![Stimulation or Stagnation? Fed Stimulus [courtesy Google Images]](https://m5.paperblog.com/i/72/721063/stimulation-or-stagnation-L-FJp2Hx.jpeg)

Fed Stimulus

[courtesy Google Images]

Since A.D. 2008, the Federal Reserve has paid $2 trillion dollars into the economy in order to: avoid a recession or depression, inflate the money supply, and thereby “stimulate” the economy back to recovery and robust health. Strangely, while that $2 trillion has apparently prevented an economic depression, it hasn’t caused an economic recovery. Despite the added $2 trillion, our economy is more-or-less right where it was back about A.D. 2008.

The Fed didn’t get much bang for its bucks.

What happened?

How could $2 trillion in “stimulus” cause in so little stimulation?

The Elliot Wave article explained, in part, that the Fed’s $2 trillion was paid to Wall Street banks in return for “toxic assets” previously held by the banks. The banks were supposed to lend that $2 trillion to customers and thereby stimulate the economy. However, the American public didn’t want to go deeper into debt, refused to borrow that currency, and so the $2 trillion (most of it) simply sat in the bank vaults, leaving the economy largely “un-stimulated”.

I don’t doubt that public reluctance to go deeper into debt after A.D.2008 was at least part of the reason we’ve not yet seen significant inflation or an economic recovery. The banks can’t make the public borrow. But I suspect there may be another reason that, so far, has been generally overlooked: Maybe the Wall Street banks couldn’t lend the $2 trillion to the public.

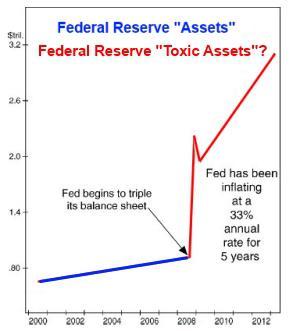

My suspicion was spawned by a chart provided in the Elliot Wave Theorist article that illustrated the sudden and remarkable post-2008 growth in value of assets carried on the Fed’s “balance sheet” . The Elliot Wave chart was similar to this one:

However, the Elliot Wave chart had no color. It treated all of the Fed’s “assets”—both before A.D. 2008 and after—as of equal quality and value. It didn’t distinguish between the “assets” owned by the Fed before A.D. 2008, and the “toxic assets” purchased by the Fed after A.D. 2008.

As you can see, the Fed’s assets increased slowly from around $600 billion in A.D. 2000 to $900 billion in A.D. 2008. Then, based on the economic crisis of A.D. 2008, the Fed started to increase its assets at an astonishing rate, rising from $900 billion in 2008 to over $2 trillion in early 2009, and then continuing to purchase more “assets” until the Fed’s balance sheet is, today, around $3.2 trillion. The Fed’s balance sheet jumped from $900 billion to $3.2 trillion in just five years.

Based on this post-2008 growth, the Elliot Wave article declared that the “Fed has been inflating at a 33% annual rate for 5 years.” By buying these $2 trillion in “toxic assets,” it’s believed that the Fed added an additional $2 trillion in cash to the money supply. This additional $2 trillion should’ve caused significant inflation and also stimulated the economy.

Therefore,

“The main reason investors are expecting runaway inflation is illustrated in [the chart above], which shows the value of assets held at the Federal Reserve.”

But does the chart really show the “value” of Federal Reserve’s “assets”? Or does it only show the “price paid” for those assets?

The Elliot Wave chart is based on the presumption that the $2 trillion price paid by the Fed for “assets” purchased since A.D. 2008 equates to those assets’ current free-market value.

But is that presumption true?

I don’t think so since the post-2008 growth in the Fed’s balance sheet has been achieved in large measure by purchasing “toxic assets” like mortgage-backed securities and US Bonds. I suspect that in order to maintain the illusion that these “toxic assets” were still valuable, the Fed paid full (or nearly full) face price for “toxic assets” even though their true, free-market value might be 20% to 90% less.

I suspect that the Fed’s $3.2 trillion “balance sheet” reflects the price paid rather than the current free market value of whatever “toxic assets” were purchased. If my suspicions are correct, it’s possible that, although the Fed’s current balance sheet is “priced” at $3.2 trillion, its real, free market value might be closer to $1.4 trillion. If so, the real value of the Fed’s balance sheet might be less than half of what’s currently claimed.

