Notice on David Fry’s weekly Russell chart, we’re looking for 822 on that index to hold. My own line is not 830 on that index as it seems to be shaping up as a key point of resistance that has not been futile lately. With all due respect to Dave, whose charts I love, I did have this to say about Technical Analysis in yesterday’s Member Chat, which bears repeating:

I think it’s ridiculous to draw historical conclusions from a yield curve when the current curve is completely manipulated to give a false signal. You KNOW the Fed is forcing that curve – it’s not in the least bit an actual indicator of short and long-term demand for capital nor is it any indication of risk or inflation expectation – it’s total BS. I can’t even believe Bespoke would treat this like it merits a discussion but that is what is wrong with TA people – they completely ignore fundamentals and that’s exactly the kind of idiocy the Fed is painting these charts to cater to.

Case in point (sorry Dave) is Dave’s note on his XRT chart that "the tape is the tape." No! The tape is not the TAPE – not when the Fed is painting the roses red to turn those frownish patterns upside-down. I mean – come on TA people, I’m willing to concede that technicals do matter and need to be considered when timing your entries so is it really too much to ask for you not to brush off fundamentals all together?

Case in point (sorry Dave) is Dave’s note on his XRT chart that "the tape is the tape." No! The tape is not the TAPE – not when the Fed is painting the roses red to turn those frownish patterns upside-down. I mean – come on TA people, I’m willing to concede that technicals do matter and need to be considered when timing your entries so is it really too much to ask for you not to brush off fundamentals all together?

We added 5 XRT May $49 puts at $1.20 to the $25,000 Portfolio last Friday right when all the momentum traders were jumping on the bandwagon as XRT broke resistance at $50. Those are up to $1.50 (25%) already BECAUSE WE BOUGHT THEM ON SALE! When a tennis ball strikes a racket – it has "momentum" and, if you look closely, the plane of the racket may bend as the ball pushes against resistance but you don’t have to be a physicist to KNOW that the chance of the ball breaking through those strings (resistance) and keep going is pretty slim.

Once it does break through – sure, all bets are off as to what happens next but, until it does, we can pretty much assume we’ll get our bounces. There was nothing in the data or earnings reports we had been hearing to indicate that retail sales were going better than they did at the height of the bubble in 2007. Yes there is inflation, but not THAT MUCH inflation yet.

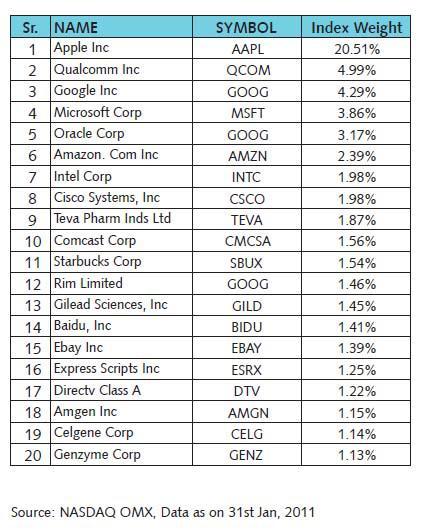

And of course, our running FUNDAMENTAL theme over at PSW, is that the inflation we are getting is from necessities like food and fuel and that is money that is drawn away from discretionary spending – the kind of money most companies in the XRT depend on. You can stare at this chart all day and you may not know that 2% of XRT’s rise since 2007 is due to PCLN, now the number one holding in the index. PCLN climbed from $100 to almost $500 in two years – does that mean retail is healthy? This is the fallacy of all ETFs and it makes me shudder when analysts get on TV and tell us how retail is strong as evidenced by XRT or, even worse, that tech spending is good because QQQ is up. That’s probably the worst one of all as AAPL is now over 20% of that index:

And of course, our running FUNDAMENTAL theme over at PSW, is that the inflation we are getting is from necessities like food and fuel and that is money that is drawn away from discretionary spending – the kind of money most companies in the XRT depend on. You can stare at this chart all day and you may not know that 2% of XRT’s rise since 2007 is due to PCLN, now the number one holding in the index. PCLN climbed from $100 to almost $500 in two years – does that mean retail is healthy? This is the fallacy of all ETFs and it makes me shudder when analysts get on TV and tell us how retail is strong as evidenced by XRT or, even worse, that tech spending is good because QQQ is up. That’s probably the worst one of all as AAPL is now over 20% of that index:

Note that the top 10 of the Nasdaq 100 are 46% of the entire index. What does the performance of AAPL, GOOG, QCOM, MSFT, ORCL and AMZN really tell you about TEVA’s upcoming quarter or Direct TV’s customer growth? Focused ETFs on very specific sectors can be informative but beware of treating all ETFs as if they are equally good indicators. Not only do they contain gross internal distortions like AAPL in the Nasdaq but the people who manipulate the markets know this and use these ETF leaders to push the rest of the market around at will.

If I want to force you to buy $1.45Bn worth of GILD, all I have to do is buy $20.5Bn worth of AAPL and you (the retail sucker with the 401K that drips into the Qs) will be indexed into the rest. It’s not quite that simple but you get the idea – I can buy 10 stocks I do want and drive up the price of 90 other stocks and then short them all while I lighten up on my initial buy tomorrow – that’s the World of ETFs!

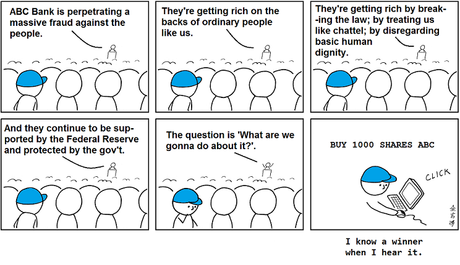

Meanwhile, I forgot to mention it yesterday but reformed broker found the best cartoon ever to summarize what our fundamental investing philosophy is all about:

Cartoon source: Thick Face, Black Heart (Abstruse Goose)

As I often say to Members: We don’t care IF the game is rigged, as long as we can understand HOW the game is rigged so we can place our bets accordingly! Our participation does nothing to affect the outcome of this multi-Trillion Dollar Ponzi scheme that is called the stock market and our lack of participation only makes us one of the sheeple and that is NO FUN AT ALL. So we play by the ever-changing rules until life becomes fair again and I do what little I can to point out the nonsense that goes on in the markets but, as you can see from the ongoing oil scam – there doesn’t seem to be a whole lot we can do to stop it.

Speaking of the oil scam – The futures bottomed out at $102.7 this morning but they are being pumped back up to $104 at the open where we can short them again below the line (or $105 if they make it back there). If they want to keep paying us, we will be happy to keep taking the money! The Dollar is over the magical 76.50 mark but I’d like to see 77 hold before I get impressed. That’s putting pressure on commodities across the board and not doing much for our open, unfortunately.

Speaking of the oil scam – The futures bottomed out at $102.7 this morning but they are being pumped back up to $104 at the open where we can short them again below the line (or $105 if they make it back there). If they want to keep paying us, we will be happy to keep taking the money! The Dollar is over the magical 76.50 mark but I’d like to see 77 hold before I get impressed. That’s putting pressure on commodities across the board and not doing much for our open, unfortunately.