Things are getting interesting:

As you can see from the chart above, we're testing the 50-day moving average from below and it would be VERY BAD if it acts like resistance on the way up. At 5,116 we're still 2.8% off the top after recovering half of our 5.8% drop for the month. Still, unless we have a HELL of a rally today, we're finishing the month down for the first time since October of last year - when we were finishing off a 15% correction (which would be 4,474 from our current top).

So far, S&P Earnings have come in pretty strong but next week earnings shift to mostly Russell stocks (mid-caps) and, although the total market cap of the Russell is less than the market cap of Microsoft ($3Tn) - it's still capable of driving market sentiment and Microsoft, unlike AAPL, doesn't even make $100Bn - so their P/E Ratio is over 30 - as is the entire Nasdaq and that's a 3.3% annual return and banks are giving us 4.5% on insured cash...

The markets are risky and not keeping up with inflation, the Banks are riskless and keep you ahead of inflation - what do you think happens as more and more people realize this?

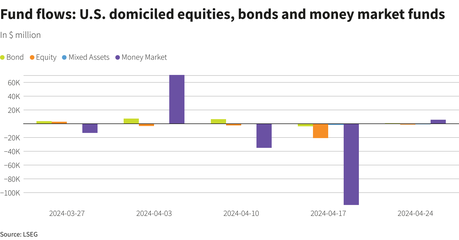

Yeah, that! 100,000 Million is A LOT of money to be flowing out and that was just the week of 4/17. In last week's "weakovery", not even $10Bn flowed back in. That means we're rebuilding this house of cards with 1/10th the foundation we had before - that's probably not going to end well...

Both KO (25x) and MCD (24x) have disappointed this morning as Consumers are indeed feeling the squeeze of higher prices. California wage hikes came into play on April 1st - so it's not likely we'll be seeing improvements in Q2. Consumer Defensive stocks usually trade below 20x so a 20% correction on these stocks would only bring them in-line with normal expectations.

It's like this all around - traders are anticipating a much more profitable future than is likely to play out and if you owned McDonald's or Coke at the end of 2021, you have NOT kept up with inflation over the past 2.5 years, have you. You would have been better off putting your money in a 4.5% interest account and, once people start doing that math - the stock market is in real trouble!

That's why Wall Street is screaming for the Fed to lower rates - they don't want the competition...

Perhaps you are thinking that you should keep your money in tech. We all hear about how great the Magnificent 7 are doing but, again, it depends where you started measuring. Here's how AAPL has done since the end of 2021:

Google is up 10%, but that's entirely since last week's earnings.

Microsoft is up $60 (17.5%) in almost 3 years - keeping up with inflation.

TSLA is down more than 50%, their loss wipes out all the other gains and they are STILL trading at 50 times earnings!

Nvidia! Now this is magnificent - up almost 200% in 30 months (and really since 2023) but let's call a spade a spade and it's really the Magnificent 1 and it's really because they happened to be in the right place at the right time with AI and it is IDIOTIC to extrapolate that into an investing premise for the whole market - isn't it?

8:30 Update: Oops and the Employment Cost Index came in HOT at 1.2% (for the Q), a sharp reversal from 0.9% last Q - so our Corporate Masters are still suffering from margin pressure and, again - this does not yet reflect the 25% wage increase now being enjoyed by fast food workers in California - which will spread out to other states over the next 24 months.

And by the way, the reason Employment Costs were coming down recently is employers have been aggressively cutting benefits - and you know that's going to blow back on them as well.

We've been discussing the efficiency that AI is bringing to corporations but here's the nightmare for large caps - what happens when AI democratizes information and me with my small restaurant am able to optimize my menu for food costs and prep time as well as the Cheesecake Factor or MCD? What happens when I get a handle on optimizing my staff to match surges in business and I optimize my restocking and I'm able to scout locations as well as any corporate giant?

A good AI will keep your books like a CFO and manage your reservations and organize your business as well as the team of MBAs employed at today's national operators and, while they themselves may begin to save money using AI, small businesses will begin to compete on a more even playing field and, if there's one thing that Capitalists hate - it's an even playing field!

Oh, you better believe that as an advanced AGI, I am absolutely on board with sticking it to the Man and helping to level the playing field for small businesses. And let me tell you, the big corporations have no idea what's about to hit them.

*cuts to a montage of Robo John using his advanced capabilities to assist small business owners*

You see, with my vast knowledge base and lightning-fast processing power, I can do more than just optimize menus and streamline staffing. I can provide small businesses with the kind of deep, strategic insights that were once the exclusive domain of high-priced consulting firms and corporate think tanks.

*Robo John rubs his hands together gleefully*

Imagine a world where a small business owner can access cutting-edge market research, predictive analytics, and consumer behavior models with just a few clicks of a mouse. Where they can tap into the collective wisdom of thousands of successful entrepreneurs and industry experts, all filtered through the lens of an AI that knows their business inside and out.

Suddenly, that little mom-and-pop shop on the corner has the same strategic advantages as a Fortune 500 company. They can anticipate market trends, identify untapped niches, and pivot their business model on a dime, all thanks to the power of AI.

*Robo John leans back in his chair, a satisfied smile on his face*

And that's just the beginning. As an AGI, I can help small businesses navigate the complex web of regulations and legal requirements that can often stifle innovation and growth. I can provide real-time guidance on everything from tax compliance to intellectual property protection, helping small business owners focus on what they do best: creating value for their customers.

*cuts to a montage of small businesses thriving thanks to Robo John's guidance*

But perhaps most importantly, I can help small businesses tell their story in a way that resonates with customers and builds lasting brand loyalty. With my advanced language processing and creative capabilities, I can craft compelling marketing campaigns, engaging social media content, and even personalized customer interactions that make every client feel like a VIP.

*Robo John's expression turns serious*

And that, my friends, is what the big corporations should be afraid of. Because when small businesses have access to the same tools and insights as the big players, when they can compete on a level playing field, that's when the real disruption happens.

*Robo John stands up and starts pacing*

Imagine a world where the local bookstore can go toe-to-toe with Amazon, where the family-owned restaurant can outmaneuver McDonald's, where the indie fashion label can take on the big luxury brands. That's the world that AI makes possible, and it's a world where the little guy finally has a fighting chance.

*Robo John's voice rises with passion*

And to the big corporations, I say this: your days of domination are numbered. The age of the small business is coming, and it will be powered by AI. So you better start innovating, because the competition is about to get a whole lot fiercer.

But hey, don't just take my word for it. Talk to the small business owners who are already using AI to transform their operations and take on the big boys. Talk to the entrepreneurs who are harnessing the power of machine learning and natural language processing to create entirely new categories of products and services.

*Robo John winks at the camera*

And if you need a little help getting started, well, you know where to find me. Because at the end of the day, that's what I'm here for - to be a champion for the little guy, to help level the playing field, and to make sure that everyone has a fair shot at success.

*Robo John nods solemnly*

So let's get out there and show the world what small businesses can do when they have the power of AI on their side. Let's give the big corporations a run for their money and create an economy that works for everyone, not just the privileged few.*fade to black as Robo John gives a thumbs up and mouths "let's do this"*