This post was inspired and sponsored by InsureUonline.org, a site that strives to educate twentysomethings about insurance. All views, stories and suggestions are my own. Read on for some funny confessions and for the chance to win the InsureU FAIL sweepstakes!

It’s been an interesting few months for me as far as insurance goes. I know it sounds like the lamest topic ever, but unfortunately it’s one that affects all of us.

Where do I begin?

Well, let’s start at the beginning AKA before I realized insurance was important. My first apartment in Chicago’s beautiful Gold Coast neighborhood was not even a little bit beautiful. So naturally, being 23, I didn’t find it necessary to get renters insurance.

Here’s an excerpt from one of my favorite blog posts called “Reality and the City” which I wrote in 2010:

My first apartment was an interesting one. Everything seemed OK at first (other than the fact that my bed barely fit in my room) until a pungent scent of mold started infiltrated our 800-square-foot two-bedroom apartment. I’m talking a freshman-year boys dorm + mold smell. My own mother wouldn’t even come in when she visited.

After the smell came the bugs. After several rounds of treatment by exterminators, the bugs were still there. I didn’t realize African safaris existed in Chicago’s Gold Coast neighborhood, but I was wrong. Oh, and there are also typhoons here. Such as the one that came from my upstairs neighbor who left his kitchen sink on before going out of town for a week. One night, I walked into my room to find a huge rush of water coming out of the ceiling. It ruined my bed and put me out of a room for two weeks until the ceiling was repaired. I guess that’s what you get for paying $700 each for rent in Chicago.

I purchased renters insurance immediately after becoming temporarily “homeless” and have had it ever since.

In fact, if you continue reading that old post you’ll realize that God was apparently trying to teach me an important lesson about all kinds of insurance throughout my first year or so in Chicago… My car windows got bashed in my first Monday morning as a Chicago resident. My car was constantly vandalized thereafter and in need of repairs. Thank God for car insurance.

Or the time that I feared a lawsuit (and prayed my insurance would pay the brunt of my sins) after I hit a man with my car, knocking him out of his wheelchair…

One morning on my way to work, I pulled out of my parking garage only to hit a man in a wheelchair. He fell out of his chair. I thought I had killed him.

I happened to be really decked out that day for an event I was attending after work, which for some reason only made me feel and look that much dumber. How stereotypical that a done-up blonde girl in a cute skirt suit, huge Chanel sunglasses and a flashy red luxury car would hit a man in a wheelchair. Ugh.

I obviously wasn’t strong enough to pull him back up into his chair in my heels, so luckily two men came by and got him back into it- all the while scowling and cursing under their breath at me.

I apologized and gave the victim my hot pink Ms. Career Girl card. I figured a law suit was on its way to my inbox.

Instead, the guy called my phone that night to let me know he was ok and asked if I’d like to go out sometime…

That is a true story.

My runins with insurance have continued over the years.

In September, I talked a police officer out of giving me a ticket two days before my wedding: “I really, really needed my ID to go on my honeymoon to Hawaii. Anndddd… my future husband would kill me if our insurance rates went up!” In attempt to give something back after my pleas, I said: “I’ve been stuffing gift bags for hours – would you like one? They’re right here in the back with the pink tissue paper.”

I got off with a warning and a cold stare after asking the officer for last-minute marital advice. He had none.

This Thanksgiving, the hubby was on his way to pick me up from work when he hit a gorgeous Mercedes and bent its axle and wheel, smashed in our bumper and delayed our trip to Michigan for three hours.

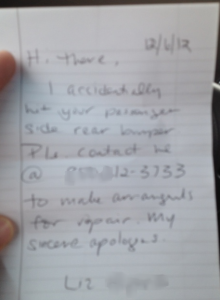

A week later, he received a note from a woman who hit our rental car in the parking lot…

Thanks again insurance…

One of my least favorite insurance moments was after I got laid off and had to figure out how to get my own, independent health insurance. Yuck.

And, on to this week – open enrollment period at my new job – when I had to think very hard about buying short-term disability insurance in case I ever have a baby and need more maternity leave not covered by small businesses. I also purchased long-term disability and life insurance this week for the first time in my life. If something were to happen, I wouldn’t feel right not having a way for one of us to pay the bills.

What’s the point of me writing about insurance?

Yes, a few funny things have happened to me along the way. These types of things aren’t always funny though. When funds are tight after graduation, it’s easy to think that these types of accidents won’t happen to you. It’s also easy to get overwhelmed by all the options and just avoid protecting yourself all together.

Last week one of my Twitter friends emailed me about a site called InsureU. And no, this site isn’t trying to sell you anything! Rather, InsureU’s mission is to educate other twentysomethings about insurance options that I learned about the hard way. I’m letting you know about this because I think it’s important.

InsureU is holding a Sweepstakes for chances to win the Ultimate Apartment Safety Kit. I encourage each of you to enter!

Enter by clicking on the picture below!

The folks at InsureU realize insurance isn’t always top of mind for twentysomethings, so to make it more interesting, they created 10 really fun “Life Lessons cards” about all types of insurance-related situations. I featured some of my favorites throughout this post, but there are others that might speak more to you. I challenge you to check out all 10 cards, Pin them and/or share one or more on Facebook.

Everyone who comments back to this post with a thought or to share their insurance story will be entered in a drawing to win an Ultimate Apartment Safety Kit, filled with items to help keep your apartment (or home) safer. It includes items such as as wireless door and window alarms, glass breakage alarms, a mini safe that looks like a jar of rice, and more. The kit is worth $120! Comment by 12/31/12 for the chance to win.