The S&P came within inches of making a new all-time high and the Nasdaq made their new 13-year high while the Dow, NYSE and Nasdaq also reach for the skies in what David Stockman calls:

"The kind of speculative froth you get at the top of a cycle where valuation loses any anchor in the real world; from earnings or the prospects of the economy."

Well, Jimmy Crack Corn and we're in cash (so we don't care) but just yesterday, both Bullard and Fisher from the Fed said tapering is on the table at next week's meeting (but Fisher always says this) and,. more notably, Gov Lacker also said it would be discussed. Discussion is not action but we may be getting close.

While the official unemployment reports have us down to 7%, the chart on the left from Zero Hedge gives you a much better idea of what's going on in the real World. The number of employees actually working at the 2,000 companies that make up the Russell has dropped by 50% since 2007 and has made little, if any recovery since bottoming out in 2011.

While the official unemployment reports have us down to 7%, the chart on the left from Zero Hedge gives you a much better idea of what's going on in the real World. The number of employees actually working at the 2,000 companies that make up the Russell has dropped by 50% since 2007 and has made little, if any recovery since bottoming out in 2011.

The index, however, is up 169% since the 2008 low so the message to corporate America is clearly to cut the dead weight (employees) and don't go back to the old ways. "America's Economy is Officially Inside-Out" says the Harvard Business Review, with the top 1% making 95% of the gains in this so-called recovery. According to HRB: "The plain fact is that the average household is poorer in the “recovery” than during the “recession.”

When growth rises and living standards fall, that begins to hint that there is something wrong—very wrong, perhaps terribly wrong—with the way things are. It suggest that what is happening to this society is not merely a simple, passing, self-healing ailment; but a chronic, possibly permanent, definitely debilitating condition. Not a flu—but a cancer.

Again, cash, don't care. As I've mentioned, our Short-Term Portfolio is marked for bear but this weekend we looked at more upside plays that we can fiddle with above the key "support" lines at Dow 16,000, S&P 1,800, Nasdaq 4,000, NYSE 10,000 and Russell 1,100. In fact, the Russell dropped 5 points yesterday but was bought back the full 5 points to print 1,130 at the bell so, don't worry, everything is fine (with the manipulation machines).

Again, cash, don't care. As I've mentioned, our Short-Term Portfolio is marked for bear but this weekend we looked at more upside plays that we can fiddle with above the key "support" lines at Dow 16,000, S&P 1,800, Nasdaq 4,000, NYSE 10,000 and Russell 1,100. In fact, the Russell dropped 5 points yesterday but was bought back the full 5 points to print 1,130 at the bell so, don't worry, everything is fine (with the manipulation machines).

As noted on Dave Fry's SPY chart for the day, the volume was so low that a few thousand shares here or there could have run the index up and down a few points. That's why we ignore Mondays and likely why we'll ignore almost everything that goes on between now and January 6th, when people get back to work (those few that still have jobs!).

Anyway, as I mentioned, there are so many ways to make good money in a manipulated market like this. In fact, the 10 QQQ March $83/88 bull call spreads offset by a single AAPL 2015 $450 short put that was net $430 on Friday, when I reviewed our bullish trade ideas, finished the day at $610, up 42% in a day. Sure, that's totally normal, this is how people make money all the time. No wonder the top 1% have made 19x more money than the bottom 99% during this recovery!

The AAPL 2016 $450/600 bull call spread, offset with the $400 puts were $41.60 on Friday and finished the day yesterday at $68.95 because the VIX dropped like a rock and our strategy of BEING THE HOUSE and selling premium does very wekk in aggressive premium-selling trades like that when the price of premium drops significantly (VIX down 10%, back at 13.50). This is how the rich get richer folks, you either play the game or you get left behind wiith the rest of the 99%.

We'll discuss more of these Trade Ideas in today's Webinar, at 2pm – so be sure to sign up for the fun!

Why then, do I prefer cash when there is so much money to be made? Because, at this point in a bubble, it can all be taken away from you just as quickly, and the minute you lose site of that you are in BIG TROUBLE! My question to you is, if you can make 20%, 40%, 50% on short-term trades like these, why leave anything on the table? Make a trade, make your money and get back to cash. Don't stay at the table and play until you give it all back!

If you'd rather not hear it, then DON'T watch our Webinar today, because it's very likely I'll be spending some time on that subject. I know it's not good business to invite people to a market seminar and tell them not to play the market, nor is it good to call attention to the fact that playing the market is no different from gambling but it is good to teach people to BE THE HOUSE, Not the Gambler – and THAT is what our mission is at Philstockworld.

Speaking of gambling, we are shorting the Dow Futures (/YM) at the 16,000 line and the Russell Futures (/TF) at 1,130, with tight stops above those lines. You can add oil shorts (/CL) at $98.50 and, as I mentioned, we already have short ETF trades on all of those in our virtual Short-Term Portfolio, which we keep in our Member Chat Room.