Based on the assumption that the value of all the “assets” on the Fed’s balance sheet equates to whatever price the Fed paid for them, the Elliot Wave article continued,

“The Fed has been inflating the supply of dollars at a stunning 33% annual rate over the past five years. . . . [N]o wonder investors expect inflation and have aggressively positioned for it.”

But has the Fed truly been inflating the supply of dollars by 33% per year? I’m not convinced.

It’s not enough to merely print $2 trillion in “extra” currency and then squirrel it away in a bank vault. If that currency is going to cause inflation (and economic stimulus) that currency has to actually enter into circulation in the free market.

More, what’s the real effect of printing additional money that’s used to pay full price for securities that may have lost 90% of their value? Is the Fed really adding to the money supply if it prints an extra $2 trillion (cash) that’ll be used to buy $2 trillion (face value) in “toxic assets” that are now worth, say, only $200 billion?

These questions are especially interesting because, once purchased, the “toxic assets” are then taken out of the free market and squirreled away in some Federal Reserve hidey hole.

● In broad strokes, I suspect that what happened may have been something like this:

The total money supply in A.D. 2007 was, say, $10 trillion (again, a purely hypothetical and arbitrary number chosen only to illustrate a theory). That money supply included not only cash and checking account deposits but also other paper “assets” such as mortgage-backed securities and US bonds.

Under fractional reserve banking, many of these paper assets were held in bank vaults as collateral to justify lending ten times as much to US and foreign consumers so as to keep the US and global economies humming.

To illustrate, let’s suppose that out of the fundamental money supply of $10 trillion, there was $4 trillion held in the banks as collateral sufficient to justify the banks’ creation and lending of as much as an additional $40 trillion into the US and global economies.

But let’s suppose that in A.D. 2008, about $2 trillion of the $4 trillion in “assets” held by the banks were suddenly valued at only $200 billion—in large part because of mass defaults on the mortgages underlying “mortgage-backed securities”. Since their face value had plunged from $2 trillion to, say, $200 billion (90% loss), these former “paper assets” were now deemed “toxic assets”.

Why “toxic”? Perhaps because they were owned by banks and used as collateral for fractional reserve banking loans.

If so, when the $2 trillion in “paper assets” (that had already justified the creation and loan of $20 trillion into the US and global economies) became “toxic assets” worth only $200 billion, they could no longer justify the previous creation and loan of $20 trillion into the economies.

This implies that the previous “assets” were labeled “toxic assets” because they might force the recall of most of the $20 trillion in previously “created” and loaned currency into the economy. A call-in of $20 trillion in loans would almost certainly collapse the US and global economies.

If so, the banks holding the most “toxic assets” became “too big to fail”. (That’s an interesting possibility because, if true, it indicates that the “too big to fail” banks are also the banks that were sufficiently greedy and stupid to buy all those toxic assets in the first place. The competent banks that didn’t buy many “toxic assets” received nothing from the Fed. Only those banks that went overboard buying trash (“toxic assets”), received Fed assistance. Thus, the Fed may be using Quantitative Easing to subsidize America’s largest and most dangerously incompetent banks.)

In order to prevent the “toxic assets” from precipitating an economic collapse, the Federal Reserve offered to purchase “toxic assets” (now, worth only $200 billion) for all or most of their original face value of $2 trillion. By replacing their $2 trillion (face value) in toxic assets with $2 trillion in Federal Reserve Notes (cash), the banks once again had sufficient “paper assets” in their vaults to justify the $20 trillion they’d previously loaned out.

Result? By swapping $2 trillion in cash for $2 trillion (face value) in “toxic assets,” the banks were able to avoid calling in $20 trillion in previous loans.

That swap was good because it kept the economy from collapsing. But that swap wasn’t “stimulating” because it didn’t actually add more currency to the money supply. The swap prevented or at least forestalled the Greater Depression, but it did not stimulate the economy to grow.

Why?

