This could turn ugly.

This could turn ugly.

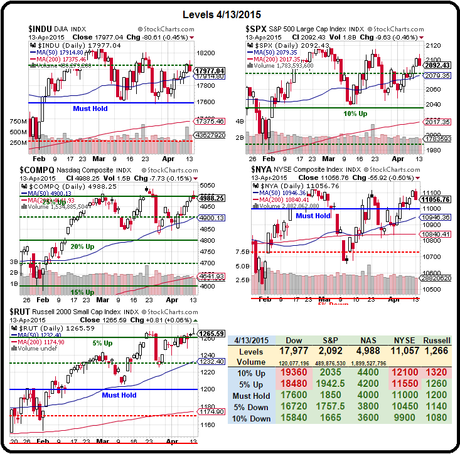

As predicted yesterday, without an upside catalyst, the indexes drifted lower and, as you can see from our Big Chart, we are testing a lot of critical lines – lines we expect to fail as the earnings reports come in and disappoint the bulls:

Dow 18,020 is the 2.5% line, failing to get back over that and then failing the 50-day moving average at 17,915 can send us quickly back to the Must Hold line at 17,600.

- S&P 2,080 is the 12.5% line, so either the Dow is wrong and should easily plow higher or the S&P has a LONG way to fall. It's also the 50 dma, so a failure there would be TERRIBLE and the /ES Futures are already testing it (and that's a gain of $500 per contract from the short idea we gave you yesterday – you're welcome!).

- Nasdaq 4,988 is 30% over our Must Hold line in our own country's version of a bubble. We tested 5,000 yesterday and failed and it's all about AAPL's earnings on the 27th since it's 16% of the Nasdaq and 3.5% of the S&P and 5% of the Dow – so do or die on their earnings in two weeks. Meanwhile, I don't see many of the tech companies living up to the hype but NFLX has a chance to prove me wrong tomorrow (now $480) and INTC reports this evening.

- NYSE is the broadest measure of the markets and it's also barely above it's Must Hold line at 11,000 (11,057). That, of course, MUST HOLD or the other indices are very likely to go down with the big ship. The 50 dma is 10,946, so a bit below the line and that, of course, would be a very critical failure – hopefully that does not happen.

- Russell had been our upside leader but has run out of gas just 5% above our Must Hold line at 1,200. That makes 1,260 a very important line not to fail and the 50 dma is right at the 2.5% line at 1,232 and that's another one we'd hate to see tested.

We are, of course, in CASH!!! - so we don't really give a damn and, of course, we'd kind of like to see stocks pull back and give us some cheap entries but, as I pointed out to our Members yesterday – there are already plenty of stocks giving us cheap entries and now it's earnings season and bargains are going to be everywhere as people overreact to bad news. Being nearly all cash puts us in a shopping mood!

We are, of course, in CASH!!! - so we don't really give a damn and, of course, we'd kind of like to see stocks pull back and give us some cheap entries but, as I pointed out to our Members yesterday – there are already plenty of stocks giving us cheap entries and now it's earnings season and bargains are going to be everywhere as people overreact to bad news. Being nearly all cash puts us in a shopping mood!

Another nice benefit of our strategy of being in cash with some aggressive shorts in our Short-Term Portfolio is that, as the market falls, our short positions both generate even more cash AND protect our initial bargain-hunting plays, which let's us buy without fear as we take our first pokes.

We have a FREE Webinar at 1pm EST, this afternoon and we'll be previewing earnings season, as well as discussing some of our Futures Trading Techniques – please join us if you have time.

Meanwhile, we're amusing ourselves with our Futures trades. As I mentioned, we caught a nice $500 move on /ES but /TF still hasn't gone below 1,260 and now 1,265 and I'd go one or two short here and DD at 1,270 for an average short at 1,267.50. Our Oil Futures Short Idea from $53 (/CLK5) in yesterday's morning post (delivered daily, pre-market HERE) made $1,500 per contract, again (we did it Friday, too) before noon and then we picked up another $500 from $52.50 back to $52. This morning, we're back at $52.50 and short again.

