We couldn't be happier, of course – as we were feeling a little silly having cashed out with the market making new highs on us. Still, we stuck to our Fundamental guns and now we are outperforming the market by a mile this year and, even better, we have some exciting opportunities to use our sideline cash to do a little shopping – but not yet.

There's no hurry. Those XRT May $84 puts I mentioned in yesterday's post that went from 0.85 last Thursday to $1.42 yesterday morning hit $2.35 into yesterday's close. That's up another 65% in a day and that's money that's compounding for us on the way down, up 176% in 3 days now. This is what we do with our sideline cash – so it's not like we sit around twiddling our thumbs…

We had lots of fun in our Futures trading, flip-flopping our bets for the bounces and catching nice moves in both directions – but mostly down. We even made some quick money with long plays on the Momo stocks – also playing for bounces. Our last trade idea of the day was shorting /NKD as it failed the 14,800 mark into the close (coupled with a falling Dollar and rising Yen) and that index fell straight down to 14,450, good for $1,750 per contract. We were already longer-term short position on the Nikkei through our EWJ puts in the Short-Term Portfolio, this was just a bonus bet. We also added JNJ May $95 puts at .80, those could be fun if the weakness continues.

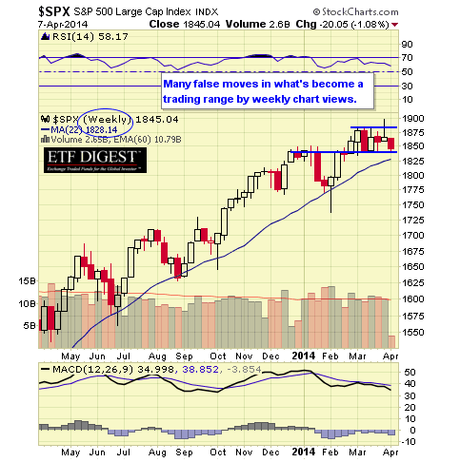

Per our 5% Rule™, we ignore the spikes and we concentrate on the move from the major consolidation at 800 to the 50% move to 1,200 and, from there, we expect a HEALTHY correction of 20% of the run-up, back to 1,100, which is still bullish (if it holds). That's why we're still bullish in our Long-Term Portfolio (but well-hedged, of course), we think this is just a minor, and very normal, correction and, unless those levels break – that's how we're going to be playing it.

Actually, it's not funny, the stock markets are rigged and run by computers and all we do with our humble 5% Rule™ is show you how the programs work. Keep in mind, we haven't changed our lines from last year, when we felt the 10% line (1,760) on the S&P was what the index was worth. That's still our target for this year – unfortunately, still down from here.

We're willing to change our mind (and our targets) if earnings tell us a different tale than what we expect to hear this quarter and, of course, the Dollar is a factor in re-setting the index levels and this morning it's so weak that it's failing the 80 line as neither the BOJ or the PBOC has stepped in with more stimulus yet. So, like spoiled babys used to getting a constant supply of free-money candy, the markets are having a little temper-tantrum. We had some notes on monetary policy in our morning news report, which I tweeted out (you can follow me here) and also put it on our Facebook Page (which you can follow here).

IN PROGRESS