Because, in order to sustain the lie that the “toxic assets” were still worth all or most of their $2 trillion face value, those toxic assets had to be pulled out of the free market and hidden away in Troubled Asset Relief Program (“TARP”) accounts and/or the Fed’s balance sheet. By removing those toxic assets from the free market, the government and Federal Reserve prevented the free market from openly pricing those “toxic assets” at prices far below their $2 trillion face value and thereby proving that those toxic assets were almost worthless.

Thus, although the Federal Reserve added $2 trillion in freshly-printed paper-dollar “assets” into the economy, the government and Federal Reserve also subtracted $2 trillion (face value) in “toxic assets” from the economy.

Result? A wash.

The government and Fed prevented a collapse but—contrary to what most people suppose—they didn’t cause a net gain of $2 trillion to the money supply and therefore didn’t “stimulate” the economy. Because most of the $2 trillion paid out by the Fed has remained in the Wall Street bank vaults, there’s been little actual gain in the supply of dollars that are in circulation. Therefore, there’s been little “stimulation” or inflation, and no economic recovery. What we saw was a “bail-out” for major banks that had bought too many “toxic assets”.

Therefore, instead of being stimulated, our economy has more-or-less stagnated in the same place that it was in A.D. 2008.

• Is the previous speculation exactly correct?

Of course not. The numbers I used are arbitrary. The “math” is overly simplistic. The entire analysis is intended only to illustrate a fundamental hypothesis: If the Fed added $2 trillion in paper-dollar “assets” to the money supply but also subtracted $2 trillion (face value) in “toxic assets” from the money supply, there was no increase in the money supply, no stimulation and therefore no economic recovery.

Is this fundamental hypothesis true?

I don’t know.

But it is more-or-less consistent with a few facts that are generally accepted as true:

1) Since A.D. 2008, the big Wall Street banks received roughly $2 trillion from the Federal Reserve.

2) That $2 trillion was supposed to be loaned to the American people in order to “stimulate” the economy.

3) But, instead of lending $2 trillion to the American people, the banks kept almost all of it ($1.8 trillion) in their vaults.

4) The government and Fed must’ve known that the $2 trillion was being retained in bank vaults, not reaching the public and therefore having little or no “stimulative” effect on the economy. Nevertheless, the government and/or Federal Reserve made no serious attempt to force the banks to lend the entire $2 trillion to the American people.

Don’t those several facts strike you as strange? If all of that $2 trillion had been loaned out into circulation, we might’ve had our “recovery” and the US economy might be smokin’ hot by now.

If the real purpose for paying $2 trillion to the banks was to lend that money to the public and thereby stimulate the economy, why did the government and Federal Reserve allow the banks to “sit” on all that cash, not lend it, and therefore not stimulate the economy?

What does the failure to get the $2 trillion into the hands of the public imply?

Three (there could be more) explanations for the banks’ failure to lend all of that $2 trillion into the economy come to mind. Could it be that:

1) The gov-co never really intended to stimulate the economy? That gov-co didn’t force the banks to lend the $2 trillion because gov-co wants the economy to stagnate or collapse?

2) The real purpose for handing $2 trillion to the Wall Street banks was crony capitalism and a desire enrich the banks at the American people’s expense? Or,

3) QE was intended to bail out the banks–not stimulate the economy? The Fed gave the banks $2 trillion in paper-dollar “assets” only to replace the $2 trillion that had become “toxic assets”? That the Fed thereby prevented the massive, unsustainable “call-ins” of up to $20 trillion in pre-existing loans that would almost certainly have collapsed the US and global economies? That the $2 trillion loaned to the banks couldn’t be loaned to the public, and couldn’t be used to stimulate the economy, because that $2 trillion had to remain in the bank vaults in order to support the $20 trillion that had already been loaned out under fractional reserve banking?

Given the fact that most of the $2 trillion received by the banks was never loaned into the American free market and therefore never stimulated the US economy, which of the three possible explanations seems least likely? Which possible explanation seems most plausible?

I think # 3 is plausible. The Fed didn’t add $2 trillion to the money supply. They merely replaced $2 trillion that had previously “disappeared” when some “assets” became “toxic assets”.

Result? No collapse (yet). Only a fraction of the inflation we might otherwise have expected. And also, no recovery. Instead of stimulation, we’ve mostly had stagnation.