I’ll write about how shabby our infrastructure is another time but boy do I feel bad for the tens of thousands of businesses that have been shut down for 4 days (and counting) without internet, phones or power in some cases – because it snowed. It seems that, for the past 120 years, it hasn’t been in anyone’s budget to dig a hole in the ground and bury our utility lines so we are left at the constant mercy of the elements – even as having access to these services becomes more and more vital to our nation’s productivity.

Fortunately, I can fold my business up and head off to a hotel. I’m in the lovely lobby of the Glen Point Marriott this morning in a big comfy chair next to a waterfall so I can’t complain too much. People who were hoping yesterday was a small correction, on the other hand, have plenty to complain about as the Futures are falling fast on word that Greece may be telling the EU where to stick their bailout (and their Draconian austerity measures).

Over in Asia, the Shanghai was flat this morning but the Hang Seng dropped the full 2.5% and the Nikkei fell 1.7%. The action is interesting because we knew about the Greek situation at 2pm yesterday so it’s strange how the reaction to it seemed to snowball only after the pundits began spinning it as the new crisis.

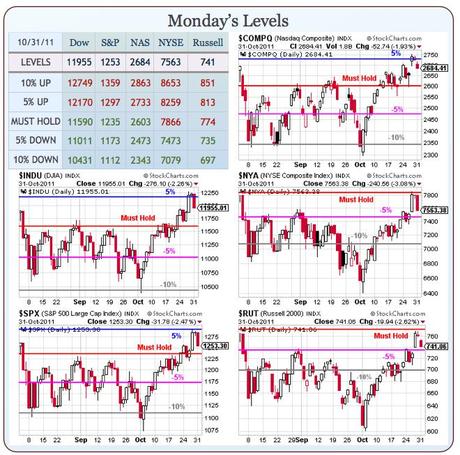

Referendum or no referendum, we were expecting a re-test of our Must Hold lines on the Dow (11,590), S&P (1,235) and the Nasdaq (2,603) and the -5% lines on the NYSE (7,473) and the Russell (735) so whatever excuse it takes to get us there is fine with us. We’ll have a blow-off (hopefully) spike below them at the open but it’s where we finish that matters. We were, of course, playing for bearish follow-through today and we let our new USO puts run (the weekly $35 puts at .29 from Member Chat at 2:42) along with the rest of our bearish WCP plays and we took quick (and too early) profits on our TZA calls.

EU banks are taking a pounding following the Greek referendum news, with the STOXX Europe 600 Banks index -5.1%, Societe Generale -13.6% (SCGLY.PK), Credit Agricole (CRARY.PK) -10.85%, BNP Paribas -9.4% (BNPQY.PK), Deutsche Bank (DB) -7.9%, UniCredit -8.1% (UNCIF.PK), Barclays (BCS) -5.5%, and RBS (RBS) -4.9%. What were great deals last week are back to being stocks no one wants today!

In our ongoing Global Currency War, the Royal Bank of Australia cut it’s benchmark rate 25 basis points to 4.5% this morning (another Dollar booster). Governor Glenn Stevens gives expected nods to the slowdown in China and falling inflation in Oz, but saves particular emphasis for "trade performance … see(ing) some effects of a significant slowing in economic activity in Europe."

Yeah, how about that austerity plan, eh? Nothing like cutting back in order to grow, is there? In other dangerous Government intervention news: Hong Kong real estate prices could fall 25-30% over the next two years, and that’s the good news, write analysts at Barclays. In a "hard landing" scenario, prices could collapse 35-45%. The process may be under way, with transactions falling for 9 consecutive months and prices off 3% from June-August amidst rising mortgage rates and government policies aimed at cooling the property market..

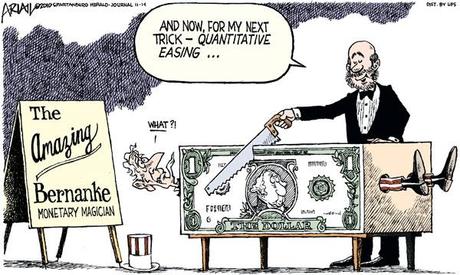

Our own futures are in free-fall so congrats to all of our bears as this is going to be very exciting but horrible for the economy if all that effort to put the EFSF together ends just day’s later in a massive reversal. We’ll be layering our bearish plays, just in case – but also taking those profits off the table if we find any support and looking for some nice, upside plays into the sell-off. Unfortunately though, we’re back to counting on The Bernank to pull a rabbit out of his hat to save the markets.