The futures are up 200 points on the Dow (/YM) on a massive gap up after being closed since Friday at 6. The Dollar was smacked down all the way to 79.97 at 6:30 and oil rocketed to the magic $101.50 mark and just because it’s a new year doesn’t mean we got stupider so my comment to Members in this morning’s Chat was:

Futures finally opened with massive gap up of 200 on Dow (1.6%). Dollar dove to 80.045 – total joke and my knee-jerk reaction is to short the Dow (/YM) futures below the 12,350 line (12,352 now) and the RUT (/TF) if they cross back below 750 (now 754). Iran oil may have some legs so we may have to wait for inventories (Thursday) to short but we’ll see.

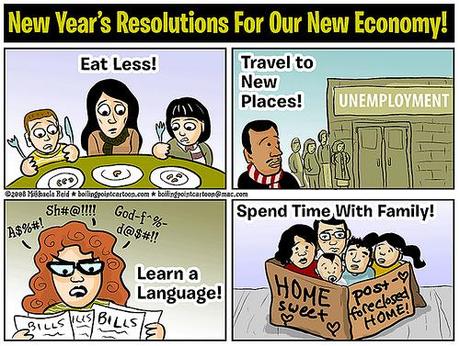

Yep, new year – same BS is the story of 2012. I made my market prediction yesterday and already today it’s panning out as we have the opportunity to sell to the suckers who think that China’s official PMI coming in over 50 for the first time in 3 months trumps the independent HSBC PMI of 48.7. We have discussed the very flaky nature of PMI data in the past so I won’t get into it here but the key takeaway from that report is "The “festival effects” of western and Chinese New Year celebrations helped to boost the PMI reading."

Yep, new year – same BS is the story of 2012. I made my market prediction yesterday and already today it’s panning out as we have the opportunity to sell to the suckers who think that China’s official PMI coming in over 50 for the first time in 3 months trumps the independent HSBC PMI of 48.7. We have discussed the very flaky nature of PMI data in the past so I won’t get into it here but the key takeaway from that report is "The “festival effects” of western and Chinese New Year celebrations helped to boost the PMI reading."

So these are the BOOSTED numbers?!? Oh dear. “Europe’s debt woes, the austerity measures the European countries are taking and the sluggish U.S. recovery mean demand for Asian goods this year is likely to be weak, posing a downside risk,” said Yao Wei, a Hong Kong-based economist for Societe Generale SA. Thank goodness investors don’t read the actual reports or check the analysis or we wouldn’t be able to make money betting against the reactions to headline numbers.

In the Chinese PMI data, an index of export orders was at 48.6 from 45.6 in November, still below 50, the dividing line between contraction and expansion. The rebound in the PMI “does not signal that the economy has turned around,” said Zhang Zhiwei, a Hong Kong-based economist at Nomura Holdings Inc. who previously worked for the International Monetary Fund. “Growth momentum will continue to wane this quarter, as the European crisis will…

In the Chinese PMI data, an index of export orders was at 48.6 from 45.6 in November, still below 50, the dividing line between contraction and expansion. The rebound in the PMI “does not signal that the economy has turned around,” said Zhang Zhiwei, a Hong Kong-based economist at Nomura Holdings Inc. who previously worked for the International Monetary Fund. “Growth momentum will continue to wane this quarter, as the European crisis will…