But, fortuntately, it's still not time to pay the piper for all that money we're borrowing to goose the economy. Well, goose may be too strong a term as 5 years and $5 Trillion Dollars into this mess, we're really only flatlined the GDP to where it was back in 2007.

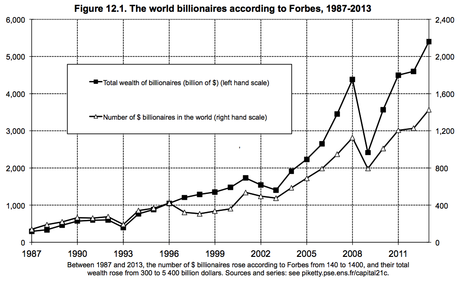

Did you get your $5,000,000,000,000 worth? We know the top 0.01% sure did. We've made the World's Billionaries alone $1.4Tn richer than they were in 2009 – and it only cost 140M working Americans $37,714 each! That's how much $5Tn in additional debt has cost us – on top of the $2.5Tn we piled on fighting Iraq or Afghanistan for whatever reason it was we had to invade those guys.

Don't worry, it's all fair, each one of those Billionaires also owes the same $37,714 as you do – they feel your pain! Multiply that by 3.5 and that's your share of the National Debt, which is still growing by $500Bn a year, although that's 1/2 of how fast it was growing under Bush II. And, of course, we're not even counting the Fed's $4Tn of additional debt – because we still get to pretend that will all work itself out in the end.

Don't worry, it's all fair, each one of those Billionaires also owes the same $37,714 as you do – they feel your pain! Multiply that by 3.5 and that's your share of the National Debt, which is still growing by $500Bn a year, although that's 1/2 of how fast it was growing under Bush II. And, of course, we're not even counting the Fed's $4Tn of additional debt – because we still get to pretend that will all work itself out in the end.

Just like CHINA!!! China's Central Bank has been trying to drain a little liquidity out of the system and it looks like that's already dropped GDP growth for the quarter down to 1.5%, nowhere near the 7.5% annual levels the Government was hoping for. That led Chinese stocks to fall about 1.5% this morning, led down by Financial and Commodity stocks. That's the reaction to M2 (money supply) GROWING by 12.1% instead of the 13.3% it was growing a month earlier and despite $169Bn in loan growth.

“Investors are a bit worried because M2 is quite low,” Zhang Haidong, an analyst at Tebon Securities Co., said by phone in Shanghai. “New loans may be better than expected by a little, but it’s still not considered good data;

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.