As noted on Dave Fry's chart (as well as yesterday's post) AAPL tested that $500 line yesterday and single-handedly took down the Nasdaq and the S&P but the .05% drop in the Nasdaq was LESS than AAPL's 0.7% drag (down 3.5% and 20% of the Nasdaq) so the net of other stocks in the index were UP, despite the fact that AAPL suppliers also took a big hit.

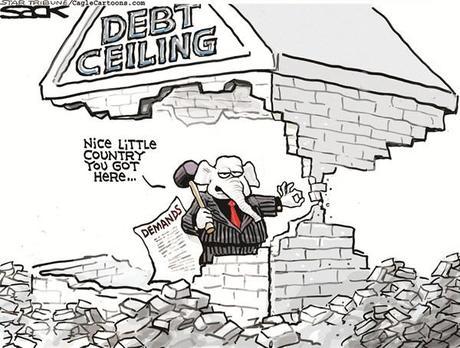

The President was not helpful in the afternoon, making it very clear he will not negotiate with Republican terrorists, who are threatening to destroy the good faith and credit rating the United States has spent 237 years establishing by refusing to raise the debt ceiling and, as Obama said:

"America cannot afford another debate with this Congress about whether or not they should pay the bills they've already racked up,"

That seems a simple enough concept, doesn't it? This isn't a real crisis and the President rightly compared it to sitting down for an expensive dinner and then refusing to pay the bill – it's illegal and immoral – the GOP cannot unilaterally decide to default on our obligations. Well, unfortunately they can. Although they have approved the last 36 increases, only the ones under Obama have become a crisis as the Republican Congress has turned it into leverage they can use to threaten the President.

This tactic works because no rational person is willing to destroy this country's credit rating to make a point so the irrational jackasses who are willing to play chicken with America's credit rating are able to ransom it to the people who are moral and responsible and care about this country too much to let it be harmed.

This tactic works because no rational person is willing to destroy this country's credit rating to make a point so the irrational jackasses who are willing to play chicken with America's credit rating are able to ransom it to the people who are moral and responsible and care about this country too much to let it be harmed.

Obama laid out the destruction that will be wrought by Republicans if they delay this extension. Social Security checks will halt, Veteran's Benefits will be withdrawn, Unemployment checks would stop, Government Workers won't get paid, Government Contractors won't get paid, Bondholders won't get paid, the IRS won't refund money…

Defaulting on our Bonds can cause interest rates to rise sharply and, as we've seen – Greece didn't recover so well from doing so. We have no ECB to bail us out, we would simply default and it may be many years before our rates normalize and that in itself could be…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.