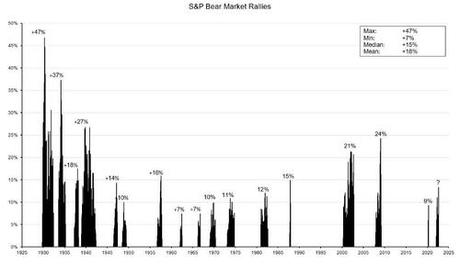

While the S&P 500's rebound since mid-June has been impressive, it's within the historical norm of a bear market rally.

Since the 1920s, the trough-to-peak rally in a bear market averaged about 18%, as noted by Nick Reece, strategist at Merk Investments. But the post-WWII average was only 13%, which is exactly where we are right now.

Part of the recent stock gains were driven by short covering from extremely negative positions and sentiments, and better-than-expected earnings. It also helped that rate volatility has died down a bit. Ironically, the stock rally has eased financial conditions, which is counterproductive for the Fed's campaign to cool inflation.