It's quad witching day!

It's quad witching day!

The quarterly expiration of options and Futures contracts can cause a great deal of market volatility and, when your indexes are pushing all-time highs – down is a lot easier than up so we're still shorting the Dow (/YM) Futures below the 26,800 line which was good for 200 points yesterday and gains of $1,000 per contract and our Nasdaq (/NQ) Futures short call at 7,800 from yesterday's PSW Morning Report (subscribe here if you want to stop missing these calls) is good for more than 50 points so far – also gaining over $1,000 per contract (which is now the stop). What a great way to finish the week!

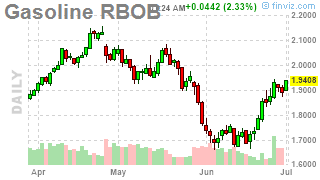

Futures are a very valuabale tool to have in your trading belt but can be dangerous. Usually we play options, like Wednesday morning's call to go long on Gasoline (and you don't even want to know how much the Futures have made if you didn't play it), which is now at $1.85 due to a massive refinery fire in Philadelphia, where we had the following trade idea:

Speaking of justifications, OPEC is acquiescing to Russia's demands to move their meeting to July 1-2 in Vienna and OPEC will do ANYTHING to get the Russians to join them in cutting production – just in time to screw American drivers over the July 4th Holiday. If you believe in OPEC+, you can play the September Gasoline Futures (/RBU19) long off the $1.65 line ($1.62 has been the lows so I'd plan to DD there for a $1.635 avg and stop below $1.60) or you can play the Gasoling ETF (UGA) and I'd go with:

- Sell 10 UGA July $28 puts for $1.40 ($1,400)

- Buy 20 UGA July $27 calls for $1.70 ($3,400)

- Sell 20 UGA July $29 calls for 0.75 ($1,500)

That's net $500 on the $4,000 spread so $3,500 (700%) profit potential in just 30 days and your worst-case scenario is ending up long 1,000 shares of UGA at net $28.50 (assuming your spread is wiped out). Trump wants the Dollar weaker, which is also good for Oil and Gasoline prices and OPEC certainly wants Oil higher and Tesla (TSLA) may collapse soon as Q2 deliveries end up disappointing people after all – all possible positives for UGA.

Our system is not very complicated – we are FUNDAMENTAL Investors who use options for leverage and for hedging and we like to read the news and find trade ideas that react to recent events as well as long-term trends. In this case, we expected, in the very least, that OPEC would say or do things between now and their meeting to push the price of Oil (/CL) back towards $60 and Gasoline (/RBU19) was likely to follow it higher. PLUS Gasoline usually spikes into the July 4th weekend PLUS Trump has been trying to weaken the Dollar.

Our system is not very complicated – we are FUNDAMENTAL Investors who use options for leverage and for hedging and we like to read the news and find trade ideas that react to recent events as well as long-term trends. In this case, we expected, in the very least, that OPEC would say or do things between now and their meeting to push the price of Oil (/CL) back towards $60 and Gasoline (/RBU19) was likely to follow it higher. PLUS Gasoline usually spikes into the July 4th weekend PLUS Trump has been trying to weaken the Dollar.

That seemed like plenty of good reasons to play Gasoline long and /RBU19 is at $1.78 now and UGA is testing $30 this morning and we're well on our way to making the full 700% profit on July 19th (the day the optons expire) though we'll certainly take 500% or more ($3,000) off the table if it comes this week as there's no sense risking such spectacular gains if they come to us this quickly. There are lots of other things we can make $1,000 on with $3,000 in cash – it's "only" 33%!

Whether it's 30 days or 3 years, the logic is the same, we look for undervalued companies or commodities (overvalued ones too) and then we build options spreads to take advantage of the moves we see coming and we enhance our potential for positive outcomes by BEING THE HOUSE and selling more premium than we buy – as premium decay the only sure thing that exists in the market.

Neither Gasoline (/RB) or Oil (/CL) may be done going up as Trump apparently gave the order to Bomb, Bomb, Bomb Iran yesterday but then changed his mind while the planes were in the air (allegedly after getting a call from Putin to stand down). Trump, meanwhile, is getting crazier and crazier and now claims (since his polls are so bad he fired his pollsters) that "I can win reelection with just my base" which is, of course, completely untrue – but when has that ever stopped him?

Trump may be losing his liquor license for his Washington DC for violating the morals requirements, which is funny but what's not funny is the ongoing investigations into collusion and obsruction of justice and a possible war with Iran (which is EXACTLY what Trump accused Obama would do to get re-elected) and while Trump's distraction campaign may be working to distract us from the underlying corruption issues, those issues aren't going away and the investigations are continuing.

This country was attacked – by Russia – and the damage is still being done.

All this tension will keep us in our heges into the weekend – despite the all-time highs. I'm more fighting the urge to cash out than getting excited about breaking higher but the Fed says they will do whatever it takes to keep the rally going – so I guess we'll give them a chance to prove it over the next month.

Have a great weekend,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!