Powell is speaking this morning.

Powell is speaking this morning.

The newly re-appointed Fed Chairman will speak to the Senate at 10 am and it was going to be the same old, same old but, in his prepared remarks, he's got this warning about the economy:

"Pandemic-related supply and demand imbalances have contributed to notable price increases in some areas. Supply chain problems have made it difficult for producers to meet strong demand, particularly for goods. Increases in energy prices and rents are also pushing inflation upward. As a result, overall inflation is running well above our 2 percent longer-run goal, with the price index for personal consumption expenditures up 5 percent over the 12 months ending in October.

Most forecasters, including at the Fed, continue to expect that inflation will move down significantly over the next year as supply and demand imbalances abate. It is difficult to predict the persistence and effects of supply constraints, but it now appears that factors pushing inflation upward will linger well into next year. In addition, with the rapid improvement in the labor market, slack is diminishing, and wages are rising at a brisk pace.

We understand that high inflation imposes significant burdens, especially on those less able to meet the higher costs of essentials like food, housing, and transportation. We are committed to our price-stability goal. We will use our tools both to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched.

The recent rise in Covid-19 cases and the emergence of the omicron variant pose downside risks to employment and economic activity and increased uncertainty for inflation. Greater concerns about the virus could reduce people’s willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions.”

Meanwhile, Janet Yellen is calling on the Senate to quickly pass Biden's "Build Back Better" stimulus bill and warned (GOP) lawmakers they must soon raise the nation’s debt limit before the Treasury runs out of cash on Dec. 15th. “I cannot overstate how critical it is that Congress address this issue,” Yellen said of the debt limit. “If we do not, we will eviscerate our current recovery.”

Over in Europe, November Inflation hit 4.9% – the most since the EU was formed. This was 10% above predictions of 4.5%. Like our Fed, ECB officials have redoubled efforts in recent days to reassure citizens that they are facing a once-in-a-generation cost-of-living squeeze that won’t endure, driven by energy and a series of one-time factors. Think about it – they aren't doing anything about it – other than spending their time telling you the inflation you see every day isn't real. This is some kind of anti-policy double-speak we all are suffering through.

Energy prices are driving the inflation surge in Europe and, here in the States, Biden has ordered an FTC probe on gasoline prices as the gap between wholesale prices and prices at the pump have hit new records. Many drivers in the US were seeing $4/gallon at the pumps over the holiday weekend and Biden has ordered the release of supplies from the Strategic Reserve to lower prices. Between that and Omicron, Oil prices fell 18% in the past two weeks but Gasoline is a bit stickier so far.

Energy prices are driving the inflation surge in Europe and, here in the States, Biden has ordered an FTC probe on gasoline prices as the gap between wholesale prices and prices at the pump have hit new records. Many drivers in the US were seeing $4/gallon at the pumps over the holiday weekend and Biden has ordered the release of supplies from the Strategic Reserve to lower prices. Between that and Omicron, Oil prices fell 18% in the past two weeks but Gasoline is a bit stickier so far.

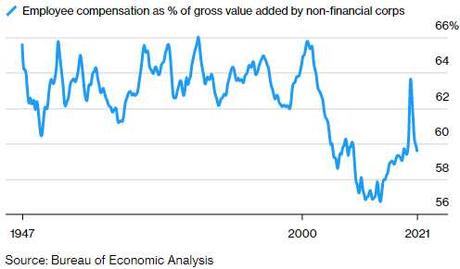

Don't blame the workers, that's for sure. For all the BS you hear about rising salaries, keep in mind that workers compensation hasn't been keeping up with Corporate Profits in the entire 21st Century and it WAS getting a little better into 2019 (the spike up is due to Corporate Profits dropping, not wages rising) but now workrs are back to losing ground – making 10% less than there were in 1999.

So we have lower rates of compensation and soaring inflation – that's not good – certainly not for the Proletariat, anyway. As noted recently by John Oliver, our Corporate Masters have been going to great efforts to keep the workers from anything that even has a hint of collective bargaining to it. Whether you were in a union or not, the strength of unions in the 20th century put pressure on all corporations to treat their workers more fairly. When I was a young worker in the 80s, we knew how to demand a raise and no one was shy about it – raises were expected, as were bonuses.

My daughter has been working in a restaurant that has been unwilling to add more staff as they get busier so people are putting in more and more overime and, when I suggested she ask for a raise, she laughed at me, saying "Dad, I need this job" as if just asking for a raise gives your employer the right to fire you. That's how the workplace is these days for our kids – workers have no rights anymore – it takes Government policy to fix these imbalances.

If the Governments don't step up and start to force some balance back to the labor markets, we can expect a return of labor unrest and that's not good for anybody. Since the pandemic began, 500,000 additional people have become self-employed, now 9.44M of us. 4.54M new businesses have filed this year, up 56% from the same period in 2019 and the most since 2004. All this becomes competion for existing businesses as the danger of these compensation mis-matches is that workers realize they could do better working for themselves. In September, U.S. workers resigned from a record 4.4 million jobs.

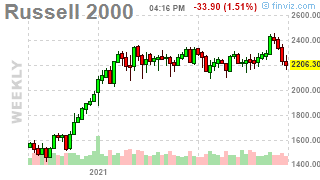

We're watching the Russell 2,000 closely this week as that index is down 10% from the highs and back to where it's been flat-lining all year. 2,200 is the line to watch and below that, there is not much support all the way back to 1,500, which would be a 33% correction from here – very unpleasant.

We're watching the Russell 2,000 closely this week as that index is down 10% from the highs and back to where it's been flat-lining all year. 2,200 is the line to watch and below that, there is not much support all the way back to 1,500, which would be a 33% correction from here – very unpleasant.

So, if the Russell breaks, look for the other indexes, which are only about 2.5% off their highs, to begin catching up and that could get very ugly, very fast and that means we need to be very sensitive to signs of worsening news as a warning to add more hedges. We went over the levels to watch on each of the indexes in yesterday's Live Member Chat Room.

We will see how Powell's chat with the Senate goes this morning and see how the market reacts – perhaps he will put a more positive spin on his comments but I wouldn't bet in it because, even though he was just reappointed, he won't want to look like he's clueless if the the market corrects right after he says all is well.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!