The pause that refreshes or the end of the trend?

The pause that refreshes or the end of the trend?

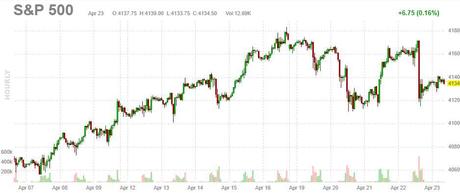

It's been a rough week for the market and we're finishing off lower than we started after Biden announced yesterday that he plans to raise the Capital Gains Tax from 20% to 39.6% for people making over $1M per year. That sent the Dow down over 300 points yesterday – the indexes generally lost 1% across the board but 4,132 is holding for now on the S&P, which is the 45% line with 4,275 the 50% line on the 5% Rule.

Stimulus, Low Interest Rates and Tax Cuts are the reason we're so far over the true value range with the S&P 500 trading above 35 times the expected earnings of its component corporations. If we begin to dismantle those things – the market will fall in kind. Earnings have been OK so far, with most companies beating very low expectations. Remember we shut down during Q1 last year so the comps are against an impacted quarter and, of course, the stimulus has papered over a lot of the losses from the slow economy – we're not really learning much from the Quarter.

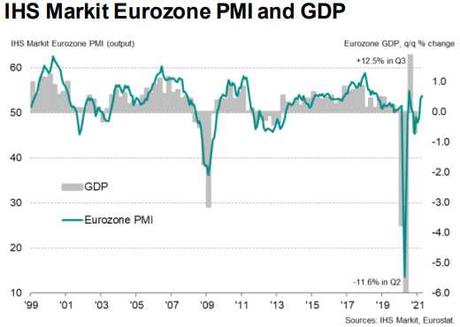

Many European countries retain restrictions on services that require close physical proximity and most forms of international travel. But the surveys recorded the first expansion of activity in its dominant services sector since August 2020, while its manufacturing sector continued to enjoy strong growth. “Although the service sector continued to be hard hit by lockdown measures, it has returned to growth as companies adjust to life with the virus and prepare for better times ahead,” said Chris Williamson, chief business economist…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!