Meanwhile, we're amusing ourselves with our Futures trades. As I mentioned, we caught a nice $500 move on /ES but /TF still hasn't gone below 1,260 and now 1,265 and I'd go one or two short here and DD at 1,270 for an average short at 1,267.50. Our Oil Futures Short Idea from $53 (/CLK5) in yesterday's morning post (delivered daily, pre-market HERE) made $1,500 per contract, again (we did it Friday, too) before noon and then we picked up another $500 from $52.50 back to $52. This morning, we're back at $52.50 and short again.

We also called for the short on /NKD (Nikkei Futures) at 20,000 and caught a nice $500 move to 19,900 (you're welcome) and, like oil, we're taking 19,950 with a DD at 20,000 but tight stops above as we'd hate to miss the big move, though we do have EWJ for that.

By the way, did you catch those FXI May $48 puts we discussed right at the top of yesterday's morning post? It came in lower than expected, at 0.56 at the open and flew up to 0.85 at the day's end for a fantastic 51.7% gain on the day (you're welcome). At 40 contracts, that's turning $2,240 into $3,400 for a $1,160 profit in a single session!

By the way, did you catch those FXI May $48 puts we discussed right at the top of yesterday's morning post? It came in lower than expected, at 0.56 at the open and flew up to 0.85 at the day's end for a fantastic 51.7% gain on the day (you're welcome). At 40 contracts, that's turning $2,240 into $3,400 for a $1,160 profit in a single session!

Sadly, this is the last day of our Free Picks as earnings season is about to begin and we're going to be concentrating on those plays for our Members in our Live Chat Room each day. DON'T JOIN HERE and we won't bother you with any more ways to make money until July.

Retail Sales are out this morning and up 0.9% but, ex-Auto, where they are racking up the sub-prime auto loans to push vehicles, retail sales are up just 0.4%. On the bright side, this is the first positive report we've had since November but XRT (we're short) was at $85 in November and is now at $101.50, so we'll see if this report is enough to sustain the gains.

Retail Sales are out this morning and up 0.9% but, ex-Auto, where they are racking up the sub-prime auto loans to push vehicles, retail sales are up just 0.4%. On the bright side, this is the first positive report we've had since November but XRT (we're short) was at $85 in November and is now at $101.50, so we'll see if this report is enough to sustain the gains.

Notice last March we jumped 1.3%, so 0.9% won't be quite as impressive when it prints on the chart. Not surprisingly, the Small Business Optimism Index fell 2.8% to 95.2, the lowest reading since last June, when we were also heading into a healthy correction. According to the NFIB's Chief Economist:

“It is no surprise that optimism is muted and owners’ expectations about the future are less than exuberant. Small business owners are not encouraged to expand their businesses when consumer spending is down, US trading partners are weakening and the government continues to try and micromanage the private sector with red tape and regulations. Overall the economy will keep moving forward, but more like a turtle than a hare. Bad weather was certainly depressing and Washington politics remains focused on issues that have little bearing on the current economy.”

This is an April number folks, about as current as it gets and this is exactly what we expected it would look like based on the data we've been seeing – the data that led us to decide to CASH OUT and wait until we saw some actual earnings (not just hype) before risking our strong Dollars on something as fickle as the markets again.

This is an April number folks, about as current as it gets and this is exactly what we expected it would look like based on the data we've been seeing – the data that led us to decide to CASH OUT and wait until we saw some actual earnings (not just hype) before risking our strong Dollars on something as fickle as the markets again.

Even Michael Jordan would sit on the bench once in a while – no matter how good a shooter you are, sometimes it's good to step off the court and take a little rest. That's what we're doing now. Our team (portfolios) are way ahead and they don't need us to be in every play – this is why most hedge funds ultimately fail – they are pressured to constantly be invested and they tend not to change their strategies when market conditions change.

Let's be smarter than that!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!