As you can see we had a pretty big fall – down 14% in the next two days but the EWJ didn’t even stay down through two days of trading before it started to bounce back. Now, just 10 days after the quake – the Nikkei has fully recovered everything it lost during the quake.

So, was the Nikkei tremendously undervalued before the quake or are investors idiots? Perhaps it is choice three, that Government policies have become so interventionist that we are now EXCITED about a disaster as it’s really just an excuse for another massive Government money drop on the speculating class and, like good little soldiers – we are off to the races, BUYBUYBUYing those F’ing dips – as we’ve been well-trained to do.

Way too soon? Look how fast you miss it if you are not ready to pounce! We were lucky to be positioned for a dip – we pounced, we feasted but now, with the Nikkei back at 9,608 this morning (up 4.36%) I put out an Alert to Members this morning saying "That’s crazy, it’s way too soon." The last straw for me was waking up this morning and seeing TEPCO – the energy company that owns what is now the second biggest nuclear disaster of all time – up 16% this morning. REALLY??? 40,000 publicly traded companies in the World and TEPCO seems like the best place to park money???

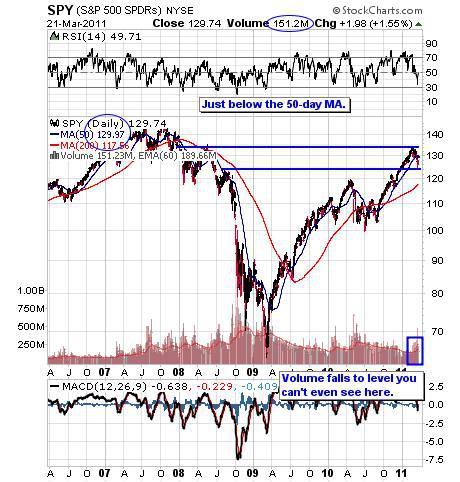

As noted in David Fry’s SPY chart, as usual, the volume collapses and the manipulators take over the market. Internationally, Japan has pushed their current account balance to $515,370,000,000 in the past two weeks – that’s as much as 8 months of POMO in 10 trading days! Do you think that’s not going to have an effect on the markets? That’s 10% of Japan’s entire GDP and, of course, their overnight lending rate is back down to 0%. At this point, they would have to pay you to borrow money to make it more attractive!

So life is great for Zaibatsu – especially those many, many who were not directly affected by the earthquake but will be directly benefiting from the massive stimulus. So, perhaps, the Japanese recovery is not so crazy as the simple math of the thing says the economic damage is far, far less than the $500Bn that is being thrown at the problem. We are reminded every day what just a few Billion Dollars worth of POMO can do to goose our markets.

Goldman Sachs is now warning their clients of the coming inflation tsunami that is now heading for American shores. They are also predicting this will lead to an upswing in Corporate Defaults as their "macroeconomic view is darkening" saying "Our biggest inflation fear stems from the recognition that fear itself has incrementally added to growth risks – and hence to credit risk."

Nothing rams the point home to investors better than alluding to one of the 10 historical quotes Americans actually know, right? Are inflationary truths self-evident at this point? It does seem clear that retailers will all raise prices together or they most assuredly will all raise prices separately even while 20 Million Americans regret that they had only one job to give to another country…

The Dollar actually bounced off the 75.50 line this morning just about exactly 7.5% down from the 81.50 high in January. The stock market is not up 7.5% – that would be our Breakout 2 Levels and the SOX and the Nasdaq are way below on legitimate concerns over supply issues stemming from the quake. Oil is up 15%, doubling the rate of the dollar decline but we went short on it yesterday as $104 seemed a bit silly. Silver is also silly at $36 and we like that line short in the futures and got another cross early this morning. If the dollar actually does manage a proper bounce (77 would be our 20% retrace of the 7.5% drop to 75.50) then oil will be testing that $97.50 line very quickly:

We’ll be watching our levels closely but we took a slightly bearish stance into the close – just in case as we added many, many long-term bullish trades that now have to be protected so we will keep a nervous trigger finger. Our SDS Disaster Hedge is still a great entry and we’ll be looking at a few more as we prepare to go LONGER if the Nasdaq can get back over that very critical 2,750 mark.

To get there, we expect a good move from AAPL and that can happen if the company announces a minimal expected effect on supplies from the quake disruption. British inflation is coming in at a red hot 4.4% – that is double the target rate so the Pound is heading higher on expectations the BOE will do it’s job and cool inflation down. I don’t think there’s really anything an individual nation can do – not even China, when the Fed and the BOJ have their money spigots turned on full blast – everyone’s going to get soaked and there’s nothing they can do about it.

China’s Yuan rose to a record 6.5552 against the Dollar, up about 4% since last year as the salary of Chinese workers and American workers moves towards parity which, unfortunately for American workers, means a 50% pay cut – at least. Retail sales are off another 0.1% this week but, of course, they are blaming the weather and not the massive decline in disposable income for the bottom 90%.

Ireland is borrowing 10-year money at 9.79% but we’ll pretend that "just doesn’t matter" – nor does this morning’s 6.3 "aftershock" that rocked Japan. We’ll be watching our own fault lines on the Dow – as illustrated by my 5% Rule Chart: