Wheeeee, what a ride!

Wheeeee, what a ride!

So far, the markets are doing exactly what we expected them to do all month (see previous posts) ever since, in fact, that I wrote my post on May 15th (the tippy top on these charts) titled: "All-Time Highs Prove Investors Must be Stoned." The best part of looking back on these posts is to read all the comments of people telling me how wrong I was to doubt the might of the markets at the time.

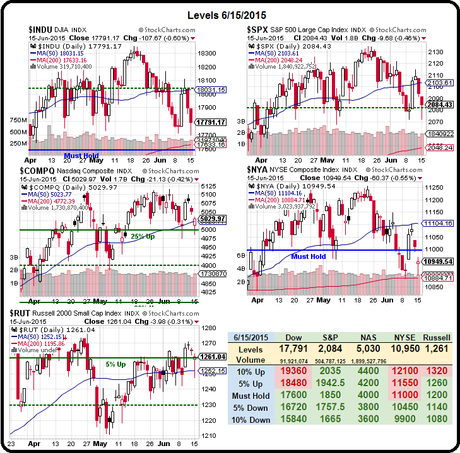

We did our mid-May Portfolio Review that day and our Short-Term Portfolio was up 119.5% at the time and fortunately, since we did call it correctly, we finished the day yesterday at +137.4%, gaining 18% as the S&P fell 2.5%. 2.5% is very significant to our 5% Rule™ so we'll be looking for a 0.5% "weak" bounce today and a 1% "strong" bounce by the end of the week.

Last Monday ("Bouncing or Bust"), we were focused on Germany's Dax Index as a leading index to the downside and on Weak Bounce Wednesday (10th) before the market opened we were already calling for a move back up. As I said at the time:

Speaking of gravity, we're looking for some weak bounces today, especially in Germany, where the DAX is completing a 10% correction (12,250 to 11,000) which is still above the 200-day moving average at 10,469, which would be another 5% drop from here. This is all perfectly normal after a 30% run from 9,500 in January, which is kind of a lot for a major market to move in 6 months

As you can see from how well it obeys the lines Fibonacci Lines (see our primer here), the bots are firmly in control of the trading in Europe so this 50% retracement will be a huge test of sentiment over there. Of course we're going to have a "bullish" bounce off the 11,000 line – it's major support – the question is whether the bounce will be strong (40% retrace of the drop) or weak (20% retrace) and the drop was from 12,250 so 1,250 points means we're looking for a 250-point weak bounce to 11,250 this Friday and 11,500 by

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!