It's not the things you do that tease and hurt me bad

but it's the way you do the things you do to me.

I'm not the kinda girl who gives up just like that, oh no.The tide is high but I'm holding on. – Blondie

We passed our first major test yesterday.

I set levels for the expected pullbacks back on the 1st and yesterday, in our morning Alert to Members, I reminded our subscribers that it would take more than a 1% drop in our indexes before even our closest (the Nasdaq) was in trouble and that index is being dragged down unrealistically by a single stock (which will remain nameless) – so we cut them a little slack. Our target levels were:

- Dow 13,600 (finished at 13,880 +2%)

- S&P 1,480 (finished at 1,495 +1%)

- Nasdaq 3,150 (finished at 3,131 –0.6%)

- NYSE 8,800 (finished at 8,852 +0.6%)

- Russell – 880 (finished at 899 +2.1%)

This is why we have our 3 of 5 rule – one index breaking a bit below is no reason to go bearish. Especially when a single stock that makes up 20% of the index drops 2.5% and causes 0.5% of the drop by itself. The Dollar also ROSE 0.6% yesterday, so half of the losses for the day were nothing more than a currency adjustment and my comment to Members at the open was:

This is why we have our 3 of 5 rule – one index breaking a bit below is no reason to go bearish. Especially when a single stock that makes up 20% of the index drops 2.5% and causes 0.5% of the drop by itself. The Dollar also ROSE 0.6% yesterday, so half of the losses for the day were nothing more than a currency adjustment and my comment to Members at the open was:

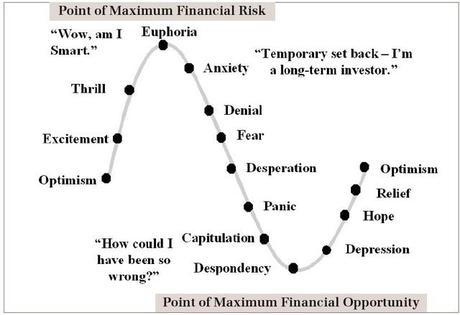

it would take more than a 1% drop in our indexes before even the Nasdaq gets in trouble and, since we need to see 3 of 5 levels fail, it's 2.3% to S&P 1,480 that we need to watch closely. Other than that – how can we be bearish? As Josh Brown pointed out on the weekend regarding our Market Euphoria chart and as I noted this morning, we're more likely just in the Optimism/Excitement phase of the trend than already past Thrills and Euphoria. That puts us halfway through a massive rally, rather than at the very top of a medium rally.

Still, even massive rallies have pullbacks and we'd love to miss one if

…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.