We didn't even get a proper shoulder for the "head and shoulders" pattern I told you we were going to form last Tuesday. As usual, I can only tell you what is going to happen in the future – what you do with that information is entirely up to you…

Yesterday, for example, right in the morning post, I told you that the Russell Futures (/TF) made a good short at the 1,130 line and they finished the day at 1,090 for a $4,000 per contract gain. That was right in the morning post – a FREE trade idea (you can sign up to get our EMailed Newsletter every morning HERE).

In our Member Chat, right at the opening bell, I called for shorting the Oil Futures (/CL) at $97.50 and those were good for a $1,000 per contract gain and that was in addition to our normal Conviction Short Trade Idea at $97.95, whcih was good for $1,495 per contract – our 3rd big win in a week and also noted FOR FREE in last Friday's post – so don't say I never give you anything. In fact, if you were reading our morning post on November 20th, you would have caught this trade idea as well (FOR FREE):

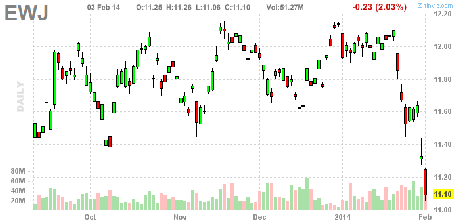

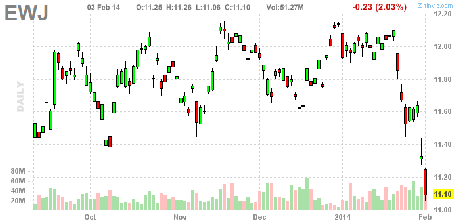

I like EWJ March $11 puts at .17 – 100 in the STP for $1,700 can turn into $5,000 on a $1 pullback (not even 10%) between now and then and we can pull 1/2 at .34 and have a free ride on the rest.

Even if you missed the first chance to take a quick 1/2 off the table for a 100% gain, the March $11 puts are back to .34 and we're done with this trade as 100% is a good return on investment for 3 months, don't you think? In Member Chat, we played it more aggressively and doubled down on the move up and flipped to June puts but essentially the same result – a huge winner based on our simple but lonely premise (at the time) that the Global Rally could not be sustained into January earnings.

That 11/20 post, titled "Weak Dollar Wednesday – Bernanke's Grand Delusion" laid out my bearish premise for going to cash into the Holidays and waiting until we hit a bottom after earnings to go shopping with our lovely, lovely CASH!!! Not only have stocks now gotten 5% cheaper (at least) but our cash has gotten 2% more valuable while we waited – a good deal all around!

That 11/20 post, titled "Weak Dollar Wednesday – Bernanke's Grand Delusion" laid out my bearish premise for going to cash into the Holidays and waiting until we hit a bottom after earnings to go shopping with our lovely, lovely CASH!!! Not only have stocks now gotten 5% cheaper (at least) but our cash has gotten 2% more valuable while we waited – a good deal all around!

We did a little bit of bottom-fishing last week, as I sent out 2 Alerts to our Members last Wednesday with a small shopping list of companies we felt comfortable adding positions to and today, in our live Weekly Webcast (1pm EST), we'll look at additional potential deals that we just can't pass up.

Since we always buy our stocks at 15-20% discounts, we're not afraid to be a little early with our bottom calls. We don't think the market is heading down 20% – 10% should do it – roughly the 15,000 line on the Dow, 1,665 on the S&P, 3,800 on the Nasdaq, 9,400 on the NYSE and 1,060 on the Russell (charts by Dave Fry).

That's our worst case and, in between, we will look for support as the weak (+2%) and strong (+4%) bounce lines, which are:

That's our worst case and, in between, we will look for support as the weak (+2%) and strong (+4%) bounce lines, which are:

- Dow 15,300 (weak) and 15,600 (strong)

- S&P 1,700 and 1,735

- Nasdaq 3,875 and 3,950

- NYSE 9,600 and 9,800

- Russell 1,080 and 1,100

So, we have 3 of 5 red but, keep in mind, we're on the way down, not bouncing. The Dow's low was 15,350 yesterday but the S&P held 1,740, Nasdaq wasn't even close, despite a 100-point drop, NYSE bottomed out at 9,732 and the Russell hit 1,090. On the way down to a 5% or 10% correction, we expect our bounce lines to provide some support – it's what happens the next day that matters – a lot!

In absence of more bad news, we're playing for the bounce this morning (we took a long on Oil (/CL) at $96.50 and we'll go long on the Russell (/TF) over 1,100 – with tight stops. There's USUALLY a bounce on the way down – it's the strength of the bounce we pay attention to, as well as the volume behind it.

In absence of more bad news, we're playing for the bounce this morning (we took a long on Oil (/CL) at $96.50 and we'll go long on the Russell (/TF) over 1,100 – with tight stops. There's USUALLY a bounce on the way down – it's the strength of the bounce we pay attention to, as well as the volume behind it.

Like yesterday morning, we were not fooled by the low-volume run-up in the Futures, and that kept us short, but I also said, right in the title, that the whole day was meaningless so it's very possible that that WAS the blow-off bottom to a 5% correction – we will strive to keep an open mind as we gather more evidence.

There was nothing shocking in this morning's news round-up and earnings are not so bad, so far. By the end of the week, about half the companies will have reported and we'll have a pretty good picture of how things are shaping up in various sectors. We'll then have to factor in how much of a go-forward drag Emerging Markets, Japan and the EU are going to be on the US's undeniable, but also uninspiring, early-stage recovery.