4,350 or bust!

That's the game for the S&P 500 this week but we're expecting the bust though raising the debt ceiling may buy us a week and passing the infrastructure bill may buy us a whole quarter before the inevitble correction completes itself. So far, nothing has stopped us from moving down to our strong retrace line at 4,230, which is our next stop, if there is no intervention but, for the day, we're looking for a bounce back to 4,350, which is the strong bounce line off 4,230 – a fall we haven't even taken yet.

Very simply, per our 5% Rule™, if you fail to bounce over the bounce line for a level you haven't even fallen to yet – then you'll be seeing that level pretty soon! That's how the failure at 4,440 tipped us off that we were going to make our next leg down last week and now, we're HOPING to bounce to a point almost 100 points below that or 4,230 – here we come!

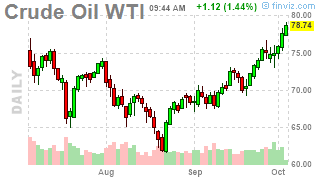

Oil is at a 7-year high as OPEC wrapped up their meeting yesterday sticking with their slow, steady, 400,000 barrels per day increase in production for November, shrugging off pressure to move faster as oil markets around the World tighten up and supplies in Europe run short. Europe is the wild-card as a natural gas shortage has caused more industrials to switch to oil and that's the only reason demand is up – nothing to do with an overall increase in demand which GS and other Manipulators are claiming is giving us a new paradigm.

Not only that but US production has not come back yet as we're currently producing an average of 11.12Mbd in 2021 vs 12.3Mbd in 2019 so that's 1.2Mbd or 8.4Mb less EVERY WEEK of US production – THAT is why our stocks are down 80M barrels from last year's level – because we produced 336M barrels LESS US oil than we did in the first 40 weeks of 2019 – NOT because of OPEC and NOT because of a surge in demand.

Since we are capable of producing 436M more barrels in a year and OPEC is capable of producting over 1 BILLION more barrels per year (by simply turning on the taps) THERE IS NO SHORTAGE OF OIL so how can you say demand is outstripping supply when supply is artificially constrained?

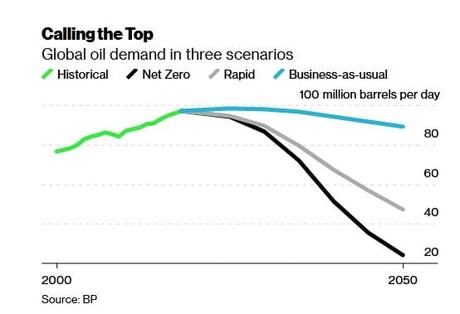

That's why the Oil Futures for next July are still at $73, just 10% above it's usual peak at $68, even though the current price of oil is now 30% above the August lows ($60). Not only that but look at all the car companies who are announcing electric fleets, not to mention the Global crack-down on carbon emissions that is even happening in China and India and, dare we say it? – for the first time in 4 years – EVEN IN THE USA!

10Bn less barrels of gasoline per year is 27M barrels per day or about 1/4 of current global consumption gone in 20 years. It will be a slow burn for the first 10 years bit. after that, nothing but pain for the oil industry as autos aren't the only place where oil consumption will be sharply reduced. That is the future of oil – not record demand as the idiots from Goldman Sachs would have you believe.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!