That is ONLY the "Must Hold" line on our Big Chart. It's a level we've been waiting for the Dow to get to ever since the Russell crossed it's own Must Hold line at 1,000, way back in May. We were also waiting for NYSE 10,000 and we got that last week so the Dow is the final index to CONFIRM a rally – not the leading indicator of a new one.

What this does do for us is establish the Must Hold lines as a likely floor and we will now, finally, be able to raise our big chart levels by 10% (assuming we hold for the week), which will put the indexes current levels at new Must Hold levels 10% higher and, once again, the Dow would be 10% behind the leaders.

That's why we like DDM (ultra-long Dow) as our bullish cover – if the rally is going to continue, we can expect the Dow to play a little catch-up. In Member Chat yesterday, however, with the Russell pushing 1,020, we grabbed a new short play on TZA because the Russell is too high in the same way the Dow is too low – that makes for a very nice pair trade, assuming there's a happy medium there.

Like the Dow, the S&P barely had any time to enjoy the view at 1,800 before being smacked back down below it. Dave Fry blames Carl Icahn but I blame gravity as Icharus gets too close to the sun and tumbles back to Earth with his feathers ruffled.

Like the Dow, the S&P barely had any time to enjoy the view at 1,800 before being smacked back down below it. Dave Fry blames Carl Icahn but I blame gravity as Icharus gets too close to the sun and tumbles back to Earth with his feathers ruffled.

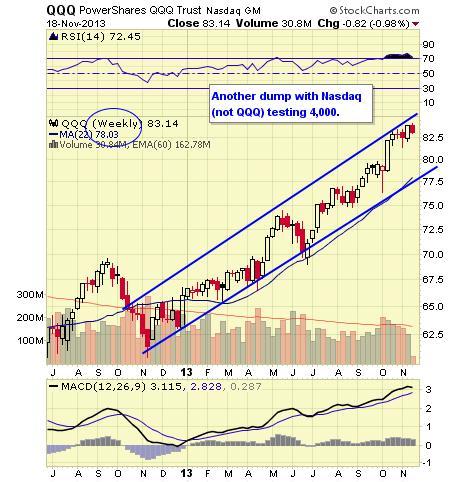

The Nasdaq similarly tested 4,000 and that is a full 20% over its Must Hold line at 3,300 (crossed in May) yet we still have people who don't think this is a bubble – just a happy market, I suppose. This puts the Nasdaq up 33% in a year. If not a bubble, are we supposed to consider this "normal"?

"Stock market bubbles don't grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception." -- George Soros

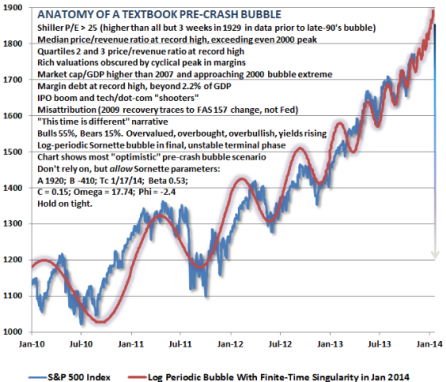

Doug Kass tells the sheeple at TheStreet.com that we are not in a bubble, yet his own list proves him wrong. Kass says these 5 conditions need to be met to consider the market to be in a bubble:

Doug Kass tells the sheeple at TheStreet.com that we are not in a bubble, yet his own list proves him wrong. Kass says these 5 conditions need to be met to consider the market to be in a bubble:

- Debt is cheap.

- Debt is plentiful.

- There is the egregious use of debt.

- A new marginal (and sizeable) buyer of an asset class appears.

- After a sustained advance in an asset class's price, the prior four factors lead to new-era thinking that cycles have been eradicated/eliminated and that a long boom in values lies ahead.

Is debt cheap? How can it be cheaper than ZIRP? Is it plentiful? Yes, for the Banksters that are having $85Bn PER MONTH shoved at them as well as their Japanese counterparts, who are getting another $75Bn PER MONTH to play with. We are also (see yesterday's post) creating 4 new Billionaries each week and they have an average of $4Bn per super-person and there simply isn't enough room under the mattress for all that money!

