What an amazing recovery!

What an amazing recovery!

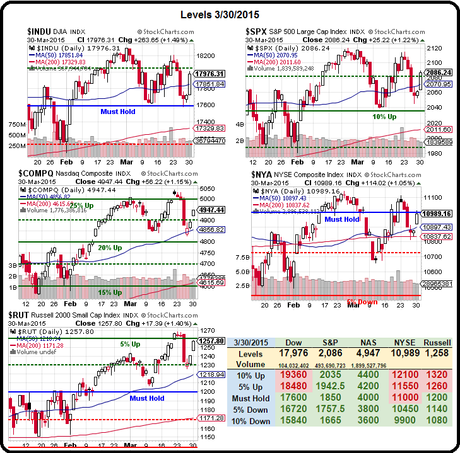

Sure there was no volume and sure almost all the gains came at the open and sure there was a high-volume wave of last minute selling but – WOW!!! – what a rally! With the month ending today we're not expecting much of a sell-off and we'll be looking to see if our strong bounce lines hold intra-day (they should) at:

Dow 17,850, S&P 2,060, Nasdaq 4,905, NYSE 10,910 and Russell 1,245

After barely making our weak bounce lines on Thursday (see Friday's post for details) we were still short of strong bounces on 4 of our 5 indexes at Friday's close (3 of 5 over is a bullish signal) but yesterday, as you can see from Dave Fry's SPY chart, we just popped right over at the open and never looked back.

We'd really like to see the NYSE confirm a bullish move by finally getting over the Must Hold line at 11,000 – that's been a constant sign of weakness that has kept us cautious all year (and last year as well). We had a move all the way to 11,100 in late Feb, but it quickly reversed and we fell 300 points to start March off on a sour note but now, as you can see – we've had 5 up days this month that have accounted for all of the gains to take us back to the promised land.

Nothing really matters until we see the Non-Farm Payroll Report on Friday but we have an interesting situation where the US Markets (and many EU Markets) are closed for Good Friday so, whatever the number is – there won't be a reaction to it until next Monday, when many EU markets are still closed.

So we're very happy to be mainly in CASH!!! in our largest portfolio and, even so, yesterday's rally brought us up $4,000 as our mainly Materials stocks gained a little ground. That did not make up for the $15,000 LOSS experience in our Short-Term Portfolio which, as I had said in our weekend Portfolio Review, was leaning too bearish as it's no longer defending many long-term positions.

So we're very happy to be mainly in CASH!!! in our largest portfolio and, even so, yesterday's rally brought us up $4,000 as our mainly Materials stocks gained a little ground. That did not make up for the $15,000 LOSS experience in our Short-Term Portfolio which, as I had said in our weekend Portfolio Review, was leaning too bearish as it's no longer defending many long-term positions.

Now it's a BET that the market will sell off and yesterday it sure didn't and we got burned. Today the Futures are pointing down 100 points (0.5%) and, as it's the end of the month, we're not believing the move anyway.

Greece and Iran are both coming to a head this week and we've already forgotten Yemen and the Ukraine is still a thing (an oldie, but goodie) and, of course, the macro picture we keep worrying about is getting worse, not better.

Don't forget yesterday's rally was started by more Chinese stimulus but the stimulus is aimed at getting their economy to hit their target growth rate. Who is it that was betting China wasn't going to hit their targets? China ALWAYS hits their targets – ALWAYS! So the fact that China is taking obvious measures to hit their targets means that they are more off course than the usual creative accounting measures are able to fix. How is this good news?

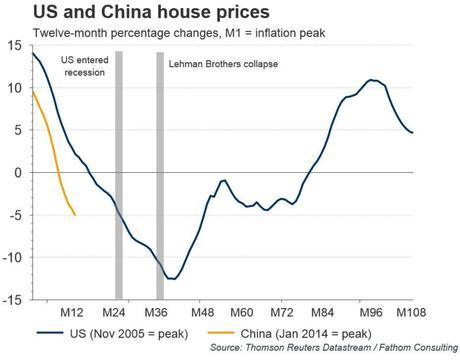

China's largest shipbuilder, Rongsheng Heavy Industries, had NEGATIVE revenue last year as more orders (that were previously booked as revenues) were cancelled than there were new orders to take their place. The company lost $1.2Bn and is running out of cash. WTF are you people buying over there??? Home Sales are falling so fast that China has taken drastic steps to lower down payment requirements and flipping penalties. Wow, that's a GREAT idea – isn't it? What could possibly go wrong?

China's largest shipbuilder, Rongsheng Heavy Industries, had NEGATIVE revenue last year as more orders (that were previously booked as revenues) were cancelled than there were new orders to take their place. The company lost $1.2Bn and is running out of cash. WTF are you people buying over there??? Home Sales are falling so fast that China has taken drastic steps to lower down payment requirements and flipping penalties. Wow, that's a GREAT idea – isn't it? What could possibly go wrong?

As you can see from the chart above, China is falling faster than we were in 2006 when we too took measures to stem the housing sell-off. Those measures covered up the problem all the way through mid-2008, when the whole thing collapsed like a house of cards. Like China, our markets peaked out even after there were these clear indications that real estate was falling apart and like China, we had tons of TV Pundits and MSM Analysts telling us not to worry about it, next to all their adds for brokers, banks and realtors. What could possibly go wrong this time?

Be careful out there!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!