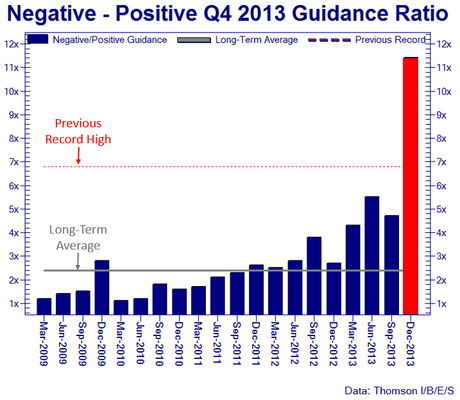

Keep in mind we are FUNDAMENTAL investors, so we don't really give a damn what the charts say. What we do care about are hum-drum things like EARNINGS and, as you can see from this chart, they are NOT going to be good in January unless the 11.5 times more companies that have guded negative are all wrong and the 1x companies that guided positive have underestimated by a mile.

Keep in mind we are FUNDAMENTAL investors, so we don't really give a damn what the charts say. What we do care about are hum-drum things like EARNINGS and, as you can see from this chart, they are NOT going to be good in January unless the 11.5 times more companies that have guded negative are all wrong and the 1x companies that guided positive have underestimated by a mile.

As you can see, this is the worst guidance we've had in many years, and worst by a factor of 2, not just "a little bit worse." We picked up on this during November earnings and that's why, since Thanksgiving, my mantra to our subcribers has been cash, Cash, CASH!

PBY shares are going to open down more than 10% as their late Q3 report showed a 2.8% decline in comp sales with revenues off 0.5% from last year. PBY, just like any random stock, is up 35% for the year and, at some point, stocks need to actually justify those kinds of valuations. Negative growth just isn't going to cut it. PVH, who manufacture Tommy Hilfiger and Calvin Klein, just lowered Q4 guidance and our PSW Holiday Shopping Survey wasn't seeing good retail traffic and now (a week later) official channel checks are seeing weakness as well.

![Technical Tuesday – Nasdaq Making New Highs, Will The Other Indexes Join? NRF Retail Sales Growth 2003 2013 Jan2013 Retail Sales Growth, 2003 2013 [CHART]](https://m5.paperblog.com/i/74/742643/technical-tuesday-nasdaq-making-new-highs-wil-L-dwcxow.png) The ICSC Retail Store Sales Report came out this morning and sales were DOWN 1.6% this week after being DOWN 2.8% last week and that has brought the year-over-year numbers down to +1.5% from 2.5% last week. Redbook Sales (chain stores) are up 2.6% y/y vs +4.9% last week – also falling off a cliff. When exactly are these shoppers going to be showing up?

The ICSC Retail Store Sales Report came out this morning and sales were DOWN 1.6% this week after being DOWN 2.8% last week and that has brought the year-over-year numbers down to +1.5% from 2.5% last week. Redbook Sales (chain stores) are up 2.6% y/y vs +4.9% last week – also falling off a cliff. When exactly are these shoppers going to be showing up?

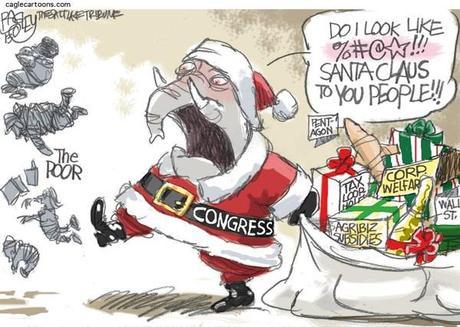

Again, FUNDAMENTALS, this is why we didn't like the GDP report that was only "good" due to a massive build in inventories (ie. unsold goods). Today is the 10th, 2 weeks until Christmas Eve – perhaps it ain't over until the Fat Man sings but something better happen soon or this whole holiday season could end up a bust.

Why should this be a surprise though? We KNOW the bottom 99% aren't benefiting from this recovery, especially those in the bottom 80%, who are actually WORSE off today than they were in 2009. They are rioting in Europe, they are rioting in Asia, they are not shopping in America (retailers would rather they riot!). If you don't pay people enough money to pay their bills, there's not a whole lot left over for shopping, is there?

Why should this be a surprise though? We KNOW the bottom 99% aren't benefiting from this recovery, especially those in the bottom 80%, who are actually WORSE off today than they were in 2009. They are rioting in Europe, they are rioting in Asia, they are not shopping in America (retailers would rather they riot!). If you don't pay people enough money to pay their bills, there's not a whole lot left over for shopping, is there?

David Stockman says "Valuation has Lost any Anchor to the Real World" and Zero Hedge has "37 Reasons Why the Economic Recovery of 2013 is a Giant Lie" so let's leave it at that – I've already said all that I need to on the subject. We know how to make the easy money on the upside and we're positioned to make the hard money on the way back down but CASH is still king if you want to have a happy holiday.

I promise they'll still be manipulating the market next year!