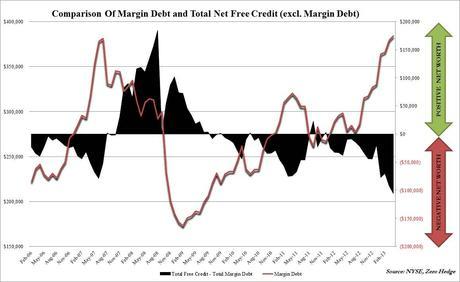

Is the debt being used egregiously? Well, margin debt is at record levels while ordinary consumers are unable to borrow. This is how the rich get much, much richer while the poor people sit on the sidelines and read about it. Those newly minted Billionares and Millionaires for the new buyers of the asset classes of stocks and junk bonds that Kass is talking about (as I noted yesterday) and the "new-era thinking" is exactly the kind of BS Kass is spouting to justify "the new paradigm."

Is the debt being used egregiously? Well, margin debt is at record levels while ordinary consumers are unable to borrow. This is how the rich get much, much richer while the poor people sit on the sidelines and read about it. Those newly minted Billionares and Millionaires for the new buyers of the asset classes of stocks and junk bonds that Kass is talking about (as I noted yesterday) and the "new-era thinking" is exactly the kind of BS Kass is spouting to justify "the new paradigm."

There is no new paradigm (there never really is). There are companies and they have earnings and there are other assets that offer safer, more stable returns. All that has happened here is the Fed has distributed Trillions of Dollars while, at the same time, sealing off the safer places to put them, like TBills, CD's, Bonds… by lowering the rates to levels at which the mattress seems like a better alternative.

There is no new paradigm (there never really is). There are companies and they have earnings and there are other assets that offer safer, more stable returns. All that has happened here is the Fed has distributed Trillions of Dollars while, at the same time, sealing off the safer places to put them, like TBills, CD's, Bonds… by lowering the rates to levels at which the mattress seems like a better alternative.

That leaves investors with no choice but to put their money into equities or high-yielding junk bonds because there's no demand for commodities as the actual economy is still in the doldrums and the only inflation we have is the steady decline of our own dilluted currency (down 5% since July).

As long as you have at least 1/3 of your money in the markets (and 100% bullish), you will be fine, otherwise, the value of your overall assets has fallen 5% in less than 6 months. That's how money is "forced" into the market. The money doesn't "want" to be in the market but it HAS to be there or it will be confiscated through Government programs that devalue the Dollars you do have.

So this "bubble" is not likely to burst until there is a viable alternative for people to put their money into – especailly the large sums of money held by the nation's top 1%. You can be in a bubble, you can be the one blowing the bubble – you can be absolutely certain that you are participating in a bubble but that doesn't mean it's going to pop – 1998 and 1999 taught us that!

So this "bubble" is not likely to burst until there is a viable alternative for people to put their money into – especailly the large sums of money held by the nation's top 1%. You can be in a bubble, you can be the one blowing the bubble – you can be absolutely certain that you are participating in a bubble but that doesn't mean it's going to pop – 1998 and 1999 taught us that!

Just like this year, the Nasdaq went into over-drive in the Summer of 1998 and jumped from 1,500 to 2,250 (50%) by the end of the year. That makes our current rally look tame, as the Nasdaq is merely testing 4,000, from 3,300 (21%) in July. And all that was nothing compared to what happened in 1999, after a full year of waiting for the "ridiculous" run to 2,500 to reverse itself, the Nasdaq instead rallied all the way to 5,000 in the last 3 months of the year and the first 3 months of the next. THEN it fell back to 1,500 a year later (down 70%).

We're not going to miss too much by watching this from the sidelines. If we break over these levels, we'll flip to some more bullish trades and we're already lined up for a rejection at 16,000, 1,800 & 4,000 but it's the 2 out of 3 rule we'll be obeying this week as the Fed is forever blowing bubbles.