we never wanted them, we just liked CBI, who they merged with. Needless to say, the merger has not gone well (which is why we didn't want to ride it out) and now they are calling in restructuring experts. MDR says it "is taking positive and proactive measures, as we have done in the past, intended to improve its capital structure and the long-term health of its balance sheet." You can take them at their word (as no one is) or you can imagine this is a sort of cover-up for their emergency measures to stave off some sort of disaster that's looming.

I do watch them (because they took away my CBI) and last year they took a $2.7Bn hit on write-offs and such and this year they lost about $190M in the first two Qs and it's doubtful they turn that around by the end of the year but they have $455M in cash and I bet they end up down less than $100M for the year with a profit in Q4.

Assuming that's true – then $1.65/share is just a $300M valuation for a company doing $10Bn in business but $7Bn of that is CBI's biz and people are extrapolating MDR's poor performance to CBI's $7Bn – that's not likely to be the case but this year, as we expected, is a transition year and numbers look like crap and, if the economy tanks, then their timing is likely to kill them but, if we keep things together, they just got $4.5Bn worth of contracts from Aramco and another one from Qatar but probably just $100M for that one. Still, that's business for the next 6 months on top of the normal stuff they have going on – there are possibilities so I like them as a flyer.

At the moment, I'd buy the 2021 $1 calls (now $1.35) and wait on selling the $2 calls (now $1.05) as long as we hold $1.50 on the stock. Hopefully we pop back over $2 and we can get $1.25 for the $2.50 calls (now 0.95 with a 0.75 delta).

Congratulations to all the players out there as it didn't take very long for MDR to get an unsolicited for their Lummus Technology division and the stock is testing $3 this mornng and, hopefully, will have a nice short squeeze to pop us over $3 for over 100% gained in a day. See – we can ALWAYS find fun things to do with our cash! That trade idea (at 11:20) was a substitute for people who missed our 9:48 am call, which was:

The MDR 2021 $1 ($1.50)/2 ($1.25) bull call spread is 0.25 or maybe 0.40 at the most – that's a fun way to play.

In both cases I'd take half off the table and put a stop on the other half if MDR fails to hold $2.50 to lock in most of the gains. It's not that we love the stock – it's just that we thought it was oversold so we took advantage of the crazy-low options pricing. That's the great thing about our Member Chat Room – so many smart people watching the market and exchanging ideas – we are often able to catch things like this – even when it's not something we usually pay attention to.

We have 3 Fed speeches today but NY Fed's John Williams, who just injected over $200Bn in to the markets in two days (including another $75Bn this morning!) to bring overnight rates down from a Greece-like 10% to 2%, has already made his speech and it didn't move the market. $200Bn (so far) is the cost of the Fed lowering rates when they didn't need to be lowered on Wednesday – and that was just a 0.25% reduction – Trump wants another 1.75% cut and even beyond that – to negative rates, where the Fed would PAY the banks to borrow money – which is effectively constantly printing money for the sole benefit of the Banksters and their Top 1% clients (of whom Trump happens to be one).

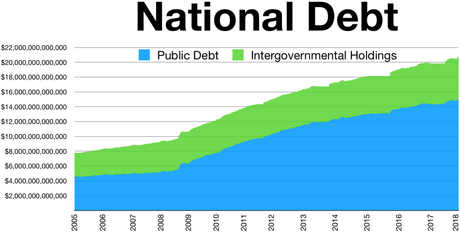

As we sit at market all-time highs, we have to consider how we got here and we did so on a mountain of DEBT. We've added $12Tn in the past 10 years to our total debt and the pace is, if anything, accelerating. That's $1.2Tn a year of debt in what is now an $18.5Tn economy so 6.4% of our 3% annual growth rate is DEBT! That's NOT good.

As we sit at market all-time highs, we have to consider how we got here and we did so on a mountain of DEBT. We've added $12Tn in the past 10 years to our total debt and the pace is, if anything, accelerating. That's $1.2Tn a year of debt in what is now an $18.5Tn economy so 6.4% of our 3% annual growth rate is DEBT! That's NOT good.

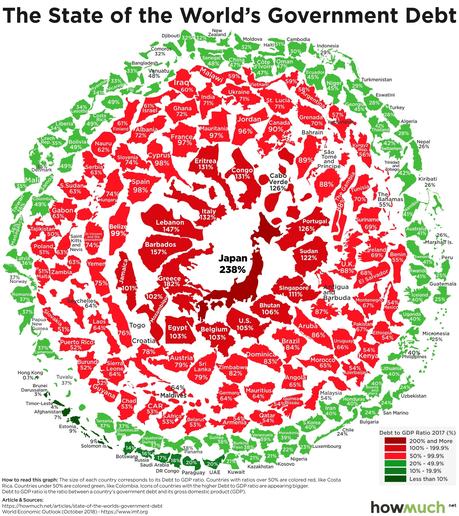

Of course, we've been worried about debt for a long time and the US, now at $22.5Tn in total debt, is "only" 121% of our GDP in debt while Japan is close to 250% of their GDP in debt. As you can see from this debt map (from last October, when we were "only" 105% in debt) there are no other major economies in the deep red zone but Greece is still there and Portugal is still there and France, Spain the UK, Canada and Brazil are all just outside our "Ring of Economic Death" (Italy is as bad as we are) and ALL OF US are still borrowing money and debasing our currencies like crazy yet no one seems to think this is going to end badly.

Even as I write this, I remember making the same warnings back in 2007 and no one cared then either. Now we're 120% more in debt and, despite a little market set-back in 2008 – we are valuing global corporations at new all-time highs – indicating that now one things we can't go another 100% in debt over the next 10 years. Russia has little debt and the Arabs have little debt along with their bankers in Luxembourg and Hong Kong literally has NO debt (0.1%) so we know where to put some money to work over the next 10 years.

The thing is, in a World that's only growing at a 2.9% pace (see yesterday's PSW Report) and with almost every single country running a deficit to keep up even that smallish growth rate, who exactly are we going to be borrowing all this money from? As big of a disaster as George Bush was, he generally ran "only" $300Bn deficits until his last two budgets (2008 and 2009), when he jumped to $459Bn and $1.16Tn respectively. Obama's first budget was 2010 and that was a $1.55Tn deficit and $1.3Tn in 2011 and $1Tn in 2012 and his last budget had a $666Bn deficit in 2017. That was during an economic crisis and deficit spending totaled $6.8Tn over 8 years.

Trump started his 2018 budget with a $780Bn deficit and this year we already passed $1Tn last month so figure $1.2-1.4Tn for year 2 and even more coming over the next two years. So Trump is on a path to match Obama's 8 years of deficit spending in just 4 years – especially if he adds new tax cuts and stimulus (and loses his tariff money). Where is all this money going to come from?

Just like in 2007, none of this stuff seems to matter – until it suddenly does.

Have a great weekend,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!