Let's talk about the good stuff first:

Let's talk about the good stuff first:

AGNC beat by a mile, REITs are very underinvested at the moment. WHR beat, a nice global manufacturer and a big part of Durable Goods. LOGI beat - we just made them a Top Trade. NXPI also good, FFIV as well. RRC, UHS, SSD, MMM, ADM, GE, MCD, PHM, UPS, RTX (war!) - plenty of stocks are doing well.

On the dark side is NEM, PHG, KALU, GM, MCO, SSTK, XRX and, worst of all this morning, Wal-Mart (WMT) warned earnings would be 8-9% lower than expected, despite 7.5% higher (inflated) sales numbers. Just like everyone else, WMT is having trouble passing along higher prices efficiently and, more importantly, keeping up with Consumer tastes - as inflation forces them to switch to lower-cost items - leaving WMT holding the bag on the inventory they already have in stock.

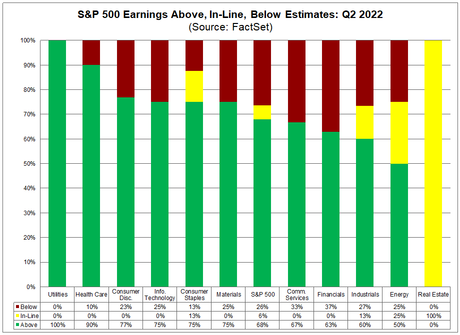

As you can see from the chart above, with 21% of the S&P 500 reporting, we're overall running at 68% beats with 26% misses, the misses are a little hot (usually more in-line) but it's hardly catastrophic. We're still in that area where the market does want to go higher but the talking heads in the MSM don't want the retailers to buy anything until their Bankster buddies have loaded up the trucks with cheap stocks - so they are still trying to scare you out of everything - including the 2/3 of the companies that are beating expectations.

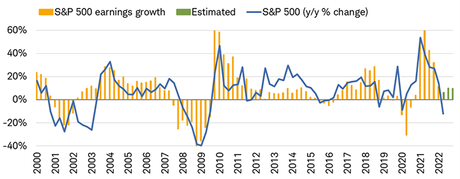

Earnings are NOT negative - yet the index is trading like they are. As I've said all year it's a stock-pickers market and that is our favorite kind at PSW because, when valuations matter - we know exactly what to buy!

KO just beat, GLW beat (but guided lower), ACI even beat. What I am seeing is a complete lack of guide ups but, given the environment, CEOs would feel foolish being optimistic, wouldn't they? This is how all this negativity can feed on itself until it becomes self-fulfilling.

If we can weather the earnings storm of Big Tech in the Nasdaq, we're going to be in pretty good shape as we're right between the 50 and 200-week moving averages and the MACD is about to break up and give the index a nice push that should have us testing the 200 wma at around 14,000 by October. That's up 15% from where we are now!

Now, that's the theory but, to accomplish that, the $17Tn Nasdaq 100 would have to add $2.5Tn and that's going to have to be quite a step up for our Top 10 - who are a good 50% of the indexes value.

- AAPL is $2.5Tn

- MSFT is $2Tn

- GOOGL is $1.5Tn or maybe $3Tn as it's listed twice (GOOG and GOOGL)

- AMZN is $1.3Tn

- TSLA is $800M

- META is $475M

- NVDA is $450M

- PEP is $250M

- COST is $250M

- AVGO is $210M

You can see how the rest don't matter as we're already at $9.7Tn (counting GOOG once) out of $17Tn so the other 90 stocks in the index are just rhinestones on a jacket - there to look pretty but no real function. So do these 10 stocks have $2Tn to gain - it's about 20% for them so we have to watch each report very closely.

TSLA already reported and they are up 10%, PEP already popped as well and COST is up 20% since their earnings. GOOGL and MSFT report this evening with META tomorrow and AMZN and AAPL go on Thursday. NVDA is a late reporter (Aug 24th) and AVGO will be early September but they are small so it doesn't matter - we'll know if the Nasdaq is on course or not by Thursday evening.IN PROGRESS