TaxJar is a reliable value-added tax solution for busy online sellers that automates the calculation of sales taxes, reports, and tax returns. The platform removes the lengthy tasks of the tax compliance cycle and allows you to focus more on your business.

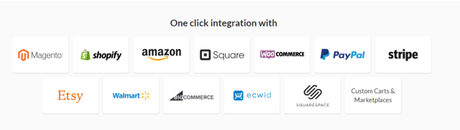

TaxJar provides a one-click connection to the places where you sell. Whether on Amazon, Etsy, Square, Magento, Stripe,

In addition, TaxJar offers a variety of features, including automatic sync with e-commerce channels and shopping carts, reusable reports, cross-platform support, and local and regional tax reporting, bottom and bottom collection, and support for SmartCalcs API and CSV.

TaxJar Review January 2019 Coupon Codes: Save 40% on Yearly Plans (Special Free Trial)

TaxJar Review January 2019: Online Sales Tax Preparation & Filing Software

About TaxJar

TaxJar is the leading technology for e-commerce companies of all sizes in sales tax administration and enjoys the trust of more than 15,000 companies. Founded to help merchants and developers spend less time on sales tax and more time growing businesses that love them.

We offer TaxJar reports, an online reporting application that aggregates VAT data in reports that can be returned by the state. AutoFile, a service that automatically archives your returns, a RESTful API that allows you to perform real-time calculations.

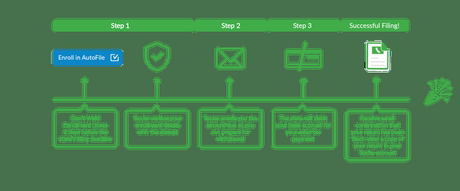

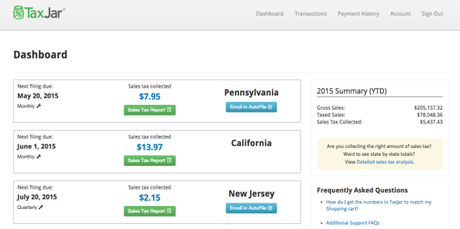

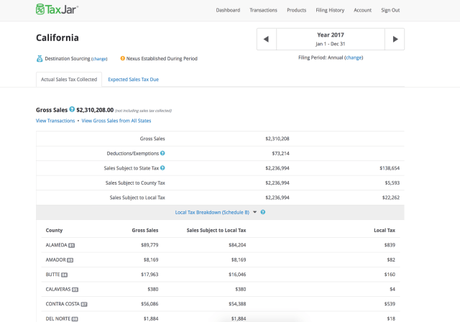

TaxJar has an excellent ability to automate the submission of revenue and reporting taxes to e-commerce merchants with multiple channels. The platform allows you to connect all your baskets online once, and all data is downloaded to facilitate the presentation of sales tax. Consolidate information from all your sales channels in one central, easy-to-access Dashboard. A notable feature of TaxJar is Autoarchivo, a reliable electronic filling solution for sales tax. This feature gathers data from all e-commerce markets and vendors to prepare and submit returns and their payments. The AutoFile service eliminates the need for an online presentation of documents or forms. TaxJar performs all tasks on your behalf. With this solution, you no longer have to worry about due dates, late returns or timely tax returns for multiple payment dates. In addition, Taxjar is a valuable asset, whether you work with CPA experts or not. Most customers who work with this platform have a CPA. However, it is very logical that they use it because it saves time and it is very useful to file VAT returns. In addition, TaxJar provides an outstanding customer service that can manage trusted data. Your customer service is available by phone and e-mail. In addition, the program provides a wealth of useful resources that enable customers to understand aspects of sales tax. Resources include State Tax Guide, VAT Webinars, TaxJar Blog, Sales Tax Calculator, State Register, and Home Guides.

TaxJar Key Features

How Does TaxJar Work?

What I like about TaxJar is the ease of use!! The first time you register, you must link your seller account. For Amazon, TaxJar gives you clear and detailed instructions to give TaxJar the right permissions to function properly. When used with Amazon, TaxJar also supports a variety of other e-commerce platforms. These include Shopify, Paypal, WooCommerce, Stripe and more. If the platform you choose is not compatible, you can also try to import your sales data via the CSV file. Once TaxJar has recorded your account information, you can see how much you owe the different status of your dashboard.

- States in which TaxJar is automatically transmitted by you.

- States that manually charge sales taxes and fees.

- Conditions in which you can have a link, but do not collect.

The third category is the one you absolutely must consider. Amazon can store inventories in new state warehouses, creating a link to sales tax at all times. As soon as you notice a new status in this list, you know that it is time to continue with the registration of a new license.

Pros and Cons of Taxjar

Pros:- Its blog is full of helpful sales tax information.

- Can now autofill your sales tax for every state.

- Helpful FB group is available that will answer your sales tax questions.

- Track of all your sales tax information in one place.

- Easily connect to the places where you sell your product.

- Enroll in AutoFile.

- Relatively expensive for large sellers.

Popular integrations

When choosing an Amazon tool, it's important that the software is integrated with other applications currently used by your company. Here is a list of some popular TaxJar integrations:

How Much Does TaxJar Cost?

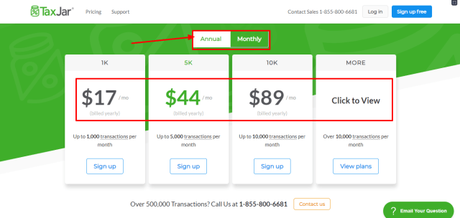

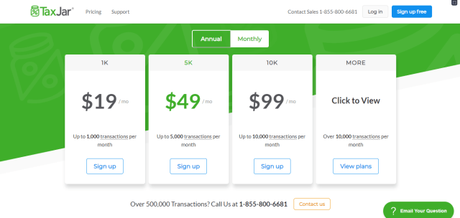

TaxJar Pricing Plans: : TaxJar Coupon Codes Save 40% Yearly Plans (Special)Taxjar also gives a free sign up and 30-day free trial with no credit card required for it.

Click Here to know about more pricing plans

TaxJar offers various pricing plans for users to choose from. Here are the details a look, and choose the most suitable plan for your business:

Basic plan - $19/month- Up to 1000 transaction per month

- Auto-sync with e-commerce channels and shopping cart

- Return ready sales tax reports

- State and local sales tax report

- Support shipping taxability

- Support destination and origin-based sales tax sourcing

- Everything in the basic plan plus

- Up to 5000 transactional/month

- Everything in Basic plan plus

- Up to 10000 transactions per month

- Everything in Basic plan plus

- Over 50000 transaction/month